-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

The Fed Hasn’t Spent a Dime Yet for Main Street Versus $735 Billion for Wall Street

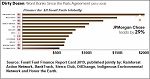

By Pam Martens and Russ Martens: May 13, 2020 ~ The stimulus bill known as the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) was signed into law by President Donald Trump on March 27. Among its many features (such as direct checks to struggling Americans and enhancing unemployment compensation by $600 per week for four months to unemployed workers so they could pay their rent and buy food) the bill also carved out a dubious $454 billion (or 25 percent of the total $1.8 trillion spending package) for the U.S. Treasury to hand over to the Federal Reserve. This was the Faustian Bargain the Democrats had to agree to in order to get the deal approved by the Wall Street cronies in the Senate. If you subtract the $454 billion from the $1.8 trillion total spending package, that left $1.346 trillion for other purposes. But the $454 billion … Continue reading

BlackRock Begins Buying Junk Bond ETFs for the Fed Today: It’s Already at Work for the Central Bank of Israel

By Pam Martens and Russ Martens: May 12, 2020 ~ It’s off to the races today for BlackRock. The New York Fed, with authority from the Federal Reserve Board and backstopped with taxpayers’ money, will begin the first phase of the Fed’s unprecedented leap into shoring up the sagging prices of investment grade corporate debt and junk bonds. BlackRock has been selected by the New York Fed to be the investment manager for these bailout facilities and will begin Phase I today by buying up Exchange Traded Funds (ETFs) containing investment grade corporate bonds as well as junk bonds. Making the situation particularly dicey is that BlackRock just happens to be one of the largest purveyors of said ETFs. The screaming conflict-of-interest that this raises in the minds of many is not ruffling any feathers at the New York Fed (which is itself a bundle of conflicts wrapped in a … Continue reading

Fed Report Shows Magical Thinking on Safety of Wall Street’s Banks

By Pam Martens and Russ Martens: May 11, 2020 ~ The chart above from the November 2019 Federal Reserve report on the condition of the biggest banks in the U.S. shows that almost half were rated unsatisfactory. There have not been any reports since that November report until the latest one from the Fed which was released last week and dated May 2020. The new report carries this headline: “The banking industry came into 2020 in a healthy financial position.” This is part of the Fed’s strategy to lay its abysmal failure to supervise the mega Wall Street banks at the door of the coronavirus pandemic. It’s very easy today to get a totally bogus headline, one that is built completely on magical thinking, flashed across a TV screen in America. As the photo below illustrates, last Friday Steve Liesman of CNBC repeated this magical thinking from the Fed accompanied … Continue reading

Meet the Fed’s Global Plunge Protection Team

By Pam Martens and Russ Martens: May 10, 2020 ~ The Dow Jones Industrial Average rallied 455 points by the closing bell on Friday. It seemed sadistic to average folks. One hour before the stock market opened, the Bureau of Labor Statistics had reported the worst U.S. unemployment figure since the Great Depression (14.7 percent) along with the staggering loss of 20.5 million jobs in just the month of April. Within the first half hour of trading, the Dow was up more than 300 points. It then added to those gains in afternoon trading. None of the explanations offered by mainstream media to explain the incongruous stock trading were accurate. It was not because the stock market had anticipated worse or that the market was rallying because it thought the worst of the economic fallout was behind us. It was because the one emergency funding facility that the Federal Reserve … Continue reading

U.S. Unemployment Reaches 14.7 Percent – Chart from Great Depression Shows Risks Ahead

By Pam Martens and Russ Martens: May 8, 2020 ~

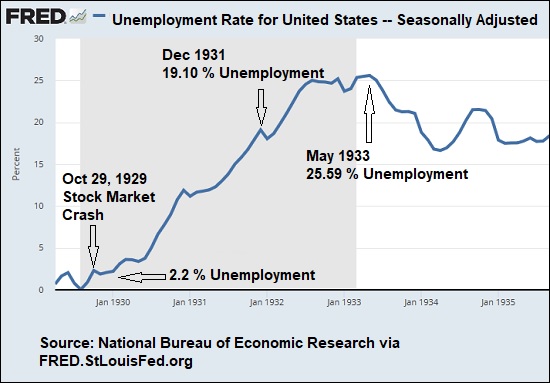

The data is out this morning and it’s not pretty. Nonfarm payrolls collapsed by 20.5 million jobs in April and the unemployment rate rose to 14.7 percent. The United States is now seeing the worst unemployment rates since the Great Depression.

We prepared the above chart from data available at the Federal Reserve Economic Data (FRED) archives at the Federal Reserve Bank of St. Louis. Following the stock market crash of October 29, 1929, it was not until August 1931 that the unemployment rate reached 15.01 percent. We’re now at 14.7 percent unemployment from a rate of 3.5 percent just two months ago in February.

Consider using the chart above to figure out just how much cash on hand you need to maintain.

U.S. Financial System “Monitor” Failed to Flash Warning as Fed Pumped $6 Trillion Emergency Liquidity into Wall Street

By Pam Martens and Russ Martens: May 8, 2020 ~ The Office of Financial Research (OFR) was created under the Dodd-Frank financial reform legislation of 2010 to keep the Financial Stability Oversight Council (F-SOC) informed on emerging threats that have the potential to implode the financial system — as occurred in 2008 in the worst financial crash since the Great Depression. The Trump administration has gutted both its funding and staff. One of the early warning systems of an impending financial crisis that OFR was supposed to have created is the heat map above. Green means low risk; yellow tones mean moderate risk; while red tones flash a warning of a serious problem. On September 17, 2019, liquidity was so strained on Wall Street that the Federal Reserve had to step in and began providing hundreds of billions of dollars per week in repo loans. By January 27, 2020 (before … Continue reading

Congress Sets Up Taxpayers to Eat $454 Billion of Wall Street’s Losses. Where Is the Outrage?

By Pam Martens and Russ Martens: May 7, 2020 ~ Beginning on March 24 of this year, Larry Kudlow, the White House Economic Advisor, began to roll out the most deviously designed bailout of Wall Street in the history of America. After the Federal Reserve’s secret $29 trillion bailout of Wall Street from 2007 to 2010, and the exposure of that by a government audit and in-depth report by the Levy Economics Institute in 2011, Kudlow was going to have to come up with a brilliant strategy to sell another multi-trillion-dollar Wall Street bailout to the American people. The scheme was brilliant (in an evil genius sort of way) and audacious in employing an Orwellian form of reverse-speak. The plan to bail out Wall Street would be sold to the American people as a rescue of “Main Street.” It was critical, however, that all of the officials speaking to the … Continue reading

Fed Chair Powell Has Upwards of $11.6 Million Invested with BlackRock, the Firm that Will Manage a $750 Billion Corporate Bond Bailout Program for the Fed

By Pam Martens and Russ Martens: May 5, 2020 ~ Most Americans likely assume that Jerome Powell, the Chairman of the Federal Reserve, is an economist, like the prior chairs of the Fed over the past 40 years. He’s not. Powell is a former investment banker at the Wall Street firm, Dillon Read; a former partner at the controversial private equity and leveraged buyout firm, the Carlyle Group, which has spent over $1 billion over the past decade lobbying the federal government; and a former lawyer at Davis Polk, a Big Law firm that played a key role advising the government and Treasury in the 2008 Wall Street bailout. Powell’s background would be strange enough but now consider this. The Vice Chairman for Supervision at the Fed, Randal Quarles, who is in charge of supervising the largest and most dangerous Wall Street bank holding companies in the U.S., has an … Continue reading

JPMorgan, Wells Fargo, Citigroup and Fossil Fuel Industry Get Bailed Out Under Fed’s “Main Street” Lending Program

By Pam Martens and Russ Martens: May 4, 2020 ~ U.S. Treasury Secretary Steve Mnuchin and Federal Reserve Chairman Jerome Powell have apparently never walked down a Main Street in America. We make that statement because there is a huge disconnect between what’s really located on a typical Main Street and what’s in the bailout program they’ve designed and are calling the Main Street Lending Program (MSLP). Americans need to sit up and pay attention to what’s going on here because the U.S. Treasury has committed $75 billion of taxpayers’ money to support this program under the illusion that it’s going to mom and pop operations on a typical Main Street in America. That initial $75 billion will be levered up to $750 billion under the Fed’s ability to create money out of thin air, with taxpayers eating the first $75 billion of losses. Once the loans are originated by … Continue reading

Wall Street’s Financial Crisis Preceded COVID-19: Chart and Timeline

By Pam Martens and Russ Martens: May 1, 2020 ~ If a reputable polling outfit were to ask Americans what caused the current financial crisis on Wall Street, they would say the coronavirus COVID-19 pandemic. If Americans were asked in the same poll when the financial crisis on Wall Street started, they would tie it to outbreaks of the virus in the U.S. this year. But as the timeline below and the chart above clearly substantiate, the financial crisis on Wall Street began in earnest on September 17, 2019, almost four months before the first death from coronavirus anywhere in the world was reported in China on January 11, 2020 and five months before the first death in the U.S. was reported on February 29, 2020, having occurred one day earlier on February 28. (See the New York Times coronavirus timetable here.) This big disconnect between what people believe about … Continue reading