-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

FDIC Investigators Are on the Premises of Collapsing Federally-Insured, Crypto Related Bank, Silvergate: It’s Not a Friendly Visit

By Pam Martens and Russ Martens: March 8, 2023 ~ A very peculiar headline appeared at Bloomberg News yesterday concerning the collapsing federally-insured bank, Silvergate Bank, which became the go-to financial institution over the past few years for crypto exchanges around the globe. The headline read: “Silvergate Is in Talks With FDIC Officials on Ways to Salvage Bank.” That headline moved quickly to other news outlets, which dutifully regurgitated that there was an effort underfoot by the Federal Deposit Insurance Corporation to save Silvergate Bank. Bloomberg News then went further out on a shaky limb with this paragraph: “Federal Deposit Insurance Corp. officials have been discussing with management ways to avoid a shutdown, according to people familiar with the matter. One possible option involves lining up crypto-industry investors to help Silvergate shore up its liquidity, said one of the people. FDIC examiners arrived at the firm’s La Jolla, California, offices last week, … Continue reading

A Federal Agency Wants to Hear Directly from the Public about Bad Practices at Credit Card Companies

By Pam Martens and Russ Martens: January 25, 2023 ~ Yesterday, the federal watchdog agency – the Consumer Financial Protection Bureau (CFPB) – announced that it wants to hear directly from the public on credit card practices. But since “the public” also includes all of the folks that are paid to carry water for the credit card industry, the voice of the average Joe and Jane is highly likely to be overwhelmed by industry sycophants, as is typically the case. Thus, we are asking our readers to give this matter some careful thought, as we outline below, and if you are so inclined, send your comments to the good folks at the CFPB using this link they have set up. The public has until April 24, 2023 to submit comments but we ask that you do so promptly. Topic 1: The Same Banks that Were Bailed Out by the U.S. Taxpayers in … Continue reading

Four Crypto-Friendly Banks Are Being Bailed Out with Billions from a Federal Housing Program

By Pam Martens and Russ Martens: January 18, 2023 ~ Remember those Fed bailouts of the mega banks on Wall Street during and after the 2008 financial crisis that the Federal Reserve battled in court for years to keep secret from the American people? Those bailouts went to the same Wall Street mega banks that collapsed the U.S. economy with their unbridled greed and unchecked corruption. The banks were even allowed to pay big bonuses to their execs with the bailout funds. When Senator Bernie Sanders forced the bailout details into the sunlight with a mandated government audit, the findings were so revolting that Senator Sanders had this to say: “As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world. This is … Continue reading

An Insider Blows the Whistle on How the Fed Has Allowed Crypto to Invade Federally-Insured Banks

By Pam Martens and Russ Martens: December 14, 2022 ~ Katie Cox worked for the Federal Reserve for 32 years, the last two decades of which were spent overseeing complex proposals for bank mergers. She left the Fed in 2020. Last Wednesday Katie Cox penned a shocker of a column for American Banker. She opened with this: “Suppose you’re a crypto company that wants to own a bank approved to engage in digital-asset activities. Here’s the fast-track way you might achieve that, while complying with rules in place since August: Go buy a bank, any bank. Convert your bank to a Federal Reserve member bank, meaning that your bank’s federal supervisor will now be the Fed, not the Office of the Comptroller of the Currency or the Federal Deposit Insurance Corp. Wait a little bit, maybe six months. Then send the Fed a letter notifying it that your bank is going … Continue reading

Evidence Grows that Crypto and Federally-Insured Banks Are a Combustible Mixture

By Pam Martens and Russ Martens: November 23, 2022 ~ The fallout from the collapse of the crypto exchange FTX and its missing billions of dollars of customer funds has, finally, galvanized some members of Congress to push back against the swarms of crypto lobbyists whose activities are clearly impacting the safety and soundness of U.S. banks. On Monday, Senator Sherrod Brown (D-OH), Chair of the Senate Banking Committee, along with Senators Jack Reed (D-RI), Chris Van Hollen (D-MD), and Tina Smith (D-MN), sent a letter to federal banking regulators warning that SoFi, a federally-insured bank, potentially posed a risk to safety and soundness as a result of its digital asset trading activities. The Senators wrote as follows: “In January 2022, SoFi received approval from the Federal Reserve for the acquisition of Golden Pacific Bancorp, Inc. and a conditional approval from the Office of the Comptroller of the Currency for the … Continue reading

FTX’s Latest Casualties: Federally Insured Crypto Banks

By Pam Martens and Russ Martens: November 21, 2022 ~ On August 1 of this year, we penned this headline at Wall Street On Parade: Brace Yourself for Federally-Insured Bank Failures Caused by Crypto. Our research for that article was so stomach-churning and frightening that we emailed the article to key staff for the Senators who sit on the Senate Banking Committee. One of the banks we researched for that article was Silvergate Bank. We wrote: “FDIC-insured Silvergate Bank is part of the publicly-traded Silvergate Capital Corp., (ticker SI). Silvergate’s website says this about its hot pursuit of crypto: ‘We began pursuing digital currency customers in 2013 and have been deliberate in our approach to serving this community since then. Today, we have 1,300+ digital currency and fintech customers that are using our platform daily to grow and scale their businesses.’ “Silvergate Capital’s 10-K (annual report) for the year ending Dec 31, … Continue reading

Casino Banking: Wall Street Mega Banks Traded More in their Federally-Insured Bank than the Total for their Bank Holding Company

By Pam Martens and Russ Martens: October 13, 2022 ~ When something happens for the first time in history at federally-insured banks, Congress and federal regulators need to pull their heads out of the sand and pay attention. We’re talking about the fact that in the second quarter of this year, trading revenues at federally-insured commercial banks eclipsed the trading revenues at bank holding companies – which typically include subsidiaries where traders actually have licenses to trade. This latest data on what is happening inside the nation’s largest federally-insured banks comes from the Office of the Comptroller of the Currency (OCC), see pages 2 and 3 here. The federally-insured banks generated a total of $10.3 billion in trading revenue in the second quarter versus $10.2 billion for the bank holding companies, or 101 percent of the bank holding company revenues. That’s never happened before according to the data provided by the … Continue reading

Brace Yourself for Federally-Insured Bank Failures Caused by Crypto

By Pam Martens and Russ Martens: August 1, 2022 ~ Last Thursday, during a Senate Banking Committee hearing, Senator Elizabeth Warren apparently grabbed the attention of federal regulators when she stated that Voyager, the crypto platform that filed for bankruptcy protection in early July, was promoting itself as being FDIC-insured. FDIC stands for Federal Deposit Insurance Corporation and is the federal agency that oversees federal deposit insurance for the nation’s regulated banks and savings associations. Crypto trading platforms and their lending operations are not federally regulated; they are frequently tied to criminal activity; they are increasingly going bust and/or filing for bankruptcy protection and locking customers out of making withdrawals of their liquid funds and/or their crypto. Letting crypto get anywhere near a federally-insured bank would undermine public confidence in FDIC-insurance and undermine public confidence in the safety and soundness of all federally-insured banks in the U.S. And yet, federal bank … Continue reading

Federal Data Show JPMorgan Chase Is, By Far, the Riskiest Bank in the U.S.

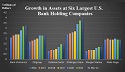

By Pam Martens and Russ Martens: July 26, 2022 ~ The long-tenured Chairman and CEO of JPMorgan Chase, Jamie Dimon, likes to use the phrase “fortress balance sheet,” when talking about his bank to Congress or shareholders. But the data stored at its federal regulators show that the bank is, by far, the most systemically dangerous bank in the United States. And, despite its high risk profile, neither Congress nor federal regulators have restricted its growth. Its assets have soared by 65 percent since the end of 2016 and stood at $3.95 trillion as of March 31, making it the largest bank in the United States. Making this situation even more dangerous, the bank has admitted to five criminal felony counts over the past eight years and a multitude of civil crimes and multi-billion dollar fines — all during the tenure of Dimon. Neither Congress nor federal regulators nor the Justice Department … Continue reading

There Are Three Separate Cases in Federal Court Accusing JPMorgan Chase of a Culture of Fraud

By Pam Martens and Russ Martens: July 19, 2022 ~ JPMorgan Chase is the largest federally-insured bank in the United States. It is also one of the largest trading houses on Wall Street. That’s the Faustian bargain the Clinton administration entered into with Wall Street when it repealed the Glass-Steagall Act in 1999. According to data from the FDIC, as of June 30 of last year, JPMorgan Chase Bank N.A. had 4,925 branches in 44 U.S. states holding $2.01 trillion in deposits. Many of those deposits belong to mom and pop savers who have no idea that the bank has admitted to five criminal felony counts since 2014 and has a rap sheet that is the envy of the Gambino crime family. (Apparently, a federal judge in New York overseeing a current JPMorgan case is just as naïve about the bank’s criminal history. More on that shortly.) The bulk of Americans … Continue reading