By Pam Martens and Russ Martens: August 1, 2022 ~

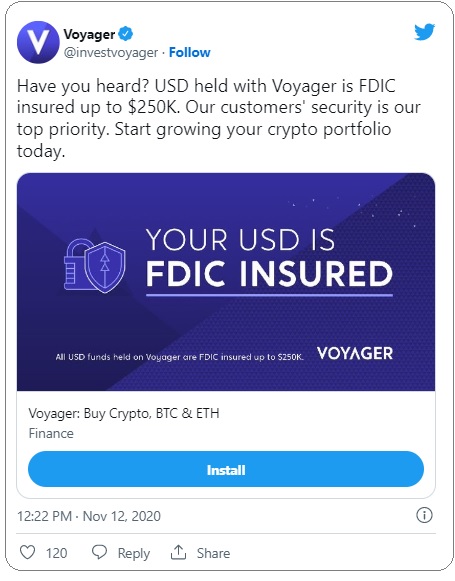

Last Thursday, during a Senate Banking Committee hearing, Senator Elizabeth Warren apparently grabbed the attention of federal regulators when she stated that Voyager, the crypto platform that filed for bankruptcy protection in early July, was promoting itself as being FDIC-insured. FDIC stands for Federal Deposit Insurance Corporation and is the federal agency that oversees federal deposit insurance for the nation’s regulated banks and savings associations.

Crypto trading platforms and their lending operations are not federally regulated; they are frequently tied to criminal activity; they are increasingly going bust and/or filing for bankruptcy protection and locking customers out of making withdrawals of their liquid funds and/or their crypto. Letting crypto get anywhere near a federally-insured bank would undermine public confidence in FDIC-insurance and undermine public confidence in the safety and soundness of all federally-insured banks in the U.S. And yet, federal bank regulators have been completely aware for years now that federally-insured banks were becoming intertwined with crypto companies and have chosen to look the other way.

Within hours of Senator Warren’s statement at the Senate Banking hearing last Thursday, the FDIC and the Fed released a joint letter it had sent to Voyager Digital that same day. The letter advised as follows:

“Voyager has made various representations online, including its website, mobile app, and social media accounts, stating or suggesting that: (1) Voyager itself is FDIC-insured; (2) customers who invested with the Voyager cryptocurrency platform would receive FDIC insurance coverage for all funds provided to, held by, on, or with Voyager; and (3) the FDIC would insure customers against the failure of Voyager itself. These representations are false and misleading and, based on the information we have to date, it appears that the representations likely misled and were relied upon by customers who placed their funds with Voyager and do not have immediate access to their funds.”

What Voyager had actually done was to open an “omnibus” account at the FDIC-insured Metropolitan Commercial Bank, which has apparently decided to roll the dice and accept deposits from multiple crypto firms. As of March 31, Metropolitan held over $1.1 billion in crypto-related deposits. The bank is part of the publicly traded Metropolitan Bank Holding Corp (ticker MCB), whose share price has lost 35 percent year-to-date (through last Friday’s close).

Because Metropolitan had given Voyager this “omnibus” FDIC-insured account, Voyager used the imprimatur of the FDIC to promote itself as a safe platform. (See Tweet below.)

Unfortunately for the stability of the U.S. financial system, Metropolitan Commercial Bank is not the only FDIC-insured bank that has decided to allow the lawless world of crypto to infect its banking operations.

FDIC-insured Silvergate Bank is part of the publicly-traded Silvergate Capital Corp., (ticker SI). Silvergate’s website says this about its hot pursuit of crypto: “We began pursuing digital currency customers in 2013 and have been deliberate in our approach to serving this community since then. Today, we have 1,300+ digital currency and fintech customers that are using our platform daily to grow and scale their businesses.”

Silvergate Capital’s 10-K (annual report) for the year ending Dec 31, 2021 that it filed with the Securities and Exchange Commission acknowledged this about the crypto market that it has so deliberately decided to pursue:

“The characteristics of digital currency have been, and may in the future continue to be, exploited to facilitate illegal activity such as fraud, money laundering, tax evasion and ransomware scams; if any of our customers do so or are alleged to have done so, it could adversely affect us…”

Silvergate’s 10-K also states that “Deposits from digital currency exchanges represent approximately 58.0% of the Bank’s overall deposits and are held by approximately 94 exchanges.”

Let’s pause for a moment to digest that last statement: More than half of a federally-insured bank’s deposits are tied to crypto while federal regulators are twiddling their thumbs and letting it happen. This news comes despite the fact that legendary investor Warren Buffet has called the largest cryptocurrency, Bitcoin, “rat poison squared”; global economist, Nouriel Roubini, told the Senate Banking Committee in 2018 that “Crypto is the Mother of All Scams and (Now Busted) Bubbles While Blockchain Is The Most Over-Hyped Technology Ever, No Better than a Spreadsheet/Database.” More recently, Bill Gates, co-founder of Microsoft, one of the most valuable tech companies in the world, stated that cryptocurrencies are “100% based on greater fool theory.” And just this past June 1, more than 1,600 scientists and software engineers wrote to Committee chairs in Congress to warn that both crypto and blockchain are shams.

On January 30, 2020, the Office of the Comptroller of the Currency brought a cease-and-desist order against M.Y. Safra Bank FSB for violations of the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws related to its interactions with crypto firms. The OCC wrote:

“From November 2016 to February 2019, the Bank opened accounts for digital asset customers (‘DACs’) which consisted of cryptocurrency-related money service businesses customers (‘MSBs’), without sufficient consideration of the BSA/AML risks and failed to implement commensurate controls to address the increased risk. The DACs included digital currency exchangers, digital currency ATM operators, crypto arbitrage trading accounts, blockchain developers and incubators, and fiat currency MSBs. (4) The Bank’s DACs and MSBs significantly increased the volume of the Bank’s domestic wires, international wires, Automated Clearinghouse (‘ACH’), and cross-border ACH transactions without sufficient monitoring or controls in place.”

Then there is Signature Bank. On the same day last week that Senator Warren was warning about crypto, reporters Dan McCrum and Joshua Franklin were writing this about Signature Bank in the Financial Times:

“What helped make it last year’s best-performing stock in the KBW Bank Index was a decision four years ago to accept crypto exchanges, stablecoin issuers and bitcoin miners as customers, as well as the launch of a blockchain-based payments system called Signet that allows bank customers to transfer dollars between each other at any time of the day.”

Unfortunately, as the relationship between the greater-fool theory and crypto has come into better focus, Signature Bank’s share price (ticker SBNY) has lost more than 40 percent of its value year-to-date.

In her statement last Thursday, Senator Warren said that it’s big investors who are “funding, hyping, and then vampire-sucking money out of crypto projects that scam mom and pop investors.” She blamed regulators for failing to properly police this space and said she will be introducing legislation to regulate the crypto market “and stamp out the worst scams by scam artists both big and small.” Warren also held out little hope that Voyager’s customers are going to get their money back. (See video below.)