-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

The Fed’s Lack of Transparency Is Harming the Dollar as the World’s Reserve Currency

By Pam Martens and Russ Martens: March 17, 2022 ~ Yesterday, it was widely reported in the business press that Saudi Arabia is considering pricing its oil deals with China in China’s own currency, the Yuan, rather than in U.S. Dollars, which is the currency of choice for the bulk of the global oil trade. While it should be noted that this talk has been making headlines for the past four years without actually coming to fruition, the U.S. should stop taking the respected status of the Dollar for granted. Three of the key reasons that the U.S. Dollar has been able to maintain its status as the global reserve currency are the following: a stable government which is not subject to being toppled by coups; a large working population which allows federal tax payments to be automatically collected from paychecks in order to pay the nation’s debts on time; and, … Continue reading

Federal Agency Censors Names of Banks in a Bombshell Study on Wall Street’s Dangerous Derivatives

By Pam Martens and Russ Martens: January 25, 2022 ~ The Office of Financial Research (OFR) is the federal agency created under the Dodd-Frank financial reform legislation of 2010. Its role is to provide early warnings to U.S. bank regulators and the public of systemic risks that threaten U.S. financial stability, so that another 2008-style Wall Street crisis can never again devastate the U.S. economy. The OFR was doing an outstanding job of sounding alarm bells until the Trump administration gutted the agency. The Biden administration has clearly not done enough to restore the integrity of the office. Consider the research report that was released by the OFR on July 12 of last year, which we just discovered yesterday. The report is titled: “Counterparty Choice, Bank Interconnectedness, and Systemic Risk.” The researchers, Andrew Ellul and Dasol Kim, examined 18 different over-the-counter (OTC) derivative markets and noted the following: “Bank interconnectedness through … Continue reading

There’s a Nasty Public Battle Raging Over Control of the Federal Agency that Insures Bank Deposits

By Pam Martens and Russ Martens: December 16, 2021 ~ The Federal Deposit Insurance Corporation (FDIC) is the agency that prevents financial panics from turning into catastrophic runs on banks by providing taxpayer-backstopped and government guaranteed insurance on deposits, up to $250,000 per depositor. Its leadership and honest governance is thus critically important to every American. So when a nasty public brawl breaks out between the Board of Directors of the FDIC and its Chairwoman, Jelena McWilliams, every American needs to sit up and pay attention. On Tuesday, Rohit Chopra, President Biden’s nominee who has been confirmed to lead the Consumer Financial Protection Bureau (CFPB), which automatically makes him a member of the Board of Directors of the FDIC, posted at the CFPB’s website serious charges against FDIC Chairwoman McWilliams – effectively stating that she was staging a one-woman coup against her Board and usurping their power to govern the FDIC. … Continue reading

Archegos Unpacked: Equity Derivative Contracts Held by Federally-Insured Banks Have Exploded from $737 Billion to $4.197 Trillion Since the Crash of 2008

By Pam Martens and Russ Martens: April 30, 2021 ~ During Federal Reserve Chairman Jerome Powell’s press conference this past Wednesday, he took a question from Brian Cheung of Yahoo Finance. The question was: “It seems like to people on the outside who might not follow finance daily, they’re paying attention to things like GameStop, now Dogecoin. And it seems like there’s interesting reach for yield in this market to some extent — also Archegos. So, does the Fed see a relationship between low rates and easy policy to those things, and is there a financial stability concern from the Fed’s perspective at this time?” As part of Powell’s long, meandering answer, he said this: “Leverage in the financial system is not a problem.” Within a second or so, Powell repeated himself: “Leverage in the financial system is not an issue.” (Read the full transcript here.) Either Powell has not read … Continue reading

A Trader’s Federal Lawsuit Against JPMorgan Chase Offers a Window into the Crime Culture at the Five Felony-Count Bank

By Pam Martens and Russ Martens: April 20, 2021 ~ Donald Turnbull, a former Global Head of Precious Metals Trading at JPMorgan Chase, has filed a doozy of a federal lawsuit against the bank. Turnbull worked on the same JPMorgan Chase precious metals desk that was deemed to be a racketeering enterprise by the U.S. Department of Justice when it handed down indictments in 2019. This was the first time that veterans on Wall Street could recall employees of a major Wall Street bank being charged under the Racketeer Influenced and Corrupt Organizations Act or RICO statute, which is typically reserved for organized crime. JPMorgan Chase, the largest bank in the United States, has the further unprecedented distinction for a U.S. bank of being charged with five felony counts by the Department of Justice in a six-year span of time, running from 2014 to 2020. The bank admitted to all of … Continue reading

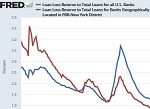

Loan Loss Reserves at Mega Banks Are Far from Where They Need to Be

By Pam Martens and Russ Martens: October 20, 2020 ~ It’s time to revisit that scene from the movie, The Big Short, where Steve Carell, playing Mark Baum, is sitting in the audience at the American Securitization Forum and interrupts the speaker on stage who has just stated that he expects subprime losses “will be contained at 5 percent.” Baum loudly asks: “Would you say that it is a possibility or a probability that subprime losses stop at 5 percent?” The speaker says: “I would say that it is a very strong probability, indeed.” Baum sits down but then begins to waive his arm in the air, forming a zero with his fingers. Baum then shouts out: “Zero! Zero! There is a zero percent chance that your subprime losses will stop at 5 percent.” You can view the scene from the movie below. That scene came to mind when we … Continue reading

BlackRock Is Bailing Out Its ETFs with Fed Money and Taxpayers Eating Losses; It’s Also the Sole Manager for $335 Billion of Federal Employees’ Retirement Funds

By Pam Martens and Russ Martens: June 4, 2020 ~ BlackRock, the international investment management firm run by billionaire Larry Fink, has played an outsized role in Federal Reserve bailouts of Wall Street. As it turns out, it’s also been quietly managing hundreds of billions of dollars for more than five million federal government employees in their retirement plan, known as the Thrift Savings Plan (TSP). During the last financial crisis of 2007 to 2010, the Federal Reserve gave BlackRock no-bid contracts to manage the toxic assets held in three programs known as Maiden Lane, Maiden Lane II and Maiden Lane III. These were Special Purpose Vehicles set up by the New York Fed. Maiden Lane purchased $30 billion of toxic assets from Bear Stearns as an inducement by the New York Fed to get JPMorgan to purchase the good parts of Bear Stearns. Maiden Lane II purchased mortgage-backed securities … Continue reading

New York Fed Has Allowed Dangerous Wall Street Banks to Have Lower Loan Loss Reserves than at time of 2008 Crash

By Pam Martens and Russ Martens: March 27, 2020 ~ The New York Fed supervises four of the most dangerous banks in America: Citigroup, JPMorgan Chase, Goldman Sachs and Morgan Stanley. That opinion is not just ours but is documented by data from federal agencies. All four of these banks own federally-insured commercial banks that are backstopped by the U.S. taxpayer while also gambling in the stock market through their own Dark Pools and in trillions of dollars of derivatives. All four of these banks received tens of billions of dollars in bailout money during the 2007-2010 financial crash, which was brought on by their greed and corrupt activities in the derivatives and subprime market. Citigroup’s losses were of such magnitude that it became insolvent, turned into a 99 cent stock, and yet secretly received the largest bailout in global banking history from the same regulator who had allowed it … Continue reading

Fed Sets Off Panic with Plan to Eliminate Reserves at Wall Street’s Mega Banks

By Pam Martens and Russ Martens: March 16, 2020 ~ Last evening, it became painfully clear that the Board of Governors at the Federal Reserve do not understand the inner workings of Wall Street. After prattling on for months about the need to rebuild “ample reserves” at the behemoth Wall Street banks after the Fed was forced on September 17 to become the liquidity provider of last resort to the tune of $9 trillion cumulatively thus far, the Fed flipped its thinking on a dime yesterday and sent markets into a panic. As of 8:55 a.m. this morning, S&P 500 futures are locked, limit down, suggesting a steep drop in stocks at the open of trading at 9:30 a.m. Along with a series of other measures to prop up liquidity on Wall Street, the Federal Reserve Board of Governors announced last evening that it “has reduced reserve requirement ratios to … Continue reading

Goldman Sachs Federally-Insured Bank Loses $1.2 Billion in Interest Rate Derivative Bets

By Pam Martens and Russ Martens: December 26, 2019 ~ A week before Christmas when Americans were focused on either the impeachment proceedings or holiday preparations, the Office of the Comptroller of the Currency (OCC) quietly released its quarterly report on the trading and derivative activities of Wall Street’s casino banks. It contained a humdinger in, literally, red ink. The report showed that Goldman Sachs Bank USA, which is, insanely, a federally-insured bank backstopped by the U.S. taxpayer that is part of the Goldman trading colossus, had lost $1.24 billion trading interest rate derivatives during the third quarter of this year. According to the Federal Deposit Insurance Corporation, the bank only holds $149.8 billion in deposits while the OCC reports it has $49 trillion in notional derivatives (face amount). (See Table 7 in the Appendix at this link.) Profits in other derivative trading areas, like the $1.14 billion Goldman Sachs … Continue reading