-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

Dirty Details Emerge as to Why Mnuchin Is Fighting Congress Over Releasing the Names of Recipients of PPP Loans

By Pam Martens and Russ Martens: June 16, 2020 ~ Taxpayers’ money is being used to make the Paycheck Protection Program (PPP) loans. Thus, the public has every right to know the names of the recipients of those loans. Despite originally promising transparency, U.S. Treasury Secretary Steve Mnuchin is now stonewalling Congress on releasing a list of the recipients. Congress sold the plan to the public on the basis that the loans would go to small businesses with less than 500 employees. The funds were to be predominantly used to keep workers employed and allow the businesses to survive the coronavirus shutdowns. Instead, our search of filings at the Securities and Exchange Commission reveals that dozens of debt zombie companies that trade on Nasdaq got the loans. Dozens of publicly-traded companies with large credit lines from banks got the loans. Dozens of companies with a lot more than 500 employees … Continue reading

Wall Street Banks Tank One Day After Fed Chair Says They’re “a Source of Strength”

By Pam Martens and Russ Martens: June 12, 2020 ~ Every major Wall Street bank tanked yesterday. Citigroup fared the worst, losing 13.37 percent of its market value versus a broader market decline of 5.89 percent on the S&P 500 Index. Bank of America didn’t look like much of a source of strength either, losing 10.04 percent on the day. The largest bank in the country, JPMorgan Chase, whose CEO, Jamie Dimon, perpetually brags about its “fortress balance sheet,” lost 8.34 percent. For a close look at what’s hiding in the tall weeds behind that fortress, see here. Just the afternoon before this bank carnage, this is what the Chairman of the Federal Reserve, Jerome Powell, had to say in his press conference about the U.S. banking system (which, of course, the Fed has been in charge of supervising in order to prevent another catastrophic blowup as occurred in 2008): … Continue reading

Fed Chair Powell Attempts to Blame U.S. Inequality on Globalization – Gets Smacked Down by Bloomberg Reporter

By Pam Martens and Russ Martens: June 11, 2020 ~ Federal Reserve Chairman Jerome Powell’s press conferences are typically snooze sessions. Yesterday’s virtual press conference got off to a similar start with mainstream media reporters asking about inflation and monetary policy instead of the more critical questions they should have been asking in the midst of the worst labor market and business closures since the Great Depression and food pantry lines that stretch for blocks. Fortunately, two reporters shook things up at the very end of the press conference. Nancy Marshall-Genzer of Marketplace, which airs on public media stations, bluntly asked Powell this: “Is there more the Fed could do to deal with inequality, for example, use the Black unemployment rate as a benchmark.” Powell’s answer was an abomination. First Powell stated that inequality is not related to monetary policy. Next, he decided to target a more specific villain – … Continue reading

The Fed Just Pulled Off Another Backdoor Bailout of Wall Street

By Pam Martens and Russ Martens: June 10, 2020 ~ The Federal Reserve has authorized 11 financial bailout programs thus far. Despite Fed Chairman Jerome Powell’s reassurances at his press conferences that these programs are to help American families, a full 10 of these programs are actually bailouts of Wall Street banks or their trading units. The latest Wall Street bank bailout to come out of hiding is the Fed’s Secondary Market Corporate Credit Facility (SMCCF). This program was supposed to buy up corporate bonds in the secondary market in order to help corporate bond markets regain liquidity. Thus far, the only thing the SMCCF has bought up are Exchange Traded Funds (ETFs) holding investment grade and junk-rated bonds. The SMCCF program began operations on May 12. By May 18 the Fed had spent $1.58 billion buying up ETFs. The ultimate goal of the facility, at this point, is to … Continue reading

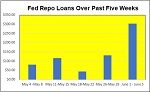

Fed’s Repo Loans to Wall Street Skyrocket by 230 Percent Week Over Week

By Pam Martens and Russ Martens: June 9, 2020 ~ The Federal Reserve is desperately hoping that the pandemic, the coast-to-coast protests and the military generals’ scathing rebuke of the President’s plan to “dominate” grannies and college kids with bayonets and Black Hawk helicopters in the streets would distract the public from its money-feeding tube to Wall Street. Unfortunately for the Fed, Americans can multitask. Between Monday and Friday of last week, the Fed made $304.20 billion in repo loans to Wall Street’s trading houses. That was 230 percent of what it made the week before and 700 percent of what it loaned the week before that. (See chart above.) This would suggest that the liquidity crisis is heating up and/or that it’s taking ever larger amounts to levitate the stock market as sellers come back in. The Fed has gone completely bonkers when it comes to its money spigot … Continue reading

Investors Were Being Blocked from Fund Withdrawals Months Before the Pandemic

By Pam Martens and Russ Martens: June 8, 2020 ~ Wall Street On Parade has previously written that a financial crisis was already well under way before the first case of COVID-19 was reported anywhere in the world. This should matter greatly to Americans because the Federal Reserve is attempting to blame the financial crisis on the virus to avoid Congressional investigations of its second epic failure in a dozen years at regulating the behemoth Wall Street banks. America needs a comprehensive investigation of what really triggered this financial crisis in order to restructure the U.S. financial system away from a casino culture into one that doesn’t regularly need massive Federal Reserve and government bailouts. These bailouts are piling more and more debt on the shoulders of taxpayers and becoming a crushing drag on the U.S. economy, notwithstanding Fed Chairman Jerome Powell’s dismissive remark to Congress that we’ll worry about … Continue reading

BlackRock Authored the Bailout Plan Before There Was a Crisis – Now It’s Been Hired by three Central Banks to Implement the Plan

By Pam Martens and Russ Martens: June 5, 2020 ~ It’s called “Going Direct.” That’s the financial bailout plan designed and authored by former central bankers now on the payroll at BlackRock, an investment manager of $7 trillion in stock and bond funds. The plan was rolled out in August 2019 at the G7 summit of central bankers in Jackson Hole, Wyoming – months before the public was aware of any financial crisis. One month later, on September 17, 2019, the U.S. Federal Reserve would begin an emergency repo loan bailout program, making hundreds of billions of dollars a week in loans by “going direct” to the trading houses on Wall Street. The BlackRock plan calls for blurring the lines between government fiscal policy and central bank monetary policy – exactly what the U.S. Treasury and the Federal Reserve are doing today in the United States. BlackRock has now been … Continue reading

Trump’s Message of Unity: “Vicious Dogs,” “Ominous Weapons,” “Heavily Armed Soldiers”

By Pam Martens and Russ Martens: June 2, 2020 ~ The words of the President of the United States over the past three days suggest that he is determined to be a wartime president and that he has found the enemy: it’s the American people. As racial justice protests raged in cities across the United States on May 30 over the murder of George Floyd in broad daylight at the hands of four policemen in Minneapolis, President Donald Trump tweeted that if the protesters had breached the fence at the White House, “they would have been greeted with the most vicious dogs, and most ominous weapons, I have ever seen.” (Considering that the President avoided military service on the basis of bone spurs, he probably hasn’t actually seen too many ominous weapons.) Yesterday, President Trump held a phone conference with state Governors around the U.S. He said this at one … Continue reading

Financial Lynching Must Be Part of the National Debate

By Pam Martens and Russ Martens: June 1, 2020 ~ As we watched the dangerous scenes of protesters interacting with riot police and the ransacking of banks and businesses in cities across the United States this past weekend, a warning from the 19th century abolitionist, Frederick Douglass, came to mind: “Where justice is denied, where poverty is enforced, where ignorance prevails, and where any one class is made to feel that society is an organized conspiracy to oppress, rob and degrade them, neither persons nor property will be safe.” The protests last week and this past weekend were sparked by unspeakable cellphone videos of a Minneapolis policeman, Derek Chauvin, torturing and murdering George Floyd with his knee crushing his throat for almost nine minutes as Floyd lay handcuffed and pinned face down on the ground by Chauvin and three other police officers. Only Chauvin has been charged with third degree … Continue reading

U.S. Debt Crisis Comes into View as Fed’s Balance Sheet Explodes Past $7 Trillion

By Pam Martens and Russ Martens: May 29, 2020 ~ On May 29, 2019, the Federal Reserve’s balance sheet stood at $3.9 trillion. As of this past Wednesday, May 27, 2020, the Fed’s balance sheet had skyrocketed to $7.145 trillion, an increase of 83 percent in one year’s time. But the explosion in the Fed’s balance sheet cannot be attributed solely to the economic downturn caused by the COVID-19 pandemic. The math and the timeline simply do not support that argument. According to the timeline at the World Health Organization, on December 31, 2019, China first reported a cluster of cases of pneumonia which were identified in early January to be the coronavirus now known as COVID-19. These were the first known cases anywhere in the world. But on December 31, 2019, the Federal Reserve was already deep into a debt crisis in the United States. We know that from … Continue reading