-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Jamie Dimon

A Closer Look at Why Mnuchin Called the Big Wall Street Banks to Check on Liquidity

By Pam Martens: January 7, 2019 ~ On Sunday, December 23, 2018, the sitting U.S. Treasury Secretary, Steve Mnuchin, lit up the airwaves with the announcement on his Twitter page that he had “convened individual calls with the CEOs of the nation’s six largest banks.” The Tweet went downhill from there. The Tweet attached a press release from the U.S. Treasury’s Office of Public Affairs which named the six banks and their CEOs involved in the calls. They were Brian Moynihan, Bank of America; Michael Corbat, Citigroup; David Solomon, Goldman Sachs; Jamie Dimon, JPMorgan Chase; James Gorman, Morgan Stanley; and Tim Sloan at Wells Fargo. Mnuchin said he asked the bank CEOs about their liquidity to fund regular operations and they told him they had “ample liquidity.” Let’s pause right there for a moment. These are the same Wall Street banks that brought the U.S. financial system to its knees … Continue reading

MIT Professor: Big Banks Are Using Data Profiling to Prey on Unsophisticated

By Pam Martens and Russ Martens: August 27, 2018 ~ The Kansas City Fed’s annual symposium in Jackson Hole is typically a dry affair with central bankers and economists expounding on theories that are incomprehensible to the average working person — whose focus is on making their monthly mortgage payment, saving for their children’s college tuition and building a nest egg for retirement. This past weekend’s event, however, produced one highly relevant paper for the average Joe. Professor Antoinette Schoar of the Massachusetts Institute of Technology (MIT) spoke on the effect of investments by “JP Morgan Chase, Citi, Goldman Sachs and Bank of America into AI [artificial intelligence], machine learning and big data,” stating that their investments are “a multiple of all other banks.” Schoar warned that the “emergent Fintech technologies” that result from these large investments “might in fact reinforce concentration in the industry given the enormous economies of … Continue reading

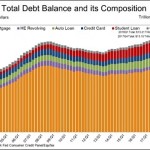

Financial Health of U.S. Consumer Will Determine Severity of the Next Recession

By Pam Martens and Russ Martens: August 6, 2018 ~ Approximately two-thirds of U.S. gross domestic product (GDP) derives from the consumer. Without financially healthy consumers, the economy cannot prosper. In a July 30 interview on the cable news channel, CNBC, Jamie Dimon, the Chairman and CEO of JPMorgan Chase, the largest bank in the U.S., said that “the consumer’s in good shape; their balance sheet’s in good shape.” On May 17 the Center for Microeconomic Data at the Federal Reserve Bank of New York released its Quarterly Report on Household Debt and Credit which raised some notable questions as to whether Jamie Dimon actually has his finger on the pulse of the U.S. consumer. According to the report, “aggregate household debt balances increased in the first quarter of 2018, for the 15th consecutive quarter. As of March 31, 2018, total household indebtedness stood at $13.21 trillion,” which is $536 billion … Continue reading

JPMorgan’s Creepy Patent: Why You Should Be Worried

By Pam Martens and Russ Martens: July 31, 2018 ~ Less than seven months after a unit of JPMorgan Chase settled with the Federal Energy Regulatory Commission (FERC) for $410 million in penalties and disgorgement over allegations that it had manipulated electricity markets in California and the Midwest, one of its employees, Shawn Wesley Alexander, submitted a really creepy patent request to the U.S. Patent and Trademark Office on February 10, 2014. The patent might not be creepy for the owner of a video game arcade but JPMorgan Chase is the largest bank in America – with a global footprint and an unprecedented three Federal felony counts to which it has pleaded guilty in the past four years. The first two counts came in 2014 for looking the other way at Bernie Madoff’s Ponzi scheme as the bank watched hundreds of billions of dollars come and go through his business … Continue reading

Could Technology Doom Facebook, Koch Industries and JPMorgan Chase?

By Pam Martens and Russ Martens: July 26, 2018 ~ Remember the late 90s when the Masters of the Universe on Wall Street were bringing to market anything that smelled of technology or had a dot com after its name. That all ended badly with the Nasdaq stock index losing 78 percent of its value from 2000 to 2002. This is how Ron Chernow correctly described what was happening for New York Times’ readers on March 15, 2001: “Let us be clear about the magnitude of the Nasdaq collapse. The tumble has been so steep and so bloody — close to $4 trillion in market value erased in one year — that it amounts to nearly four times the carnage recorded in the October 1987 crash.” Chernow characterized the Nasdaq stock market as a “lunatic control tower that directed most incoming planes to a bustling, congested airport known as the … Continue reading

As Crime Soars on Wall Street, Its Top Cop Launches a PR Offensive

By Pam Martens and Russ Martens: July 2, 2018 ~ Wall Street’s top cop, Securities and Exchange Commission Chair Jay Clayton, will embark on a four-city Town Hall type event with retail investors beginning next Monday, July 9. The cities targeted will be Miami, Washington D.C., Philadelphia and Denver. The SEC says it wants to hear first-hand about retail investors’ experiences with their investment advisers. That announcement came from the SEC on Friday. On Monday of the previous week, Clayton delivered a speech on improving the Wall Street culture at a full day symposium held by the New York Fed — an institution whose culture has also been deeply compromised by Wall Street. (See Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?) The low point of Clayton’s speech came in the opening minutes when he lavished praise on the scandal-laced tenure of the President of the … Continue reading

How Did JPMorgan Reverse an Arrest Warrant for its Mexico Bank Chief?

By Pam Martens and Russ Martens: June 15, 2018 ~ On Monday Reuters reported that “a judge in Mexico has issued an arrest warrant for the country head of U.S. investment bank JPMorgan for alleged fraud….” Details about the arrest warrant were provided the same day in a lawsuit filed in the Federal District Court for the Southern District of New York. The lawsuit explained that “…a prosecutor has conducted a criminal investigation into fraud by J.P. Morgan. Based on the preliminary evidence collected, the prosecutor recently (in June 2018) requested that a judge detain Eduardo Cepeda, the chairman of the board and chief executive officer of Defendant’s Mexican unit, and former J.P. Morgan managing director Miguel Barbosa. Upon review of the evidence presented by the prosecutor, a criminal court judge has found the elements of felony fraud in the amount of $100 million, and issued a detention order for … Continue reading

Wall Street CEO to Worker Pay Ratios Don’t Capture What’s Going On

By Pam Martens and Russ Martens: June 5, 2018 ~ The Dodd-Frank financial reform legislation that was passed in 2010 required that publicly traded companies report publicly how much the CEO makes compared to the median salary of workers. The Securities and Exchange Commission, with its close ties to Wall Street, stonewalled for years in passing the final rule and had to be pressured and publicly embarrassed in open letters from members of Congress before it finally implemented the rule. As a result, eight years later, we are finally seeing the hard numbers that define CEO greed in America. In May, Democratic Congressman Keith Ellison from Minnesota’s 5th District released a study on the new data that was being released. The study was titled “Rewarding or Hoarding: An Examination of Pay Ratios Revealed by Dodd-Frank.” Among the key findings in the study were the following: Two-thirds of the richest 1 … Continue reading

Citigroup Faces Criminal Charges in Australia: 3x Felon JPMorgan Is Said to be Cooperating

By Pam Martens and Russ Martens: June 4, 2018 ~ The largest bank in the United States, JPMorgan Chase, is already a 3-time felon. It received two felony counts in 2014 for its role in the Bernie Madoff Ponzi scheme and pleaded guilty to an additional felony count in 2015 for its role in a bank cartel that was rigging foreign currency trading. One more felony count and its Chairman and CEO, Jamie Dimon, might have finally been sacked by the bank’s timid Board for placing the bank’s global reputation under yet another scandal. So, it appears this morning, based on an avalanche of reporting from Australia, that JPMorgan Chase has ratted out U.S. behemoth, Citigroup; the troubled German bank, Deutsche Bank; and Australian bank ANZ, in order to save its own skin. The Australian Financial Review politely writes that “JPMorgan blew the whistle” on the other banks over a … Continue reading

Facebook and JPMorgan Chase: Case Studies in Exploitive Monetization

By Pam Martens and Russ Martens: April 5, 2018 Last week the CEO of Apple, Tim Cook, gave a harsh critique on how Facebook is making its money. Cook told an MSNBC Town Hall: “The truth is we could make a ton of money if we monetized our customer, if our customer was our product. We’ve elected not to do that.” Cook has good reason to believe that Facebook has “monetized” its customers. After a whistleblower from the data mining company, Cambridge Analytica, exposed that Facebook had allowed the private information on 50 million Facebook users to be exploited for micro-targeting on behalf of the Trump presidential campaign, the company has come under withering criticism. Yesterday, in a press conference, Mark Zuckerberg, the CEO of Facebook, conceded to reporters that the privacy breach by Cambridge Analytica could have affected as many as 87 million Facebook users. The company also announced … Continue reading