By Pam Martens and Russ Martens: February 1, 2022 ~

Adding to a very long laundry list of questions about exactly whom the New York Fed serves, is the help-wanted ad that was posted four days ago. The ad is for a Financial Planning & Analysis Expert to work at the New York Fed’s headquarters in lower Manhattan. One part of the job description is this: “modelling of potential investment opportunities.”

The New York Fed is supposed to be implementing monetary policy on behalf of the United States as mandated by the Federal Open Market Committee (FOMC). As far as public FOMC records indicate, the New York Fed has not been assigned the job of seeking out “potential investment opportunities.” So for whom is it seeking out these investment opportunities? Is it looking for profit-making investments for the Wall Street megabanks who own it and whose CEOs rotate on and off its Board of Directors? Had the New York Fed not become so cozy with these megabank executives, one would not have to be asking that question.

Every time there is a massive Fed bailout of these megabanks, the New York Fed manages to be the entity creating trillions of dollars out of thin air for the bailouts; handing out no-bid contracts to manage the bailouts to the same megabanks being bailed out; and then locking up for two years the names of the banks that got all the loot so that the public’s attention has moved on when the shocking details are finally revealed.

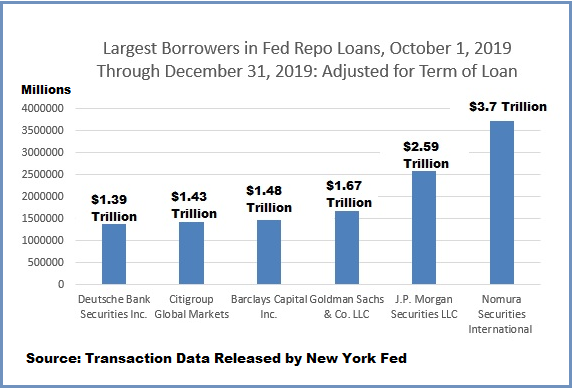

Consider the chart below reflecting the largest secret borrowers from the New York Fed’s emergency repo loans that it funneled to Wall Street trading houses in the last quarter of 2019. These trading houses were receiving trillions of dollars from the New York Fed in cumulative loans, that morphed from overnight loans to term loans for as long as 42 days at a time, and yet neither the Federal Reserve Board of Governors in Washington, D.C. nor the New York Fed have offered any credible explanation for what this financial crisis was all about. Clearly, it was unrelated to COVID-19 because the emergency repo loans began on September 17, 2019 – months before the first case of COVID-19 was reported anywhere in the world.

The problem with allowing an unaccountable behemoth to continuously expand its footprint is that pretty soon there’s no ability at all to rein it in. Consider our report yesterday, which had somehow failed to grace the business newspapers of New York. The New York Fed has quietly expanded its footprint to Chicago – yes, 796 miles away in Chicago. It’s opened an additional trading floor there and staffed it up.

The New York Fed’s Second Federal Reserve District has nothing to do with Chicago, Illinois. It consists of New York State, 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico and the U.S. Virgin Islands. And yet the Federal Reserve Board of Governors, the Senate Banking Committee and House Financial Services Committee – all of whom oversee the Fed – are asking no questions and providing no answers to the American people about why the New York Fed needs a trading floor in Chicago.

Corrupt activities that go on inside the New York Fed were chronicled in a book in 2018 by one of its own former bank examiners, Carmen Segarra. Her book, Noncompliant: A Lone Whistleblower Exposes the Giants of Wall Street, describes the culture inside the New York Fed as follows:

“…nothing I had seen during my decade of legal work had prepared me for what I witnessed in just a few short months at the New York Fed.

“In those months I discovered a disorienting world full of hidden clues, where people said one thing but meant another. Beneath the public face of the Fed laid a web of incompetence, corruption, rampant mismanagement, secrets, and lies. In the “fake work” culture of the Fed, where supervision was a job title, not a job, the most important thing was to control the process to serve the ultimate master. The New York Fed was not simply failing to stop the banks; it was actually enabling their bad behavior.”

Our reporting on the New York Fed over the past decade very much confirms the assessment of Carmen Segarra. (See related articles below.)

It’s long past the time for the U.S. Justice Department to do its job and investigate this deeply troubled and co-opted institution.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

The New York Fed Is Exercising Powers Never Bestowed on It by any Law

Instead of Draining the Swamp, the Swamp Is Draining the U.S. Treasury via the New York Fed

Dangerous Liaisons: New York Fed and JPMorgan’s Incestuous Relationship

New Documents Show How Power Moved to Wall Street, Via the New York Fed