-

Recent Posts

- Matt Gaetz Case Has Echoes of the Justice Department’s Failure to Prosecute Jeffrey Epstein’s Sex-Trafficking Ring

- Trump’s Nominees Are Being Hand-Picked to Enact a Dangerous Platform the Koch Brothers Made Public 44 Years Ago

- Trump Makes Second Attempt to Install Wall Street’s Lawyer, Jay Clayton, to Oversee Prosecutions of Wall Street

- Trump Is President-Elect for Just 7 Days and a Sex, Drugs and Bribe Scandal Breaks Out

- Howard Lutnick, the Wall Street Billionaire Staffing Trump’s Cabinet, Hosted a Fundraiser for Hillary Clinton’s Presidential Bid in 2016

- The U.S. Has Failed Its Children – In the Most Unconscionable Ways

- Jamie Dimon’s House of Frauds Is the Target of More than 200 Investigations, Costing $2 Billion in Legal Expenses in Less than Two Years

- New York Fed Report: 27 Percent of Bank Capital Is “Extend and Pretend” Commercial Real Estate Loans

- The U.S. Government Is Plowing Billions into SpaceX, Overlooking Drug Use, Sex Parties, and Elon Musk’s Coziness with Putin

- The U.S. Has Given Top Secret Clearance to Elon Musk and Over $19 Billion in Contracts, Ignoring His Illegal Drug Use and Phone Chats with Putin as His SpaceX Puts Spy Satellites into Orbit

- Goldman Sachs Has Ripped Off Its Customers for a Century – a Puny $64.8 Million Fine for Abusing Thousands of Apple Credit Card Customers Fails the Smell Test

- Academic Paper Finds U.S. Banking System Is Less Safe Today than Before the 2010 Dodd-Frank Financial Reform Legislation Was Passed

- Jerome Powell’s Fed Notches an Historic Record of $204 Billion in Cumulative Operating Losses – Losing Over $1 Billion a Week for More than Two Years

- Could Big Tech Own Federally-Insured Banks? Here Are the Dangers

- FEMA Was First Targeted by Project 2025; Now FEMA Workers Are Being Threatened While Providing Disaster Relief in North Carolina

- Bloomberg News Writes Puff Pieces on Jamie Dimon While Its Parent Does Business Deals with the Bank He Heads, JPMorgan Chase

- Hurricanes Helene and Milton Send Climate Change Wakeup Call as Gulf of Mexico Water Breaks Heat Records

- A Bank Regulator Provides a Frightening Look at the Trading Casino Jamie Dimon Has Built Inside His Federally-Insured Bank

- Report: “Flash Flooding Is the Number One Storm-Related Killer in the U.S.” Few Cities or Towns in America Are Built to Survive Its Wrath

- Hurricane Helene Dumped 20 Trillion Gallons of Rain, Destroying Entire Towns in Western North Carolina, Hundreds of Miles from any Coastline

- Half of All Deaths from Hurricane Helene Occurred 485 Miles North of Where It Made Landfall

- What Did Madoff, Jeffrey Epstein and Sanctioned Russian Mercenary Group, Wagner, Have in Common? They All Banked at JPMorgan Chase

- Deadly, Exploding Pagers Force the U.S. to Get Serious About Malware from China in U.S. Products that Are Potential National Security Threats

- Wall Street Has Moved Vast Sums of Its Trading to Its Federally-Insured Banks

- The Stock Market Had a Psychotic Episode After the Fed Rate Cut Yesterday, Plunging 479 Points from the Day’s High

- As Trump Launches a Crypto Firm, FBI Reports Crypto Fraud Has Exploded to $5.6 Billion; Representing Almost 50 Percent of All Financial Fraud

- Everything this Book Predicted on Wall Street Megabanks Ruling their Regulators Is Now Unfolding

- The Fed Just Kicked the Capital Increases for the Dangerous Megabanks and their Derivatives Down the Road for Years

- Intel, Boeing and U.S. Steel May Hold the Secrets to What’s Behind All the Talk of a U.S. Sovereign Wealth Fund

- Trump and Paulson’s Proposal: U.S. Sovereign Wealth Fund (or Another Grifter Bailout)

- A Wall Street Regulator Is Understating Margin Debt by More than $4 Trillion – Because It’s Not Counting Giant Banks Making Margin Loans to Hedge Funds

- After JPMorgan Threatens to Sue, the Fed Cuts Its Capital Requirement on the 5-Count Felon from a Planned 25 Percent Hike to Less than 8 Percent

- Three Megabanks Had Loans Outstanding of $1.832 Trillion to Giant Hedge Funds on March 31

- Jamie Dimon’s Washington Post OpEd Gets Pummeled at Yahoo Finance

- In the Span of 72 Hours, Four People Tied to a Hewlett-Packard Criminal Case Died in Two Separate Events

- Crypto Took Down Another Federally-Insured Bank and Just Handed Its CEO a 24-Year Prison Sentence

- All the Devils from 2008 Are Back at the Megabanks: Leverage, Off-Balance-Sheet Debt, Over $192 Trillion in Derivatives, Shaky Capital Levels

- New Study Says the Fed Is Captured by Congress and White House — Not the Megabanks that Own the Fed Banks and Get Trillions in Bailouts

- Data from the Fed’s Emergency Funding Program Shows Spring 2023 Banking Crisis Was Far Deeper than Americans Were Told

- These FDIC-Insured Banks Have Lost 69 to 40 Percent of their Market Value Year-to-Date

- Exposure at Hedge Funds Has Skyrocketed to Over $28 Trillion; Goldman Sachs, Morgan Stanley and JPMorgan Are at Risk

- We Charted the Plunge and Rebound in the Nikkei Versus Nomura and Citigroup; the Correlation Is Frightening

- Former U.S. Labor Secretary Says Billionaires Have No Right to Exist Because their Wealth Comes from Five Illegal or Bad Practices

- Citigroup Is Having a Helluva Summer: A Protest on Thursday Will Turn Up the Heat

- Nikkei Has Biggest Drop in History: Here’s What’s Causing the Global Market Selloff

- JPMorgan Is Tapping Illiquid Assets in its Global Collateral Program; the New York Fed Is Paying for Its Services

- Bank Regulators Issue Warnings on Fintech and Banking as Disasters Pile Up

- Donald Trump Gives a Speech on Not Letting China Win the Crypto Race – Not Realizing China Banned Crypto Mining and Transactions Four Years Ago

- The New York Fed Has Contracted Out Key Functions to JPMorgan Chase; We Filed a FOIA and Got These Strange Invoices

- On the Eve of Netanyahu’s Address to Congress, Senator Bernie Sanders Delivers a Breathtaking Assessment of His War Crimes

Search Results for: bank collusion

Are Big Banks Manipulating Their Share Prices?

By Pam Martens and Russ Martens: October 20, 2015 During the recent Democratic Presidential debate that aired on CNN on October 13, Senator Bernie Sanders of Vermont said: “Let us be clear that the greed and recklessness and illegal behavior of Wall Street, where fraud is a business model, helped to destroy this economy and the lives of millions of people.” Most Americans clearly understand that reality, and yet, Wall Street’s regulators continue to look the other way at the most outrageous conflicts of interest. On June 2, 2014, Wall Street’s self-policing body, FINRA, disclosed for the first time details on which publicly traded companies were being traded in dark pools and the source and volume of that trading. Dark pools are effectively unregulated stock exchanges and are operated by some of the largest commercial banks on Wall Street – which are also backstopped by the taxpayer for any losses … Continue reading

Have the Mega Banks Put the U.S. on Course for Another Crash? The Answer May Reside in Nomi Prins’ New Book

By Pam Martens: March 31, 2014 “All the Presidents’ Bankers: The Hidden Alliances that Drive American Power” by former Wall Street veteran, Nomi Prins, is a seminal addition to the history of continuity government between the White House and Wall Street from the days of Teddy Roosevelt and the Panic of 1907 right up through the Panic of 2008 and the Presidency of Barack Obama. (Don’t be intimidated by the 69 pages of footnotes; while meticulously researched, this is a captivating read for anyone seeking clarity on why Wall Street can collapse, get bailed out by the taxpayer, cause a Great Recession and still call the shots in Washington.) The hefty hardcover deserves instant classic status for two reasons: like no other tome before, it explains through original archival material why the mega Wall Street banks are coddled by Washington and have been allowed to survive a century of public … Continue reading

Top UK Regulator: People Have Good Reason Not to Trust Currency Rates Set By Big Banks

By Pam Martens: February 5, 2014 Yesterday, Martin Wheatley, the Chief Executive of Britain’s top financial regulator, the Financial Conduct Authority (FCA), testified before Parliament’s Treasury Select Committee that the public has valid reasons not to trust the way that rates are set in the foreign currency exchange markets “because of what they’ve seen and the stories that they’ve seen come out.” Global investigators have accumulated evidence that strongly suggests that traders at the too-big-to-fail banks have been rigging foreign exchange rates in much the same manner that they rigged the interest rate benchmark, Libor. Unfortunately for the public, Wheatley said it is likely that the investigation will drag into 2015, meaning the public will just have to go on not trusting a marketplace that trades $5.3 trillion a day. (Is this any way to run a global financial system or have we permanently entered the Alice in Wonderland world … Continue reading

Senator Sherrod Brown Takes on the Fed’s Support of Wealth Stripping the Middle Class

By Pam Martens and Russ Martens: January 31, 2024 ~ Smart Americans have found two ways to outwit the wealth extraction machinery on Wall Street. They buy a home and build its value over time with sweat equity; and/or they start their own small business. A very large number of Americans who are living comfortably in retirement today built their wealth through one or both of these avenues. Wall Street banks, on the other hand, typically extract wealth from the little guy in a multitude of insidious ways – from high interest credit cards to excessive fees, tricked-up mortgages and outright frauds. Nothing better illustrated this wealth stripping than the 2013 PBS program from Frontline called The Retirement Gamble. The program documented the following: If you work for 50 years and receive the typical long-term return of 7 percent on the stock mutual funds in your 401(k) plan, and your fees are 2 … Continue reading

Nasdaq Plunge Provides a Sobering Look at What’s to Come

By Pam Martens and Russ Martens: December 17, 2021 ~ The Nasdaq Composite Index dropped 385 points yesterday for a loss of 2.47 percent. At the lows of the day, it was down 446 points at 15,119.49. That compares with a loss of just 29.79 points on the Dow Jones Industrial Average or 0.08 percent. The Nasdaq is packed with Big Tech stocks trading at nose-bleed multiples and meager dividends, or no dividends at all. Tesla is trading at a trailing price-to-earnings ratio of 302 and pays no dividend. Amazon is trading at a trailing P/E of 67 and pays no dividends. Tesla tanked 5 percent yesterday while Amazon lost 2.56 percent. Other Big Tech losers were Apple, down 3.93 percent; Microsoft, down 2.91 percent; and a whopping smackdown of Adobe, which shed 10.19 percent. Notably, Adobe also doesn’t pay a dividend and trades at a trailing P/E of 54. The … Continue reading

“Today’s Rates, the Lowest in 4,000 Years, Harm Savers, Advantage Speculators, Misdirect Capital, and Perpetuate the Unnatural Lives of Failing Businesses…”

By Pam Martens and Russ Martens: April 22, 2021 ~ The headline above was Point Number 6 in a multi-point Tweet offered by Grant’s Interest Rate Observer on November 18 of last year on how the Fed has grossly distorted markets. The 4,000-year claim is derived from the seminal book on interest rates, Sidney Homer’s A History of Interest Rates, Fourth Edition, co-authored by Richard Sylla. One of our readers recently sent us a link to a fascinating interview with James Grant, the Founder and Editor of Grant’s Interest Rate Observer. The interview was conducted in February by Consuelo Mack for the PBS program, WealthTrack. We listened carefully to the interview and were delighted to see that over the more than three decades that Grant has been chronicling the Fed’s thumb on the scale, the powerful forces on Wall Street have failed to compromise his voice. If anything, Grant has become … Continue reading

Watch the Last Four Federal Reserve Chairs Sing their Loyalty to Wall Street

Ask and it shall be given: pic.twitter.com/FcnwtuAJQT — Trevor Chow (@tmychow) March 11, 2021 By Pam Martens and Russ Martens: March 12, 2021 ~ Trevor Chow is a first-year economist and Jardine Scholar at Trinity College, part of the University of Cambridge in England. With his hilarious and profoundly thought-provoking video satire of the four most recent Chairs of the Federal Reserve singing the words to Rick Astley’s 1987 hit single, “Never Gonna Give You Up,” he has immortalized himself with us and, very likely, Nomi Prins, Senator Bernie Sanders and the family of the late, courageous reporter, Mark Pittman of Bloomberg News. All of us have attempted to bring transparency to the wayward path of the Fed. Debuting in what is sure to be the first of many such Fed singing videos are, left to right, former Fed Chairs Alan Greenspan, Ben Bernanke, Janet Yellen and the current Fed Chair, … Continue reading

Jim Cramer’s Thesis that Reddit’s WallStreetBets’ Guys Caused the Short Squeeze in GameStop Is Falling Apart

By Pam Martens and Russ Martens: February 8, 2021 ~ There’s an important debate going on about whether the Reddit message board known as WallStreetBets fanned the short squeeze that inflated GameStop from an $18.84 stock on December 31 of last year to a $483 stock intraday on January 28 – a breathtaking run of 2,465 percent in four weeks. Last week GameStop came plunging back to earth, closing the week at $63.77. Similar short squeezes are causing other targeted stocks to whipsaw in wild trading action. The House Financial Services Committee will hold a hearing on the matter on February 18 and multiple investigations are underway by both federal and state authorities. At this time one year ago, the Reddit WallStreetBets’ message board had 900,000 users — not a particularly big number for a group that started in 2012. This morning, as a result of all the publicity, the … Continue reading

GameStop Shares: Dark Pools Owned by Goldman Sachs, JPMorgan, UBS, et al, Have Made Tens of Thousands of Trades

By Pam Martens and Russ Martens: January 28, 2021 ~ Dark Pools owned by the biggest names on Wall Street – such as Goldman Sachs’ Sigma X2, JPMorgan Chase’s JPM-X, UBS’ UBSA, Morgan Stanley’s MSPL, and Credit Suisse’s Crossfinder — have been making tens of thousands of trades in the shares of GameStop on an ongoing weekly basis. FINRA, Wall Street’s highly compromised self-regulator, reports the Dark Pool data on a stale basis, two to three weeks after the trading has occurred. It is then lumped together for the whole week, rendering it useless in terms of monitoring price manipulation. The chart above is taken from the latest available information from FINRA. (See our previous reporting on Dark Pools in Related Articles below.) It’s a fair guess that you haven’t heard a peep about Dark Pools on the evening news. The fact that you haven’t is a perfect commentary on … Continue reading

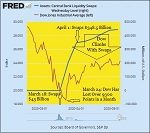

Meet the Fed’s Global Plunge Protection Team

By Pam Martens and Russ Martens: May 10, 2020 ~ The Dow Jones Industrial Average rallied 455 points by the closing bell on Friday. It seemed sadistic to average folks. One hour before the stock market opened, the Bureau of Labor Statistics had reported the worst U.S. unemployment figure since the Great Depression (14.7 percent) along with the staggering loss of 20.5 million jobs in just the month of April. Within the first half hour of trading, the Dow was up more than 300 points. It then added to those gains in afternoon trading. None of the explanations offered by mainstream media to explain the incongruous stock trading were accurate. It was not because the stock market had anticipated worse or that the market was rallying because it thought the worst of the economic fallout was behind us. It was because the one emergency funding facility that the Federal Reserve … Continue reading