-

Recent Posts

- It’s Time to Name the “Wall Street Financiers” in the Epstein Files

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

Category Archives: Uncategorized

At Press Conference, Fed Chair Powell Refuses to Answer Whether Wall Street Banks Are Too Big to Manage

By Pam Martens and Russ Martens: September 19, 2019 ~ Following a lack of liquidity on Wall Street, which necessitated the Federal Reserve having to provide $53 billion on Tuesday and another $75 billion on Wednesday to normalize overnight lending in the repo market, the Chairman of the Fed, Jerome (Jay) Powell held his press conference at 2:30 p.m. yesterday. The press gathering followed both a one-quarter point cut in the Fed Funds rate by the Fed yesterday as well as the first intervention by the Fed in the overnight lending market since the financial crash. (The Fed had to intervene again this morning, making another $75 billion in repo loans available.) The week’s unsettling events should have provided the basis for reporters to fire questions at the Fed Chair along the following lines: (1) Did the overnight repo lending rate jump to an historical high of 10 percent on … Continue reading

The Fed Intervened in Overnight Lending for First Time Since the Crash. Why It Matters to You.

By Pam Martens and Russ Martens: September 18, 2019 ~ Yesterday felt a little like that scene from the 1946 movie “It’s a Wonderful Life” starring Jimmy Stewart. There’s a run on Stewart’s bank because his absent-minded Uncle Billy loses the cash he was sent off to deposit on behalf of the bank. The bank examiners discover there’s money missing and rumors spread. The rumors that spread yesterday were not that money was missing at a Wall Street bank but that liquidity was missing. It had dried up to the point that the major Wall Street banks could not, or would not, handle the demand for loans called overnight repurchase agreements (repos) that were coming their way. (Repos are a short-term form of borrowing where corporations, banks, brokerage firms and hedge funds secure loans by providing safe forms of collateral such as Treasury notes.) The oversized demand for the repos … Continue reading

Will Jamie Dimon Finally Lose His Job Over Racketeering Charges?

By Pam Martens and Russ Martens: September 17, 2019 ~ Yesterday, three traders at JPMorgan Chase, the bank headed by Jamie Dimon, got smacked with the same kind of criminal felony charge that was used to indict members of the Gambino crime family in 2017. The charge is racketeering and falls under the Racketeer Influenced and Corrupt Organizations Act or RICO. According to the Justice Department, the traders engaged in a pattern of rigging the gold, silver and other precious metals markets from approximately May 2008 to August 2016. One of the traders, Michael Nowak, was actually a Managing Director at the bank and the head of its Global Precious Metals Desk. The other two traders are Gregg Smith and Christopher Jordan. RICO is typically used to indict mobsters – which makes its use against employees of the largest bank in America a very disquieting event. But even more disquieting … Continue reading

In the WeWork IPO, the Money Trails End Up at JPMorgan’s Doorstep

By Pam Martens and Russ Martens: September 16, 2019 ~ According to the amended prospectus filed with the Securities and Exchange Commission to alert the public to the thousands of warts with malignant possibilities sprouting out of the office rental company, WeWork, which plans to offer its shares to the public for the first time, JPMorgan Chase will receive something no other underwriter is getting in this deal: a cool $50 million extra as a “structuring fee.” On top of that, of course, the bank will also get the fat underwriting fees that the other banks involved in the IPO get. That’s just one of the many curious ways that JPMorgan Chase stands out in its relationship with WeWork. (The parent of WeWork, The We Company, is actually offering the shares to the public.) As it turns out, quite a few of JPMorgan Chase’s commercial real estate clients who have … Continue reading

Bernie Sanders Says in Last Night’s Debate that Richest 3 Americans Own More Wealth than Bottom 160 Million Americans. It’s Actually Worse than That.

By Pam Martens and Russ Martens: September 13, 2019 ~ During last evening’s Democratic debate, Senator Bernie Sanders said this: “You’ve got three people in America owning more wealth than the bottom half of this country.” According to Politifact, Sanders is basing this claim on a 2017 study done by the Institute for Policy Studies which put the richest three Americans’ wealth as follows (based on the Forbes list of billionaires at that time): Bill Gates of Microsoft with $89 billion; Jeff Bezos of Amazon with $81.5 billion; and Warren Buffett of Berkshire Hathaway with $78 billion — for a total of $248.5 billion. That wealth figure contrasts with the $245 billion owned by the bottom 50 percent of Americans according to the 2016 Survey of Consumer Finances conducted by the Federal Reserve. (The Fed’s survey is conducted every three years and the 2019 study has not yet been released.) But … Continue reading

Alexandria Ocasio-Cortez on WeWork IPO: “You’re Getting Fleeced”

By Pam Martens and Russ Martens: September 12, 2019 ~ Yesterday the U.S. House of Representatives’ Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets held an extremely timely hearing titled: “Examining Private Market Exemptions as a Barrier to IPOs and Retail Investment.” The thrust of the hearing was the negative impact that the ballooning private equity market is having on the dramatically shrinking pool of publicly traded stocks and the good of society in general. As the WeWork IPO train wreck plays out in the media, showing how two of the most sophisticated banks on Wall Street, JPMorgan Chase and Goldman Sachs, were set to bring this 9-year old office rental company to the public markets via an IPO, despite outrageous conflicts of interest by WeWork’s founder and CEO and a proposed valuation that turns out to have been off the mark by tens of billions of dollars, it was … Continue reading

The Wall Street Campaign to Stop Elizabeth Warren Officially Began on September 10, 2019

By Pam Martens and Russ Martens: September 11, 2019 ~ On May 6 of this year, Wall Street On Parade predicted that Senator Elizabeth Warren, now rising rapidly in her bid for President, would be targeted by Wall Street in an effort to derail her campaign. Yesterday, that Wall Street campaign officially began. CNBC’s Jim Cramer and David Faber discussed on TV how they are hearing from Wall Street bank executives that Warren must be stopped. On the same day, September 10, 2019, Bloomberg News, which is majority owned by billionaire Michael Bloomberg, whose $52.4 billion net worth derives from leasing his data terminals to thousands of Wall Street trading floors around the globe, ran this headline: “Richest Could Lose Hundreds of Billions Under Warren’s Wealth Tax.” Obviously, that wouldn’t sit too well with Michael Bloomberg, who has frequently penned his own OpEds for his financial news empire. But the … Continue reading

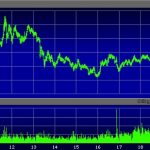

Citigroup Says Gold Could Go to $2,000; Is It Talking Its Book?

By Pam Martens and Russ Martens: September 10, 2019 ~ Citigroup released an analyst’s note yesterday stating that “We expect spot gold prices to trade stronger for longer, possibly breaching $2,000 an ounce and posting new cyclical highs at some point in the next year or two.” Gold was last on a record-breaking streak in 2011 when it shot through handles of $1500, $1600, $1700 and $1800 from April through August of that year. On an intraday trading basis, gold reached a high of $1,917.90 an ounce on August 23, 2011 and another intraday high of $1923.70 on September 6, 2011. Gold then spent the next five years trading back down to the $1100 range. As the chart above indicates, gold has been moving decidedly higher this year, up 16.9 percent from January 2, 2019 to yesterday’s close. At 9:16 this morning, gold was trading at $1,504.40 an ounce. Is … Continue reading

Is Corporate Media Tricking the Public with Reports that the Stock Market Is Setting New Highs?

By Pam Martens and Russ Martens: September 9, 2019 ~ On January 26, 2018 the Dow Jones Industrial Average set a new record high of 26,616.71. Despite setting new highs multiple times thereafter, the moves were so negligible on a percentage basis that the reality is that the stock market has been a real dog over the past year and a half. This past Friday, the Dow closed at 26,797.46. That’s a meager 180.75 points, or less than a one percent move, in 19 months. That’s not exactly the stuff that retirement dreams are built on. But if you’re a typical American who has to rely on headlines or TV sound bites to tell you what’s going on in the market because you’re too busy working long hours, running the kids to dentist appointments and soccer games, doing grocery shopping and laundry on the weekends, then you may have been … Continue reading

Here’s the Proof the Federal Government Is Overtly Lying to the Public about Wall Street’s Derivatives

By Pam Martens and Russ Martens: September 6, 2019 ~ Based on every meaningful investigation into the epic financial crash of 2008 that resulted in the worst economic crisis in the U.S. since the Great Depression, derivatives that were concentrated at Wall Street’s largest banks played a central role in the crisis. And yet, 11 years later, neither Federal regulators nor Congress have meaningfully reined in these risks. Three years ago we reported on President Obama’s press conference of March 7, 2016 where Obama overtly misled the American people about how Wall Street banks were complying with the 2010 Dodd-Frank financial reform legislation that mandated that the banks’ trillions of dollars in dangerous derivatives be centrally cleared rather than traded as opaque private contracts between two counterparties. President Obama stated during this press conference that “you have clearinghouses that account for the vast majority of trades taking place.” That wasn’t … Continue reading