By Pam Martens and Russ Martens: August 26, 2020 ~

At his press conference on June 10 of this year, Fed Chairman Jerome Powell said this about the U.S. banking system, which includes a little more than 5,000 federally insured banks but is dangerously concentrated in the hands of just five mega banks on Wall Street.

“You have a banking system that is so much better capitalized, so much stronger, better aware of its risks, better at managing its risks, more highly liquid. You have all of those things and they’ve been lending, they’ve been taking in deposits, they’ve been a source of strength in this situation.”

Warren Buffett, Chairman and CEO of Berkshire Hathaway, is apparently not buying the story that Powell is attempting to sell to the public. According to Berkshire Hathaway’s 13F filing with the Securities and Exchange Commission for the quarter ending June 30, 2020, Buffett dumped 35.5 million shares of JPMorgan Chase or 61.5 percent of his 57.7 million share holding in the bank.

Buffett also dumped the remainder of his position in Goldman Sachs, which amounted to 1.9 million shares. Buffett had already exited 84 percent of his shares of Goldman Sachs in the first quarter of the year.

Making Buffett’s massive dump of JPMorgan Chase even more embarrassing was the headline in Barron’s on January 3 of this year which blared: Why Warren Buffett Loves JPMorgan Chase Stock. Equally untimely, a well-known Wall Street bank analyst, Mike Mayo of Wells Fargo, reiterated his buy rating on JPMorgan Chase on March 31.

According to MarketBeat, 15 Wall Street analysts have buy ratings on the stock of JPMorgan Chase. Goldman Sachs issued a buy rating on JPMorgan Chase on July 24.

When a storied investor like Warren Buffett is dumping what the Street is pumping, it’s never a good sign.

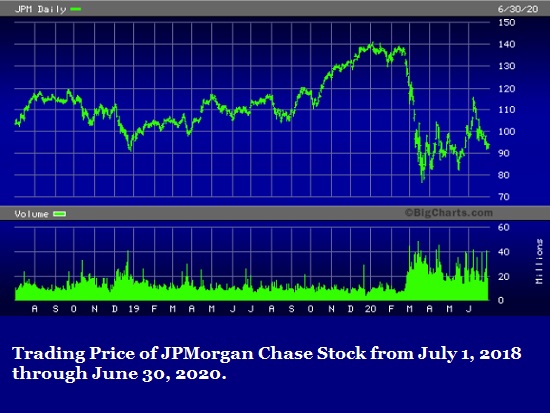

According to earlier 13F filings, Buffett acquired 35.66 million shares of JPMorgan Chase in the third quarter of 2018. He then took that position to a total of 50 million shares in the fourth quarter of 2018 and added the balance of his position in the first quarter of 2019. As the chart above indicates, Buffett likely paid more for his shares than he realized from his sale proceeds in JPMorgan Chase in the second quarter.

One of the things that could be spooking Buffett when it comes to JPMorgan Chase is the unquantifiable risk in its derivatives book. This is, after all, the bank that famously lost $6.2 billion of its bank depositors’ money in its London Whale derivatives scandal of 2012. Buffett has previously dubbed derivatives “financial weapons of mass destruction.”

According to the regulator of national banks, the Office of the Comptroller of the Currency, as of March 31, 2020, JPMorgan Chase had the largest exposure of any U.S. bank to derivatives. Its notional exposure (face amount) was $59 trillion. The bank with the second largest exposure was the Goldman Sachs bank holding company, at $47.7 trillion.

Related Articles:

As Markets Plunged in March, Dark Pools Upped their Trading in JPMorgan’s Stock

The Fed Has 233 Secret Documents about JPMorgan’s Potential Role in the Repo Loan Crisis