-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

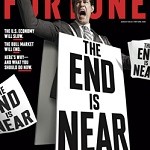

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

Yes, James Freeman, We Do Know How Bad the Federal Reserve Is

By Pam Martens and Russ Martens: August 10, 2018 ~ Earlier this week, James Freeman, the Assistant Editor of The Wall Street Journal’s editorial page, wrote an opinion piece headlined as “We’ll Never Know How Bad the Federal Reserve Is.” Freeman is also a Fox News contributor so one might be prone to suspect there is that typical right-wing bias to bash the Fed. Freeman, however, has a legitimate beef. His new book, “Borrowed Time: Two Centuries of Booms, Busts and Bailouts at Citi,” with co-author Vern McKinley was published this week and Freeman laments in the article about how the Fed “hides and then destroys documents.” If you’re a journalist attempting to compile a truthful and accurate account about a financial institution or a financial era and a key institution holding those documents refuses to release them, then the American people have lost the ability to exercise oversight of … Continue reading

Why Did Trump Just Bully the Federal Reserve on Interest Rates

By Pam Martens and Russ Martens: July 20, 2018 ~ Could we start hearing chants of “lock him up” against Fed Chair Jerome Powell at Trump rallies? Could Powell be ridiculed as “Little Interest Rate Man” on Trump’s Twitter feed? Trump may be attempting to plant those seeds of angst in Powell’s brain. In addition to playing with Powell’s head, President Donald Trump accomplished two things in his interview on CNBC yesterday when he made it clear that he’s “not thrilled” with the Federal Reserve’s plans to continue raising interest rates. He threw more red meat to his base (many of whom want to abolish the Fed altogether) and he laid the groundwork for scapegoating the Fed if the economy goes south on his watch. Trump had this to say about the Federal Reserve raising interest rates to CNBC anchor Joe Kernen (see full interview in video below): “I’m not … Continue reading

Just How Big a Player Is the Federal Reserve in the Stock Market?

By Pam Martens and Russ Martens: January 18, 2018 To understand how the U.S. central bank, known as the Federal Reserve, is influencing the froth of the stock market, you need to take a few moments to understand the interaction of bond yields with stock prices. Sophisticated investors who predominate in the markets compare the yield on bonds to the cash dividend yield on stocks to determine which is a better value. Following the financial crash of 2008, the Federal Reserve began buying up Treasury bonds and mortgage-backed bonds in the marketplace to the overall tune of more than $3 trillion. This has driven down bond yields and provided an artificial boost to the stock market. The Fed’s assets swelled from $914.8 billion at the end of 2007 to $4.5 trillion in 2014 from its bond buying program. In just the single year of 2013 the Fed’s assets mushroomed by … Continue reading

Federal Reserve Reform Upstaged by Trump’s Potty Mouth

By Pam Martens and Russ Martens: January 12, 2018 On Wednesday, the House Financial Services Committee held a hearing on a topic of critical importance to all Americans: restructuring the Federal Reserve into a modern day central bank instead of a captured regulator controlled by the very banks it purports to supervise. Dean Baker, the Senior Economist at the Center for Economic and Policy Research, presented an important assessment of reforms needed at the Fed but you will be hard pressed to find any mainstream media coverage of his testimony. Instead, President Trump’s characterization yesterday of Haiti and African nations as “sh**hole countries” is dominating the news. How much critical work is falling by the wayside because mainstream media, dependent on ratings, elects to pursue only the most sensational stories – which they have no shortage of finding under President Trump. Congress began its latest push to reform the Federal … Continue reading

Should the Federal Reserve Be Doing the Nation’s Work with a Skeleton Crew?

By Pam Martens and Russ Martens: August 3, 2017 The Federal Reserve Board of Governors is supposed to have a roster of seven Governors. It currently has four. Equally alarming, it lists just two members serving on each of its eight committees. One Fed Board Governor, Lael Brainard, is listed as one of the two members on six of the eight committees, or 75 percent of all committees. Governor Jerome Powell sits on five of the eight committees, or 63 percent of all committees. The Fed’s Committee on Supervision and Regulation consists of just Powell and Brainard. And yet, this is what the Fed’s 2015 Annual Report describes as the institutions the Fed supervises: 4,922 Bank Holding Companies 442 Domestic Financial Holding Companies 470 Savings and Loan Holding Companies 839 State Member Banks 154 Foreign Banks Operating in the U.S. Along with other entities per the graph above. There … Continue reading

Federal Reserve Tries Wizardry to Cure Derivatives Problem

By Pam Martens and Russ Martens: May 4, 2016 Yesterday, the Federal Reserve held a public board meeting to propose two new Byzantine rules to prevent another 2008-style financial contagion on Wall Street and potential crash of the U.S. economy. Unfortunately, the details brought images of the curtain scene from the Wizard of Oz. If you looked beyond the copious verbiage, there didn’t seem to be much there, there. Both plans appeared to target concerns over derivatives. Coincidentally, Freddie Mac, already a ward of the government as a result of the 2008 crash and a derivatives counterparty to some of Wall Street’s largest banks, reported yesterday that it had lost $4.56 billion in its derivatives portfolio in just the first three months of this year. Derivative losses were an early precursor to the 2008 crash. The first proposal mapped out by the Fed is called the Net Stable Funding Ratio … Continue reading

Exclusive Federal Reserve Videos and the Glass-Steagall Media Conspiracy

By Pam Martens: October 19, 2015 A funny thing happened in 2012 after Andrew Ross Sorkin, a financial writer at the New York Times, wrote his spectacularly false narrative telling readers that the repeal of Glass-Steagall Act had nothing to do with the crash because problem firms like Lehman Brothers, Merrill Lynch and AIG didn’t own insured commercial banks — which would have been prohibited under the Glass Steagall Act, had it not been repealed in 1999. In fact, all three of the firms did, indeed, own banks insured by the FDIC at the time of the crash. We figured that Sorkin had just made an error, or, well, three monster errors, so we wrote to his editor. We heard nothing. We wrote to the New York Times public editor who is supposed to uphold the integrity of the paper. Nothing. We wrote to the publisher. Nothing. To this very … Continue reading

Four Words That Have the Federal Reserve in a Panic: “Pushing on a String”

By Pam Martens and Russ Martens: October 15, 2015 Yesterday, the U.S. Treasury auctioned one-month Treasury bills at a zero percent interest rate. By late afternoon, the bills were trading in the secondary market at a negative yield of 0.0152. As the above chart shows, short term Treasury bill rates today are tracking a pattern similar to that of the Great Depression. That spike in the yield in the above chart in 1937 came as a result of the Federal Reserve increasing bank reserve requirements – a credit tightening – which sent the economy into a further leg of the downturn and more deflation. After the tightening in 1937, GDP fell by 10 percent and unemployment returned to 20 percent. The well known lesson of the 1937 folly is the major reason many Fed historians do not believe the Fed has any serious intention of raising its Federal Funds rate … Continue reading

Suspicions About the Federal Reserve Spill Out in House Hearing

By Pam Martens and Russ Martens: March 2, 2015 Fed Chairman Janet Yellen fielded questions last Wednesday before a combative House Financial Services Committee. Tempers flared, fingers stabbed the air, arms waved wildly as House reps expressed pent up frustrations with how the Federal Reserve is handling the economy. At times, Yellen answered curtly and at one point rolled her eyes at questioning from Congressman Scott Garrett (R-NJ) who insinuated that Yellen had politicized her office by meeting so frequently with President Obama and Treasury Secretary Jack Lew. The anger and frustration were evident from both sides of the aisle. Congressman Michael Capuano, (D-MA), was incensed that the largest, most dangerous Wall Street banks are still being allowed to fail their living wills. Capuano read a portion of a statement from FDIC Vice Chair, Thomas Hoenig, which stated that these living wills “provide no credible or clear path through bankruptcy … Continue reading

Panic at the Federal Reserve 2007: Robert Rubin Calls at 5 P.M.

By Pam Martens and Russ Martens: March 5, 2014 Based on the appointment calendars of Former Fed Chairman Ben Bernanke obtained under a Freedom of Information Act request filed by Wall Street On Parade, and the newly released Fed transcripts and documents from the financial crisis era, we are able to reconstruct the August 2007 panic that gripped the Fed Chairman, notwithstanding the dozens of headlines now proclaiming the Fed remained in the dark about the seriousness of the crisis. It started with a call to Bernanke from Citigroup’s Robert Rubin at 5 p.m. on August 8, 2007. By the next morning, it appeared that the Fed Chairman had gone into a high state of alert. At 11:00 a.m. the next morning (August 9, 2007) Bernanke met with Lewis Ranieri, the granddaddy of mortgage backed securities and a pioneer in the securitization market. Fed Governor Randall Kroszner and Sandy Braunstein, … Continue reading