-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: is the new york fed too conflicted

Bombshell Emails Raise Questions about What Sullivan & Cromwell Knew about Fraud at Sam Bankman-Fried’s Crypto Firms

By Pam Martens and Russ Martens: February 6, 2023 ~ Just four days before Sam Bankman-Fried’s crypto exchange, FTX, collapsed into bankruptcy, Sullivan & Cromwell law partner Andrew (Andy) Dietderich sent an email to an attorney representing Voyager Digital’s Official Committee of Unsecured Creditors in its bankruptcy proceedings, stating that FTX was “rock solid.” At the time, Sullivan & Cromwell was representing FTX in a very aggressive move to purchase $1 billion of Voyager’s crypto assets. The law partner representing the Voyager creditors was Darren Azman of law firm McDermott Will & Emery. The email exchange on November 7, 2022 went as follows, according to exhibits McDermott Will & Emery submitted to the Voyager bankruptcy court in the Southern District of New York last week: Azman: “We are getting a lot of inbounds regarding liquidity issues at FTX/Alameda. We also had a lot of leftover questions from the last town hall. … Continue reading

Serious New Issues Emerge in Sullivan & Cromwell’s Deeply Conflicted Role in the FTX Bankruptcy Case

By Pam Martens and Russ Martens: January 26, 2023 ~ We don’t know what kind of legal kryptonite the University of California, Berkeley, School of Law is bestowing on its graduates but one young alumnus appears to be fearless about whom he takes on. Marshal Hoda, the young attorney from a one-man office in Houston, who is representing two customers of the collapsed FTX crypto exchange, tested out his super powers in a January 20 hearing in the U.S. Bankruptcy Court in Delaware. Hoda is pitched against the 900-attorney Big Law firm of Sullivan & Cromwell in one of the most closely-watched (and bizarrely conflicted) bankruptcy cases in U.S. history. Co-counsel with Hoda for the two customers are John D. McLaughlin, Jr. of Ferry Joseph, P.A. and Patrick Yarborough of Foster Yarborough, PLLC. During the hearing, Hoda admonished Sullivan & Cromwell with this: “When you find yourself in a hole, stop … Continue reading

After 16 Months, There Are Still No Arrests in the Fed’s Trading Scandal

By Pam Martens and Russ Martens: January 5, 2023 ~ This coming Saturday will mark the 16-month anniversary of former Wall Street Journal reporter Mike Derby setting off a media firestorm with his reporting that the then President of the Dallas Fed, Robert Kaplan, had “made multiple million-dollar-plus stock trades in 2020,” a year in which Kaplan was a voting member of the Fed’s Federal Open Market Committee (FOMC) with access to inside information. While the trading scandal spread to numerous other Fed officials, including Fed Chairman Jerome Powell, the case against Kaplan seemed like a prime candidate for a criminal investigation by the U.S. Department of Justice. Not only was Kaplan sitting on inside information gleaned from the Fed, but he was making market-moving statements himself on television. When Wall Street On Parade obtained Kaplan’s trading records from the Dallas Fed shortly after Derby’s article appeared, it became clear that the stock trading … Continue reading

Quietly, the Fed Releases Its Financial Stability Report and Lines Up a Scapegoat

By Pam Martens and Russ Martens: November 7, 2022 ~ One minute after the stock market closed on Friday, the Federal Reserve mailed out a link to its newly-released Financial Stability Report to folks who have signed up to get press releases from the Fed. For those of you who have been reading our reports on the Fed for years – its unaccountable money printing and bailouts of Wall Street, the opaque activities of the trading floors owned by the New York Fed, its unchecked conflicts of interest, and its brazen, and as yet unprosecuted, trading scandal – you might suspect that the Fed would have pulled a lot of punches in its “Financial Stability Report.” You would be correct. On the topic of derivatives, which remain the greatest risk at the mega banks on Wall Street, the word “derivatives” is mentioned just eight times in the report – with little … Continue reading

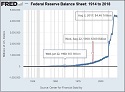

Fed Data Shows a Half Century of Moderate Growth in the Fed’s Balance Sheet through Two World Wars – Then a Seismic Explosion Under Bernanke, Yellen and Powell

By Pam Martens and Russ Martens: June 6, 2022 ~ Last month the Federal Reserve Bank of New York released its 2021 annual report from its “Markets Group.” That’s the group that operates a trading floor (complete with speed dials to the trading houses on Wall Street) at the New York Fed, located not far from the New York Stock Exchange, as well as another trading floor on the premises of the Chicago Fed, which is not far from the futures exchanges in Chicago. That report showed that despite all of the recent talk about the Fed dramatically shrinking its balance sheet from its current size of $8.9 trillion, the internal Federal Reserve plan for the balance sheet is actually this: “After declining by about $2.5 trillion from the peak size reached in the first half of 2022, the portfolio stops declining in mid-2025, at which point it is held constant … Continue reading

New Data Shows Fed Chair Powell Misled Congress on the Condition of the Megabanks and their Need for Emergency Loans

By Pam Martens and Russ Martens: April 5, 2022 ~ Throughout 2020, Fed Chair Jerome Powell repeatedly testified to Congress that the banks in the U.S. had proven to be a “source of strength” during the pandemic. Last Thursday the Fed released the names of the banks and dollar amounts they had needed to borrow under some of the Fed’s emergency loan operations. The data showed that units of two of the largest depository banks in the country, JPMorgan Chase and Citigroup, had required vast sums from the Fed’s emergency repo loan operations as well as its Primary Dealer Credit Facility (PDCF). In the Fed’s first report to Congress on its Primary Dealer Credit Facility which provided a dollar amount outstanding, the Fed reported that “the total outstanding amount” as of April 14, 2020 was $34.5 billion. The PDCF was announced on March 17, 2020 and began making loans on March … Continue reading

Wall Street Banks Have an Alibi for their $11.23 Trillion in Emergency Repo Loans from the Fed – It’s a Doozy

By Pam Martens and Russ Martens: January 6, 2022 ~ From September 17, 2019 through July 2, 2020, the trading units of the Wall Street megabanks (both domestic and foreign) took a cumulative total of $11.23 trillion in emergency repo loans from the Federal Reserve. The loans were conducted by one of the 12 regional Fed banks, the Federal Reserve Bank of New York – which is literally owned by megabanks, including JPMorgan Chase, Goldman Sachs, Citigroup, Morgan Stanley and others. The New York Fed is also responsible for sending its bank examiners into these same banks to make sure they aren’t plotting some evil scheme that will bring down the U.S. economy, as they did with their derivatives and subprime debt bombs in 2008. Unfortunately, if a New York Fed bank examiner doesn’t listen to the “relationship managers” at the New York Fed, and insists on giving a negative review … Continue reading

Biden’s Nominee Omarova Has a Published Plan to Move All Bank Deposits to the Fed and Let the New York Fed Short Stocks

Pam Martens and Russ Martens: October 26, 2021 This month, the Vanderbilt Law Review published a 69-page paper by Saule Omarova, President Biden’s nominee to head the Office of the Comptroller of the Currency (OCC), the Federal regulator of the largest banks in the country that operate across state lines. The paper is titled “The People’s Ledger: How to Democratize Money and Finance the Economy.” The paper, in all seriousness, proposes the following: (1) Moving all commercial bank deposits from commercial banks to so-called FedAccounts at the Federal Reserve; (2) Allowing the Fed, in “extreme and rare circumstances, when the Fed is unable to control inflation by raising interest rates,” to confiscate deposits from these FedAccounts in order to tighten monetary policy; (3) Allowing the most Wall Street-conflicted regional Fed bank in the country, the New York Fed, when there are “rises in market value at rates suggestive of a … Continue reading

Was Boston Fed President Rosengren Trading with Citigroup’s Money?

By Pam Martens and Russ Martens: September 29, 2021 ~ The culture of Wall Street has now completely engulfed the Fed: it’s legal if you can get away with it. For more than five years the President of the Dallas Fed, Robert Kaplan, was trading like a hedge fund kingpin in “over $1 million” transactions in S&P 500 futures while refusing to follow the requirements of the Fed’s financial disclosure form and list the specific dates of his purchases and sells so that the transactions could be examined for whether he had inside information from the Fed at the time. That information is now as much as five years overdue to the American people and we have asked the Dallas Fed to provide it promptly. The Dallas Fed further hampered the free press in America from doing its job by refusing to answer our simple question as to whether Kaplan … Continue reading

Biden Is Bringing Financial Crisis Guys from the New York Fed’s Markets Group to His Administration: Should We Worry?

By Pam Martens and Russ Martens: August 17, 2021 ~ President Joe Biden is tapping insiders from the Federal Reserve Bank of New York for key financial posts in his administration. These insiders played key roles during the financial crash of 2008 or the repo loan crisis in the fall of 2019 or the pandemic-related financial crisis of 2020. One of them was around for all three. We’ll get to the specific names in a moment, but first some necessary background. The Federal Reserve Board of Governors is an independent federal agency whose Board members are appointed by the President of the United States. But the 12 regional Federal Reserve banks that are part of the Federal Reserve System are owned, outright, by commercial banks, thus making these Fed banks private entities. The New York Fed stands out because it is owned by some of the largest and most dangerous mega … Continue reading