-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: JPMorgan

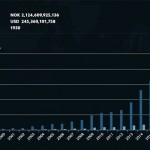

Federal Regulator: Wall Street Stock Trading Plunged 88.6 Percent in Q4

By Pam Martens: March 24, 2019 ~ The Office of the Comptroller of the Currency (OCC), the Federal regulator of national banks, which includes the largest banks on Wall Street, quietly issued its quarterly report on trading in cash instruments and derivatives on Friday. The report contained a shocker: stock (equity) trading had plunged 88.6 percent in the fourth quarter of 2018 versus the fourth quarter of 2017 on a consolidated basis at the bank holding companies, which includes the results of their commercial and investment banks. Equally stunning, stock trading was down an even more staggering 91.7 percent from the third quarter of 2018. (See chart above from the report.) This bombshell statistic is something that we have not heard a peep about from either the Wall Street banks on their earnings calls or the business media. In fact, Wall Street banks have been telling business media that their … Continue reading

Fed’s Powell Wasn’t Expecting this Kind of Drama at his Press Conference

By Pam Martens and Russ Martens: March 21, 2019 ~ The real drama in the market yesterday was not the 2:00 p.m. release of the Federal Open Market Committee (FOMC) statement to hold rates steady but what happened about twenty minutes into the press conference that began at 2:30 p.m. when Fed Chairman Jerome (Jay) Powell began to answer questions from an intrepid group of reporters. The youthful, fresh-scrubbed faces from well-known media outlets presented a paradoxical contrast to the gritty questions they lobbed at the man who clearly understood that losing his cool could tank the stock market. But despite Powell’s calm exterior, the stock market didn’t like the questions or the responses from Powell. Opacity is treasured by the masters of today’s stock market. Too much transparency or honesty sends hedge funds and dark pools running for the safety of Treasury notes. Not only did the Dow Jones … Continue reading

Will the FAA Do to Boeing What the SEC and NY Fed Did to Wall Street

By Pam Martens: March 14, 2019 ~ A crony Federal regulator, or one perceived to be captured by the industry it polices, will eventually doom consumer confidence in the products and services of the industry to which it provides oversight. President Obama appointed Mary Jo White to serve as his Securities and Exchange Commission Chair for the final term of his presidency. White and her husband both worked for large law firms that together had represented every major Wall Street bank – the same ones that had created the largest financial collapse since the Great Depression in 2008. White’s supervision of Wall Street was so derelict that Senator Elizabeth Warren sent her a scathing 13-page critique of her performance. Warren called out the SEC’s practice of settling the vast majority of cases without requiring meaningful admissions of guilt and White’s repeated recusals from investigations because of her prior employment (and her husband’s … Continue reading

The Fed’s Fancy Footwork on Stress Tests Was About Silencing Bank Examiners

By Pam Martens: March 12, 2019 ~ Last Wednesday, the Federal Reserve Board of Governors rushed through a rule change to its stress test for the too-big-to-fail banks on Wall Street, putting it into immediate effect without the customary 30-day delay. It is further noteworthy that the Board did not get the customary unanimous vote to move forward with the rule change: Fed Board Governor Lael Brainard, arguably the smartest member of the Board, voted against the rule change while the four other Governors, including Chairman Jerome Powell, voted in favor. There is a strong case that can be made that the rushed rule change was to protect the biggest banks on Wall Street – the ones serially charged with crimes around the globe – while putting the public at risk of another epic financial collapse. What the rule change effectively did was to tell the recidivist banks that their … Continue reading

A Book on Wall Street’s Dark Underbelly Could Alter Election Outcome in 2020

By Pam Martens: March 11, 2019 ~ The underlying theme that Wall Street’s Federal regulators have become whores for the industry permeates most of the well-researched books that have been written about Wall Street over the past decade. But no book has connected the dots to the nuances and subtleties of how this whoring works as effectively as Noncompliant: A Lone Whistleblower Exposes the Giants of Wall Street. Written by Carmen Segarra, the petite lawyer turned bank examiner turned whistleblower turned one-woman swat team, the 340-page tome takes the reader along on her gut-wrenching workdays for an entire seven months inside one of the most powerful and corrupted watchdogs of the powerful and corrupted players on Wall Street – the Federal Reserve Bank of New York. (The days were literally gut-wrenching. Segarra reports that after months of being alternately gas-lighted and bullied at the New York Fed to whip her … Continue reading

A Look Back at How Reforming Wall Street Failed So Miserably Under Obama

By Pam Martens: March 7, 2019 ~ Progressives have every right to harbor a seething contempt toward the Wall Street wing of the Democratic Party. Democrats controlled both houses of Congress in the last two years of George W. Bush’s presidency as Wall Street blew itself up and Congress passed the massive taxpayer bailout of the Wall Street mega banks. (Democrats held fewer than 50 seats in the Senate but they held operational majority since two Independents caucused with them.) In Obama’s first two years in office (January 2009 to January 2011), Democrats had increased their majorities in both chambers of Congress. Democrats were in charge when it became crystal clear from Congressional hearings that Wall Street mega banks had created, through unbridled greed and corruption, the most catastrophic financial crash since the Great Depression. Democrats were in charge when it became profoundly evident that Wall Street needed a major … Continue reading

This Tiny Country Has $245 Billion Invested in U.S. Stocks

By Pam Martens: March 5, 2019 ~ According to the United Nations, Norway has a current population of 5.4 million people. That’s less than 2 percent of the population of the United States. The people of Norway don’t particularly like the United States right now, giving its leadership an abysmal 12 percent approval rating according to a recent Gallup survey. But according to data provided at the website of Norway’s central bank, Norges Bank, every man, woman and child in Norway has the equivalent of a $45,000 stake in U.S. stocks. The central bank manages the Government Pension Fund Global (also known as the Norwegian Oil Fund) which owned a whopping $245 billion of the U.S. equity market as of December 31, 2018. That $245 billion includes big chunks of change in U.S. social media/tech stocks and the mega banks on Wall Street. Here’s a sampling: $7.5 billion in … Continue reading

Memo to Maxine Waters: Wells Fargo Is Far from the Biggest Problem on Wall Street

By Pam Martens: February 26, 2019 ~ Yesterday, Congresswoman Maxine Waters of California, the Chair of the House Financial Services Committee, released the titles of the hearings she plans to hold during the month of March. Of the hearings held by this Committee in February, none addressed the systemic risk to the U.S. economy from the interconnected mega banks on Wall Street. According to the hearing list released yesterday for the month of March, systemic risks at the mega banks has again gone missing. The only mega bank to be grilled in March will be Wells Fargo, and that will focus on its “pattern of consumer abuses.” This lack of attention to the most dangerous, interconnected mega banks on Wall Street – JPMorgan Chase, Citigroup, Goldman Sachs, Bank of America and Morgan Stanley – by the newly installed Democratic Chair of the House Financial Services Committee does not bode well … Continue reading

Wall Street’s Banksters Are Clandestinely Trading the “Digital Gangster” Stock of Facebook

By Pam Martens: February 19, 2019 ~ Being called a “digital gangster” by an investigative committee of the United States’ closest ally, the United Kingdom, might have been expected by the rational among us to do some serious damage to the share price of Facebook when it opened for trading this morning. The U.K. report was released yesterday when U.S. markets were closed for Presidents’ Day. But by this morning’s opening bell, it was business as usual for the serially investigated Facebook. Facebook closed Friday at $162.50 per share and opened this morning at $160.50. After a half hour of trading, Facebook’s stock was off a mere 63 cents. America is now the political dystopia ruled by Wall Street banksters and digital gangsters so the stock market no longer punishes corporate criminality. In fact, there is ample evidence to suggest that it rewards it. Just look at how the stock … Continue reading

4,823 U.S. Banks Have Disappeared Since 1999

By Pam Martens: February 18, 2019 ~ At the end of 1999, the year that President Bill Clinton and his Treasury Secretary Robert Rubin brokered the deal to repeal the Glass-Steagall Act of 1933 and allow the casino investment banks on Wall Street to gobble up deposit-taking banks, there were 10,220 federally insured banks and savings institutions in the United States. Today, that number stands at 5,397, a decline of 47 percent according to the Federal Deposit Insurance Corporation (FDIC). What exactly happened to those disappeared banks? We examined FDIC data to see if the sharp falloff in bank numbers was from failures or mergers. We found that the vast majority of the decline resulted from banks being absorbed in mergers. By the end of 2005, six years after the repeal of Glass-Steagall, the U.S. still had 8,832 federally insured banking institutions. But in just that year alone, 315 banks … Continue reading