-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

Jamie Dimon Goes Way Out of Town for Shareholders’ Meetings: For Good Reason

By Pam Martens and Russ Martens: May 31, 2018 ~ JPMorgan Chase likes to hold its annual shareholders’ meetings far away from the media glare of New York City’s pesky press corps. Jamie Dimon, Chairman and CEO of JPMorgan Chase, has good reason to want to dodge Manhattan’s investigative reporters – who might start to see a pattern of fraudulent behavior. At the 2011 shareholders’ meeting in Columbus, Ohio more than 1,000 protesters descended on the event to protest the bank’s unsavory foreclosure practices. JPMorgan Chase’s 2013 shareholders’ meeting in Tampa – 1100 miles from New York City — came less than two months after the U.S. Senate’s Permanent Subcommittee on Investigations issued a 300-page report on how JPMorgan Chase had used its bank depositors’ money to gamble in risky derivatives in London, eventually losing $6.2 billion of that money. The 2014 shareholders’ meeting, also in Tampa, came four months … Continue reading

Wall Street Banks Tank Yesterday as Contagion Threat Grows

By Pam Martens and Russ Martens: May 30, 2018 ~ Big Wall Street bank stocks outpaced the decline in the markets yesterday by a big margin. That’s a serious problem but here’s a bigger problem: if you get your information from mainstream media, you have no idea this happened or what it portends for the U.S. economy. Corporate media (a/k/a “mainstream” media) is obsessed with ratings, clickbait and celebrities behaving badly – which goes a long way in explaining why the U.S. has a billionaire celebrity in the oval office who publicly talks about television ratings when he greets hostages released by North Korea. It’s also now clear why so many members of Congress claimed that nobody could have seen the 2008 financial crisis coming: mainstream media simply refused to heed and report on the many warnings. The same thing happened yesterday. The Standard and Poor’s 500 Index fell by … Continue reading

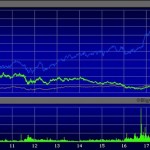

What Is the Yield Curve Telling Us About the U.S. Economy?

By Pam Martens and Russ Martens: May 16, 2018 ~ On November 9 of last year, a mere six months ago, we asked the question: “Does Jerome Powell Hear the Alarm Bells from Flattening Yield Curve?” Jerome Powell is, of course, the new Chairman of the Federal Reserve — the U.S. central bank and the body in which the United States has entrusted its monetary policy, for better or worse. We wrote at the time: “As of 7:48 a.m. this morning, the spread between the 10-year Treasury Note (yielding 2.33 percent) and 30-year Treasury Bond (yielding 2.81 percent) is even smaller, at a meager 48 basis points or less than half of one percent. “It is a serious commentary on the bizarre financial times in which we live that a fixed income investor would be rewarded with less than half a percent of additional income to add 20 years of … Continue reading

Banking Fraternity Felons – Except for Goldman Sachs

By Pam Martens and Russ Martens: May 9, 2018 ~ Three years ago this month the U.S. Department of Justice brought felony charges against two of the largest Wall Street banks, JPMorgan Chase and Citigroup, for their involvement in rigging foreign currency markets. On the same date, two foreign banks, Barclays PLC and the Royal Bank of Scotland (RBS), were charged with felonies in the same matter. A fifth bank, UBS, was charged with a felony for its role in rigging the interest rate benchmark known as Libor. All five banks pleaded guilty to the charges. Citigroup was fined $925 million by the Justice Department for its foreign currency conduct that ran from as early as December 2007 until at least January 2013, roughly five years. JPMorgan was fined $550 million for rigging activity that ran from as early as July 2010 to January 2013, about two and a half … Continue reading

Robert Rubin Exorcises Citigroup from His Career in Today’s NYT OpEd

By Pam Martens and Russ Martens: May 1, 2018 ~ Former U.S. Treasury Secretary, Robert Rubin, has decided he wants to rewrite his resume, removing the ugly warts from his days at Citigroup. That mega bank started as a financial supermarket that Rubin helped to make possible behind the scenes in the Bill Clinton administration, followed by a giant crash and the largest bank bailout in U.S. history from 2007 to 2010. Rubin strolled out the door of Citigroup in early 2009 $120 million richer than when he originally rolled his shopping cart into the well-stocked aisles of hubris at Citigroup almost a decade earlier. The New York Times has apparently decided to help Rubin exorcise Citigroup from his past. In an OpEd in the New York Times New York edition today, neither he nor the New York Times in its bio mentions so much as a syllable about Rubin’s … Continue reading

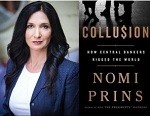

Nomi Prins’ New Book Is a Far More Important Read than Comey’s

By Pam Martens and Russ Martens: April 30, 2018 ~ Tonight, at 7 p.m., Wall Street historian and author, Nomi Prins, will be speaking at The Strand bookstore at 828 Broadway in New York City. (See admission details here.) The appearance marks the launch of her latest book, Collusion: How Central Bankers Rigged the World, set for release tomorrow. While former FBI Director James Comey’s new book, A Higher Loyalty, has been getting lots of attention on cable news, Collusion is a far more important book. America can recover from a disastrous presidency, the topic of Comey’s book. But America might not be able to fully recover from another epic financial crash brought on by disastrous central bank policy – the subject of Prins’ book. Collusion not only proves that the 1 percent got bailed out while the 99 percent got sold out as a result of policies of the U.S. … Continue reading

Trump’s Tax Cut Follows a Pattern of Poor Vetting at White House

By Pam Martens and Russ Martens: April 27, 2018 ~ It’s increasingly looking like President Trump vetted his tax cut plan about as thoroughly as he vetted his cabinets picks. That is likely to have a serious negative impact on U.S. economic growth, the housing market and consumer spending. Yesterday Trump’s pick to head the Veterans Affairs Administration withdrew his name from consideration after allegations of drinking on the job and wrecking a government car while drunk surfaced in statements made by two dozen of his current and former colleagues. Later in the day, Trump’s Senate-confirmed head of the Environmental Protection Agency, Scott Pruitt, was being grilled at two separate House hearings on his wasteful spending of taxpayer dollars for first class travel to Italy and Morocco, a $43,000 soundproof phone booth for his office despite the agency already having secure facilities, and for accepting a dramatically below-market rate of $50 … Continue reading

Deutsche Bank’s Stock Is Trading Below Pre-Crisis Levels; But So Is Citigroup’s

By Pam Martens and Russ Martens: April 26, 2018 ~ There is a great deal of hand-wringing in the U.S. media today over the plight of Deutsche Bank, the big German financial firm that has a hefty presence on Wall Street. Its first-quarter net profit slumped by 79 percent, it replaced its CEO of less than three years, John Cryan, this month with new CEO Christian Sewing whose game plan revolves around “painful” cuts. On September 15, 2008, a key moment in the 2008 financial collapse on Wall Street when Lehman Brothers filed bankruptcy, Merrill Lynch was forced into the arms of Bank of America and Citigroup teetered toward insolvency, Deutsche Bank’s shares closed the day at $58.80 (equivalent price adjusted for a subsequent stock split). Yesterday, its shares closed at $14.60 on the New York Stock Exchange. Not only has it not recovered from the financial crash but it’s … Continue reading

Why Isn’t the Justice Department Bringing Treasury-Rigging Charges Against Wall Street?

By Pam Martens and Russ Martens: April 24, 2018 ~ The U.S. Department of Justice has had an ongoing investigation into the potential rigging of the U.S. Treasury market by big banks on Wall Street for the past three years according to a series of past media reports. And yet, no formal charges have been brought. Lots of Wall Street watchers are wondering why – especially since private law firms have brought very specific charges in the matter into Federal court. There are only so many times the Justice Department can charge the largest Wall Street banks with felony counts for rigging markets before the public catches on that it’s a feature not a bug of their business model. Continuous rigging charges could lead to growing public demands and newspaper editorials to break up these serially-charged behemoths at a time when members of Congress – who depend on the largess … Continue reading

Eric Holder, After Failing to Prosecute Wall Street, May Run for President

By Pam Martens and Russ Martens: April 20, 2018 ~ Make no mistake about it, the Big Law firms that played a major role in the Wall Street corruption that led to the financial crash of 2008 and have been burying corporate crimes through their crony ties to Washington for decades, are desperate to put their own man in the White House in 2020. On Tuesday, former Attorney General, Eric Holder, who headed the U.S. Department of Justice in the Obama administration, appeared on the MSNBC program, “All In with Chris Hayes.” Holder told Hayes that he was considering a run for the President of the United States in 2020 but had not made a final decision. (See video below.) Obviously, if Holder ran, it would be as a Democrat, something that is certain to enrage the progressive wing of the party. Holder effectively transplanted his pals from his law … Continue reading