-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Federal Reserve

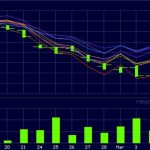

Two Charts Explain Why Wall Street Banks Are Under So Much Selling Pressure

By Pam Martens and Russ Martens: March 6, 2020 ~ Yesterday, the Dow Jones Industrial Average of 30 large cap companies closed with a loss of 969.5 points or 3.58 percent. That was bad enough but the losses among the biggest Wall Street banks outpaced the Dow losses by a significant margin. Typically, JPMorgan Chase is one of the better performers among the Wall Street banks in the midst of a big selloff. But not yesterday. It closed with a loss of 4.91 percent – a loss larger than Goldman Sachs (- 4.77 percent), which has a large criminal fine hanging over its head. The news that Jamie Dimon, Chairman and CEO of JPMorgan Chase, had heart surgery on Thursday was not reported until after the stock market had closed. The losses among the other mega banks on Wall Street yesterday were equally unsettling. Morgan Stanley lost 5.86 percent; Citigroup … Continue reading

Demand for Fed’s Repo Loans Surges Past $100 Billion a Day as 10-Year Treasury Hits Lowest Rate in 149 Years

By Pam Martens and Russ Martens: March 5, 2020 ~ Federal Reserve Chairman Jerome Powell certainly has an odd notion of what constitutes an “orderly” market. At his press conference on Tuesday, following the announcement that the Fed was cutting its Fed Funds rate by a half point without waiting for its regularly scheduled meeting when rate cuts are normally deliberated, Powell said that “financial markets are functioning in an orderly manner and all that sort of thing.” Challenging Powell’s assessment of “orderly,” the Dow dropped 603 points in the span of less than 30 minutes while he was speaking at his press conference and trying his best to bolster confidence in the market. That didn’t seem very orderly. On top of that, at 8:45 a.m. that very morning, the New York Fed had pumped $100 billion in 1-day repo loans into the trading houses on Wall Street, $8.6 billion … Continue reading

Timeline of How Fed Chair Powell Knocked 603 Points Off the Dow Yesterday

By Pam Martens and Russ Martens: March 4, 2020 ~ We write this with some trepidation that after this appears in print Federal Reserve Chairman Jerome Powell will stop taking questions at his press conferences or that all media questions will have to be routed through Vice President Mike Pence’s press office, as is now occurring with matters pertaining to the coronavirus. (We say that with only some facetiousness.) However, in this age of spin, facts matter more than ever. First, a little background. After losing 3600 points the prior week, the Dow Jones Industrial Average staged a monster rally (more likely a short squeeze) on Monday, climbing 1293 points to close at 26,703. At 1:34 a.m. (the wee hours of Tuesday morning) President Donald Trump posted a tweet to his Twitter page stating, among other things, that the Fed should ease and “cut rate big” adding that “Powell led … Continue reading

Central Bankers Can’t Save Us This Time

By Pam Martens and Russ Martens: March 3, 2020 ~ There is a time for scientists and carefully vetted facts and a time for men who tell the public that everything is great, nothing to see here. It’s clearly a time for the former and less delusional chatter from the latter. The latest magical thinking is that if Fed Chairman Jerome Powell and U.S. Treasury Secretary Steve Mnuchin get on a phone call this morning with the other G7 finance ministers and central bank governors, they can seduce or strongarm the group to announce rate cuts or fiscal stimulus to keep stock markets from further steep declines and GDP from contracting. (For how this played out previously, we recommend Nomi Prins’ brilliant book, Collusion: How Central Bankers Rigged the World.) Unfortunately, the Fed Chair and the U.S. Treasury Secretary are fighting the last war, the financial crisis of 2008, when … Continue reading

Jamie Dimon’s Remarks on Discount Window Add to Market Panic

By Pam Martens and Russ Martens: February 27, 2020 ~ During the financial panic of 1907, John Pierpont Morgan corralled the money men of New York together and convinced them to join him in bailing out teetering financial institutions in order to calm the panic in the markets. His plan worked. Flash forward to today. Jamie Dimon is Chairman and CEO of the bank that bears John Pierpont Morgan’s name: JPMorgan Chase. The bank is the largest federally-insured bank in the U.S. with $1.6 trillion in deposits. It has more than 5,000 bank branches across America accepting the life savings of moms and pops. But JPMorgan Chase is also the largest trading and derivatives house on Wall Street – a dangerous, combustible mix as it proved so well in 2012 when it lost $6.2 billion of depositors’ money making wild gambles in derivatives in London. On Tuesday of this week, … Continue reading

Fed’s Stress Tests on Banks Should Have Factored in a Pandemic

By Pam Martens and Russ Martens: February 26, 2020 ~ Each year the Federal Reserve comes up with a hypothetical, severely adverse economic scenario against which it evaluates the ability of Wall Street’s mega banks to weather the storm. Called “stress tests,” this year’s severely adverse scenario features a severe global recession, unemployment of 10 percent, elevated stress in corporate debt markets and commercial real estate, along with a bank’s major counterparty defaulting if it has significant derivatives trading exposures. The stress test results are typically disclosed in June by the Fed with an immediate announcement by the banks (that get the green light from the Fed) about how many billions of dollars they plan to spend on stock buybacks and dividend increases to artificially boost their share prices. What the Federal Reserve has not planned for in its stress test is a global recession (which was looking entirely likely … Continue reading

There Was a Flash Crash in the Stock Market Yesterday: Here’s Why You Should Be Very Concerned

By Pam Martens and Russ Martens: February 21, 2020 ~ At 10:52 a.m. yesterday, the Dow Jones Industrial Average which was trading at a level of 29,348, began a bungee-style plunge. By 11:32 a.m. the market landed with a thud at a level of 29,013. Then the stock market began an equally inexplicable climb, closing the day down just 128 points. This is what is known as a “Flash Crash,” a sudden plunge in the market with no reliable explanation. No one on Wall Street has yet to offer a convincing explanation for the plunge. An early attempt to pass it off to worries about the coronavirus was easily dispelled because the news report of rising infections from the virus came much earlier than the plunge in the market. Our chart research also shows that the plunge was not related to the coronavirus because Procter & Gamble, a component of … Continue reading

Paul Krugman Returns to Perpetuating the Big Lie for Wall Street

By Pam Martens and Russ Martens: February 19, 2020 ~ Paul Krugman, the New York Times columnist who won the 2008 Nobel Memorial Prize in Economic Sciences, is back to pedaling his Big Lie that Wall Street banks were not responsible for the financial crash of 2008 or the ensuing housing crash. This time he’s told such a doozie of a lie that there is no longer any doubt that he’s on a mission to restore Wall Street’s credibility, even if he has to rewrite the history of the financial crash and every official report that’s been published on it. The latest Big Lie from Krugman appeared in yesterday’s print edition but first appeared in the digital edition on Monday under a different headline, “Have Zombies Eaten Bloomberg’s and Buttigieg’s Brains?” In a very clever sleight of hand, Krugman is complaining, correctly so, about the fact that presidential candidate Michael … Continue reading

Fed Slashes 14-Day Repo Loans to $25 Billion; Will Cut Further in March

By Pam Martens and Russ Martens: February 18, 2020 ~ Federal Reserve Chairman Jerome Powell sat through two days of grueling hearings before the House Financial Services Committee and Senate Banking Committee last week. At numerous times, the Fed and Powell were portrayed by Congressional members as sugar daddies for Wall Street while aloof to the financial suffering of the average American. (See Fed Chair Tells Congress There Is a 10-Year “Game Plan” to Deal with Financial Crisis But No Plan to Deal with Americans Left Devastated By It.) The House Financial Services Committee held its hearing on Tuesday. The Senate Banking Committee held its hearing on Wednesday. On Thursday, in a surprise move, the Fed announced that it would be trimming the $30 billion it has been making in 14-day loans (at about 1.60 percent interest) to Wall Street’s trading houses to $25 billion through March 12 and trimming … Continue reading

Fed Chair Powell Is a Member of a Private Club with a History of Racism and Sexism

By Pam Martens and Russ Martens: February 14, 2020 ~ Congresswoman Katie Porter opened a hornet’s nest on Tuesday during a House Financial Services Committee hearing where Fed Chair Jerome Powell answered questions. As we reported, Porter held up a photo of Powell in black tie attending a lavish party for billionaires and politicians at the Washington D.C. home of one of the richest men in the world, Amazon CEO Jeff Bezos. As it turns out, that wasn’t even the worst part of the story. The real jaw dropper is that the Bezos party was the after-party for a secretive private club’s annual dinner. The so-called Alfalfa Club is a 107-year old, invitation-only club that bars the press from attendance and banned membership of blacks and women for the bulk of its existence. Fed Chair Powell is a member of that club. More on that shortly, but first some background. … Continue reading