-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

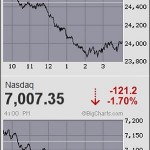

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: rap sheet

Mega Banks Tell SEC: Derivatives Could Blow Up Wall Street Again

By Pam Martens: April 1, 2019 ~ The most recent 10Ks (annual reports) filed by the largest Wall Street banks covering their financial condition as of December 31, 2018, provide the strongest argument thus far for Congress to enact legislation to separate the Federally insured, deposit-taking commercial banks from the trading casinos on Wall Street. In other words, Congress needs to restore the Glass-Steagall Act, which kept the U.S. financial system safe for 66 years until its repeal in 1999. If the average American knew that the very same banks that blew up the U.S. economy, devastated the housing market, crashed the stock market, threw millions of Americans out of work just a decade ago were warning in their own 10K legal filings with the Securities and Exchange Commission that the same thing could happen again at any moment, there would be mobs with pitchforks in the street. But because corporate … Continue reading

U.S. Treasury Yields Go Haywire as Times Reveals Trump Tax Evasion

By Pam Martens and Russ Martens: October 4, 2018 ~ Yesterday’s Treasury market was a mess. So was the front page of the New York Times, which featured a montage of tax records evidencing tax scams by the Trump family. We think there’s a connection. The New York Times’ 14,000 word expose and exhibits effectively render Trump a lame-duck president. That means that the country is left with the unprecedented national debt created under his big tax cuts for corporations and the wealthy along with a billionaire Emperor devoid of either clothes or the aura of a self-man man. The outlook for mounting U.S. debt pushing up Treasury yields comes at the same time that the Federal Reserve is scaling back its crisis-era purchases of Treasuries and as the European Central Bank begins this month to halve its bond purchases. The Federal Reserve, using a previously released schedule, began … Continue reading

Bernanke, Geithner, Paulson: The Fed Should Be Able to Make Secret Trillion Dollar Loans Again

By Pam Martens and Russ Martens: September 10, 2018 ~ There seems to be a growing amount of concern these days about another epic financial crash on Wall Street. That, in itself, is a concern. After all, we’ve had only two great crashes in the past 89 years: one from 1929 to 1933 and one from 2008 to 2009. Why is another crash on the tip of so many tongues today? Last week JPMorgan Chase released a lengthy research report in which its analyst Marko Kolanovic suggested that in the event of another major Wall Street crisis, the Fed should not only have its emergency powers restored to buy up toxic debt with abandon from Wall Street but that the Fed might also have to buy up stocks – an unprecedented action for the U.S. central bank – or at least unprecedented as far as the public knows. The outrage … Continue reading

The $4 Trillion Answer to Why Turkey Is Rattling Wall Street Banks and Insurers

By Pam Martens and Russ Martens: August 13, 2018 ~ On Friday the Dow Jones Industrial Average closed with a loss of 196 points as contagion jitters from Turkey’s worsening situation rattled markets. Among the big Wall Street banks, these were the biggest losers: Citigroup, down 2.39 percent; Morgan Stanley, down 2.12 percent; Goldman Sachs, down 1.78 percent; Bank of America, down 1.30 percent; and JPMorgan Chase closed off by 0.98 percent. Deutsche Bank, the big German lender whose U.S. subsidiary has a big footprint on Wall Street, lost 4.68 percent. Deutsche Bank has now lost 41 percent of its market value since February. But the selloff didn’t stop there. Two big U.S. life insurers also tumbled on Friday. MetLife lost 3.19 percent while Prudential Financial was off by 2.97 percent. What do Wall Street banks and U.S. life insurers have to do with a selloff in Turkey’s currency? Not … Continue reading

Wall Street Banks Tank Yesterday as Contagion Threat Grows

By Pam Martens and Russ Martens: May 30, 2018 ~ Big Wall Street bank stocks outpaced the decline in the markets yesterday by a big margin. That’s a serious problem but here’s a bigger problem: if you get your information from mainstream media, you have no idea this happened or what it portends for the U.S. economy. Corporate media (a/k/a “mainstream” media) is obsessed with ratings, clickbait and celebrities behaving badly – which goes a long way in explaining why the U.S. has a billionaire celebrity in the oval office who publicly talks about television ratings when he greets hostages released by North Korea. It’s also now clear why so many members of Congress claimed that nobody could have seen the 2008 financial crisis coming: mainstream media simply refused to heed and report on the many warnings. The same thing happened yesterday. The Standard and Poor’s 500 Index fell by … Continue reading

What Is the Yield Curve Telling Us About the U.S. Economy?

By Pam Martens and Russ Martens: May 16, 2018 ~ On November 9 of last year, a mere six months ago, we asked the question: “Does Jerome Powell Hear the Alarm Bells from Flattening Yield Curve?” Jerome Powell is, of course, the new Chairman of the Federal Reserve — the U.S. central bank and the body in which the United States has entrusted its monetary policy, for better or worse. We wrote at the time: “As of 7:48 a.m. this morning, the spread between the 10-year Treasury Note (yielding 2.33 percent) and 30-year Treasury Bond (yielding 2.81 percent) is even smaller, at a meager 48 basis points or less than half of one percent. “It is a serious commentary on the bizarre financial times in which we live that a fixed income investor would be rewarded with less than half a percent of additional income to add 20 years of … Continue reading

Trump’s Tax Cut Follows a Pattern of Poor Vetting at White House

By Pam Martens and Russ Martens: April 27, 2018 ~ It’s increasingly looking like President Trump vetted his tax cut plan about as thoroughly as he vetted his cabinets picks. That is likely to have a serious negative impact on U.S. economic growth, the housing market and consumer spending. Yesterday Trump’s pick to head the Veterans Affairs Administration withdrew his name from consideration after allegations of drinking on the job and wrecking a government car while drunk surfaced in statements made by two dozen of his current and former colleagues. Later in the day, Trump’s Senate-confirmed head of the Environmental Protection Agency, Scott Pruitt, was being grilled at two separate House hearings on his wasteful spending of taxpayer dollars for first class travel to Italy and Morocco, a $43,000 soundproof phone booth for his office despite the agency already having secure facilities, and for accepting a dramatically below-market rate of $50 … Continue reading

Why Did Yesterday’s Market Rout Miss the Big Wall Street Banks?

By Pam Martens and Russ Martens: April 25, 2018 ~ Wall Street knows something that the rest of us don’t. Based on past experience, when Wall Street keeps secrets it never works out well for the rest of us. We’re thinking about the time Wall Street banks colluded on rigging prices on the Nasdaq market; or the time they rigged their research departments and told us to buy stocks that they were secretly callings dogs and crap; or the time they got S&P and Moody’s to give them triple-A ratings on subprime pools of debt while keeping it a secret that they had internal reports showing the loans didn’t meet their origination standards — and then they went out and secretly shorted that debt while continuing to sell it to their customers as a good investment. Yesterday, something decidedly weird happened as U.S. stock markets were being pummeled. Three of … Continue reading

Senate Hearing: Facebook CEO Zuckerberg Is Questioned on Ties to CIA-Funded Company

By Pam Martens and Russ Martens: April 11, 2018 As Facebook’s CEO Mark Zuckerberg fingered his cheat sheet of canned answers to a barrage of questions from Senators yesterday on how Facebook had allowed a Trump-backed political operation to harvest personal data from 87 million of its users, Zuckerberg attempted to channel motherhood, apple pie, dorm room entrepreneurism and an altruistic desire to connect people around the world in one harmonious melding of human spirit. Unfortunately, the facts just kept getting in the way. There was the questioning from Senator Richard Blumenthal pointing out that Facebook had been caught red-handed in 2011 by the Federal Trade Commission in egregious abuses of its users’ personal data. Blumenthal said current activities at Facebook showed that Facebook was in “violation of the FTC consent decree.” Another uncomfortable moment came when Senator Patrick Leahy asked if Special Counsel Robert Mueller had issued subpoenas to … Continue reading

Democrats Gutting Wall Street Reform? Follow the Money.

By Pam Martens and Russ Martens: March 5, 2018 Today’s front page of the print edition of the New York Times has articles on the Oscars, the election in Italy, Ben Carson’s reign at HUD and the death of an elderly Briton who once broke the four-minute mile among numerous other less than urgent news pieces. What it does not have on its front page is any headline showing concern that the seminal piece of Wall Street reform legislation of the Obama era, which already has enough loopholes to set off champagne corks on K Street, may be dismantled this week by a vote in the Senate. The move would come in the midst of the 10th anniversary of the greatest Wall Street collapse and economic catastrophe since the Great Depression, both of which were underpinned by casino capitalism — Wall Street banks making obscenely leveraged bets for the house … Continue reading