-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: rap sheet

A Private Citizen Would Be in Prison If He Had Citigroup’s Rap Sheet

By Pam Martens and Russ Martens: November 27, 2017 Since its financial meltdown in 2008 and unprecedented bailout by the U.S. taxpayer, Citigroup (parent of Citibank) has been repeatedly charged by its Federal regulators with odious crimes against its pooled mortgage investors, credit card and banking customers, student loan borrowers, and for its foreclosure frauds. It has paid billions of dollars in fines for its past misdeeds while new charges pile up. In 2015, it became an admitted felon for participating in rigging foreign exchange markets. In short, Citigroup is a lawbreaking recidivist. If it were a mere human, it would be serving a long prison term. Instead, its fines for charges of egregious acts are getting smaller, not larger. Last Tuesday, the Consumer Financial Protection Bureau (CFPB), which typically has a good track record of holding the big Wall Street banks accountable for their misdeeds, imposed an unusually feeble … Continue reading

DOJ Calls Out UBS Rap Sheet; Ignores Homegrown Citigroup’s Rap Sheet

By Pam Martens and Russ Martens: May 22, 2015 When the U.S. Department of Justice held its press conference on Wednesday to announce that five mega banks were each pleading guilty to a felony charge, paying big fines and being put on probation for three years, Assistant U.S. Attorney General Leslie Caldwell specifically took a battering ram to the reputation of Swiss bank, UBS. Four banks — Citicorp, a unit of Citigroup, JPMorgan Chase & Co., Royal Bank of Scotland and Barclays — pleaded guilty to an antitrust charge of conspiring to rig foreign currency trading while UBS pleaded guilty to one count of wire fraud for its earlier involvement in rigging the interest rate benchmark, Libor. In explaining why the Justice Department was ripping up the non-prosecution agreement it had negotiated with UBS in December 2012 over its involvement in the Libor fraud and now charging it with a … Continue reading

All the Devils from 2008 Are Back at the Megabanks: Leverage, Off-Balance-Sheet Debt, Over $192 Trillion in Derivatives, Shaky Capital Levels

By Pam Martens and Russ Martens: August 20, 2024 ~ As indicated on the above graph, as of December 31, 2023, Goldman Sachs Bank USA, JPMorgan Chase Bank N.A., Citigroup’s Citibank and Bank of America held a staggering total of $168.26 trillion in derivatives out of a total of $192.46 trillion at all federally-insured U.S. banks, savings associations and trust companies. That’s just four banks holding 87 percent of all derivatives at all 4,587 federally-insured financial institutions in the U.S. that existed as of December 31, 2023. You might be asking yourself the very valid question as to why the Dodd-Frank financial reform legislation of 2010, that followed the Wall Street financial quake of 2008, didn’t correct the derivatives gambling that played a central role in crashing the U.S. financial system. For why the threat of derivatives never actually went away, see our report: Meet the Two Congressmen Who Facilitated Today’s Derivatives … Continue reading

The DOJ’s Incestuous Relationship with Jamie Dimon Is Captured in a Graphic from an Historic Lawsuit

By Pam Martens and Russ Martens: January 18, 2024 ~ On February 10, 2014, the non-profit watchdog, Better Markets, took a bold and historic action. It filed a federal lawsuit against the highest law enforcement agency and officer in the United States – the U.S. Department of Justice and the man who sat at its helm, Attorney General Eric Holder. The lawsuit challenged a $13 billion out-of-court settlement that had been agreed to by the Justice Department and the Wall Street mega bank, JPMorgan Chase, over its sale of toxic mortgages. Better Markets wrote on its website that this was at the time “The largest settlement in U.S. history from a single entity by more than 300%” and that it “granted JP Morgan blanket civil immunity for years of alleged, but undisclosed, pervasive, egregious and knowing fraudulent and illegal conduct that contributed to the 2008 financial crash and the worst economy since the … Continue reading

JPMorgan Chase Has Lost a Quarter Trillion Dollars in Deposits in Last 7 Quarters — Fortress Balance Sheet or Leaky Sieve?

By Pam Martens and Russ Martens: October 16, 2023 ~ On May 1, the Federal Deposit Insurance Corporation announced that First Republic Bank had failed and that it was being sold to JPMorgan Chase. At the time, JPMorgan Chase was already the largest and riskiest bank in the United States. The sweetheart deal the bank got from the FDIC to take over First Republic included the FDIC eating 80 percent of any losses on single-family residential mortgages for 7 years and 80 percent of any losses on commercial loans, including commercial real estate, for five years. The FDIC also provided JPMorgan Chase with a $50 billion, five-year fixed-rate loan at an undisclosed interest rate. According to the filing that JPMorgan Chase made with the Securities and Exchange Commission last Friday, the deal also gave JPMorgan Chase something that it desperately needed: deposits. According to the 8-K filing that JPMorgan Chase made with the … Continue reading

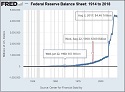

Fed Data Shows a Half Century of Moderate Growth in the Fed’s Balance Sheet through Two World Wars – Then a Seismic Explosion Under Bernanke, Yellen and Powell

By Pam Martens and Russ Martens: June 6, 2022 ~ Last month the Federal Reserve Bank of New York released its 2021 annual report from its “Markets Group.” That’s the group that operates a trading floor (complete with speed dials to the trading houses on Wall Street) at the New York Fed, located not far from the New York Stock Exchange, as well as another trading floor on the premises of the Chicago Fed, which is not far from the futures exchanges in Chicago. That report showed that despite all of the recent talk about the Fed dramatically shrinking its balance sheet from its current size of $8.9 trillion, the internal Federal Reserve plan for the balance sheet is actually this: “After declining by about $2.5 trillion from the peak size reached in the first half of 2022, the portfolio stops declining in mid-2025, at which point it is held constant … Continue reading

The SEC Has a Graph of the Wall Street Short-Term Loan Market that Blew Up: It Needs a Surgeon General Warning Before Viewing

By Pam Martens and Russ Martens: December 10, 2020 ~ If you suffer from chronic nightmares, experience migraine headaches from stress, or have anger management issues when confronted with abject stupidity, you probably want to avoid looking at the above graph that the Securities and Exchange Commission has created to show how one of the most critical financial markets in the United States functions. Or perhaps we should say, why it’s incapable of functioning when it’s most needed. The market is Wall Street’s Short-Term Funding Market which includes its integral repurchase agreement (repo) market. The repo market blew up in 2008 during the last financial crisis and required a Fed bailout. It blew up again on September 17, 2019 for reasons that have yet to be credibly explained and required at least $9 trillion in cumulative emergency loans from the Federal Reserve over the next six months. As we reported … Continue reading

Taxpayers Are on the Hook for 98 Percent of the Fed’s $6.98 Trillion Balance Sheet

By Pam Martens and Russ Martens: May 19, 2020 ~ If there has been any positive outcome from the COVID-19 pandemic, it has been that the American people are beginning to take a cold, hard look at how the U.S. economy has been engineered as a vast wealth transfer system for the one percent. We have peeled back the dark curtain further today on how the Federal Reserve has been structured as an unlimited money spigot to enrich that one percent as it privatizes profits for the criminally-inclined Wall Street titans and socializes the losses to the law-abiding 99 percent of hardworking Americans. ~~~ The Federal Reserve Board of Governors consists of seven individuals appointed by the President of the United States and confirmed by the U.S. Senate. As of today, only five of those Governor seats have been filled. As of last Wednesday, these five unelected individuals were overseeing … Continue reading

These Two Graphics Show Why New York City Is the Virus Epicenter in the U.S.

By Pam Martens and Russ Martens: March 23, 2020 ~ For want of a mask the largest economy in the world has been gutted, with Goldman Sachs now projecting that U.S. GDP could contract by as much as 24 percent in the second quarter. New York City, a major contributor to U.S. GDP, is now the epicenter of coronavirus cases in the U.S. We saw this as a likely outcome from the moment that we learned that droplets could be spread from person to person through the air. According to the Center for Sustainable Systems at the University of Michigan, “the average population density of the U.S. is 87 people per square mile.” But in New York City, “the population density is 27,012 people per square mile,” far greater than any other major city in America. Let that sink in for a moment. The population density in New York City … Continue reading

Fed’s Balance Sheet Spikes by $253 Billion, Now Topping $4 Trillion

By Pam Martens and Russ Martens: October 18, 2019 ~ Shhh! Don’t tell Congress that the Federal Reserve is back to electronically creating money out of thin air to throw at a liquidity problem (of an, as yet, undetermined origin) on Wall Street. And be sure not to mention that the Fed’s balance sheet has shot up in a period of just 42 days by $253 billion. And, of course, don’t remind Congress that before the last Wall Street crisis was over the Fed had secretly, with no oversight from Congress, piled up a $29 trillion tab to bail out Wall Street — a fact it fought years in court to keep under wraps. On September 4, 2019, the Fed’s assets on its balance sheet stood at $3.761 trillion. As of October 16, that figure is $4.014 trillion, edging closer to the $4.5 trillion peak it reached in 2015 following the … Continue reading