By Pam Martens and Russ Martens: January 27, 2020 ~

According to the data made available on the public website of the New York Fed, since September 17, 2019 it has funneled a cumulative total of $6.6 trillion to some of the 24 trading houses on Wall Street that are known as its “primary dealers.” The giant sum has been sluiced to Wall Street in the form of repurchase agreement (repo) loans without any details being provided to the elected representatives in Congress as to which firms are getting the money or what it’s being ultimately used for. But since the stock market has set repeated new highs since the program launched, some veteran market watchers believe the Fed is fueling a Ponzi-like rally in stocks.

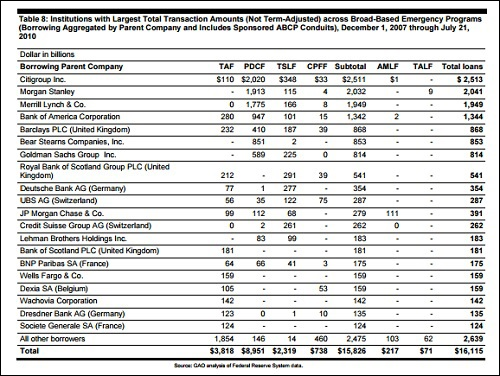

When the nonpartisan investigative arm of Congress, the General Accountability Office (GAO), tallied up the cumulative total that the Federal Reserve had secretly sluiced to Wall Street from December 2007 through July 21, 2010, it came to $16.1 trillion. (See chart below.) But the GAO did not include all of the programs that came out of the New York Fed. When those other programs are added, the Levy Economics Institute, using the Fed’s own data, arrived at the tally of $19.559 trillion to the Wall Street trading houses and another $10 trillion in central bank liquidity swaps, bringing the bailout figure to over $29 trillion.

Why is it essential to report on the cumulative tally that the New York Fed pumped during the crisis and is doing once again to Wall Street’s trading houses? As L. Randall Wray wrote in 2011 to explain Levy’s calculations: “The cumulative lending by the Fed contributes to our understanding of the depths of their [the Wall Street banks’] problems.”

The fact that both the auditors at the GAO and the university academics working on behalf of the Levy Economics Institute found the cumulative tally to be important means that it is important to report to the American people.

There are other key reasons to keep a close tab on the cumulative tally. The cumulative tally during the financial crisis was a measure of just how long an emergency response from the New York Fed was needed to calm an epic financial crash on Wall Street. The GAO measured the response from December of 2007 to July 21, 2010 – a period of more than two and a half years. That it took the New York Fed that long and trillions of dollars to calm markets was indicative of just how incompetent it and other Federal regulators of Wall Street had been in reining in the wild gambles that were occurring in derivatives across Wall Street.

The Fed’s own negligent role in supervising the Wall Street banks may well explain why it battled in court for more than two years to keep the details of its loans a secret from Congress and the American people.

Then, as now, the Fed loans were being made at ridiculously low rates of interest that would not even have been available to AAA-credit corporations. Many of these Wall Street trading houses were either insolvent or teetering on the verge of insolvency so the cheap loans (a significant portion of which were made at less than 1 percent interest) were a subsidy to Wall Street – a form of corporate welfare at a time when the same banks were charging consumers double-digit interest rates on their credit cards. Bloomberg Markets magazine reported in January 2012 that the underpriced loans amounted to $13 billion in extra income for the Wall Street banks.

Today’s repo loans are being made at 1.55 to 1.57 percent interest by the New York Fed. On September 17, 2019 the free market wanted to price those loans at 10 percent. That’s when the New York Fed jumped in with both feet with a pile of money priced at fictitious interest rates.

The cumulative tallies also allow us to measure this current unnamed crisis that has prompted the New York Fed to plow $6.6 trillion into Wall Street in a period of four months versus prior crises. For example, during the first week of the Fed’s repo loan program in 2019 – from September 17 through September 24 – the New York Fed cumulatively plowed $373.9 billion into the trading houses of Wall Street using repo loans.

Compare that dollar figure to the amount the New York Fed pumped into its primary dealers during the pivotal week of the worst financial collapse since the Great Depression. On Monday, September 15, 2008, the century-old Lehman Brothers filed for bankruptcy; the giant insurer, AIG, which was the counterparty to tens of billions of Wall Street’s derivative bets, was put into receivership with the U.S. government; and 94-year old Merrill Lynch was teetering so badly under subprime debt losses that it had to merge with Bank of America. From September 15, 2008 through September 22, 2008, the New York Fed provided cumulative liquidity of $285 billion under its repo loan program — $88.9 billion less than during its first week of repo operations last year.

Last September was the first time the New York Fed has used this repo loan operation since the financial crisis. And, yet, Fed Chairman Jerome Powell refuses to say that there is any crisis on Wall Street. On November 13, 2019 Powell testified before the Joint Economic Committee of Congress, stating: “The core of the financial sector appears resilient, with leverage low and funding risk limited relative to the levels of recent decades.”

That statement comes despite the fact that the Federal regulator of national banks, the Office of the Comptroller of the Currency (OCC), reported in December that just four Wall Street banks hold 87.2 percent of all derivatives in the entire banking industry. Those four Wall Street banks (JPMorgan Chase, Citigroup, Goldman Sachs and Bank of America) have notional exposure (face amount) of $175 trillion in derivatives.

Looking equally out-to-lunch, the November 7, 2019 minutes of the Financial Stability Oversight Council (F-SOC) did not mention one word about the trillions of dollars in repo loans the New York Fed is pumping into Wall Street. F-SOC was created under the Dodd-Frank financial reform legislation of 2010 to monitor and prevent a potential crisis on Wall Street that might, once again, destroy the U.S. economy.

Last Friday’s trading action seemed to flatly contradict Fed Chairman Powell’s assessment that “the core of the financial sector appears resilient.” The S&P 500 Index closed down just 0.90 percent but shares of JPMorgan Chase significantly outpaced those losses with a decline of 2.48 percent. The other three big derivative banks closed as follows: Citigroup was down 1.73 percent; Goldman Sachs lost 1.49 percent; while Bank of America was off by 1.70 percent.

This morning at 8:37 a.m. (ET), Dow Jones futures were showing a loss of 454 points, suggesting a deep red ink open for the stock market at 9:30 a.m. The New York Fed had already this morning pumped $49.60 billion in repo loans to its Wall Street trading houses, at an interest rate of 1.55 percent.