By Pam Martens and Russ Martens: January 31, 2024 ~

Smart Americans have found two ways to outwit the wealth extraction machinery on Wall Street. They buy a home and build its value over time with sweat equity; and/or they start their own small business. A very large number of Americans who are living comfortably in retirement today built their wealth through one or both of these avenues.

Wall Street banks, on the other hand, typically extract wealth from the little guy in a multitude of insidious ways – from high interest credit cards to excessive fees, tricked-up mortgages and outright frauds.

Nothing better illustrated this wealth stripping than the 2013 PBS program from Frontline called The Retirement Gamble. The program documented the following: If you work for 50 years and receive the typical long-term return of 7 percent on the stock mutual funds in your 401(k) plan, and your fees are 2 percent, almost two-thirds of your account will go to Wall Street. (We fact-checked the math and it’s correct; read our report here. Also see Related Articles linked below for more insight into how wealth stripping works.)

If an individual attempts to legally challenge being ripped off by Wall Street, they will end up in a private justice system created by Wall Street lawyers and run by a self-regulatory agency. You will not be allowed to take your claim to one of the nation’s courts where juries are randomly selected from a large pool of fellow citizens. You will have limited discovery and the arbitrators of your claim do not have to follow legal precedent or case law.

Even when serious financial crimes are committed against our cities and counties, causing mass layoffs and economic suffering to millions, no one will go to jail. Prosecutors will allow Wall Street to pay a fraction of the amount stolen and walk away.

After each illegal cartel on Wall Street is exposed, removing any doubt that this is an institutionalized wealth transfer system, new Wall Street cartels crop up faster than you can say “where are the customers yachts.”

Add dark pools, high frequency trading, and stock exchange collusion to the 401(k), private justice system and cartel fleecing activity and you have an almost perfect system for wealth transfers with impunity.

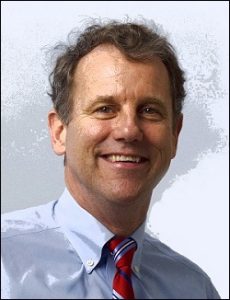

Many Americans believe that the Federal Reserve (“the Fed”) is the linchpin to Wall Street’s wealth transfer program to the 1 percent. Yesterday, the Chair of the Senate Banking Committee, Senator Sherrod Brown (D-OH), raised similar concerns in a hard-hitting letter to Fed Chair Jerome Powell. Brown wrote in part:

“…Because monetary policy operates on a lag, keeping interest rates elevated will continue to apply downward pressure on the labor market and wages, and drive up mortgage costs, while doing nothing to tackle the cause of continued high prices. When the Fed justifies higher interest rates for the sake of weakening demand, that is, in effect, a euphemism for suppressing wages and job creation. The burden of attaining price stability should not fall on the backs of workers and home-buyers…

“To lower costs for all Americans, we must address inflation’s root causes without undercutting economic growth. Monetary policy does nothing to address the underlying cause of higher prices – namely, corporate price-gouging – but it does undermine economic growth. Higher rates are locking Americans out of the two primary means for building wealth—buying a home and starting or growing a small business…

“Higher rates hurt prospective home buyers. I hear from so many Ohioans that they feel trapped – those who rent feel like they’ll never be able to afford to buy and those who already own their homes feel like they will never be able to afford a larger one if they decide to grow their family. Prices have been too high for too long for both renters and homebuyers across the country, and these challenges have only grown more acute as interest rates have stayed elevated. For prospective home buyers, the same mortgage for a home purchased today costs nearly double what it did in 2020. Higher rates have also given corporations an advantage over consumers in the housing market. As consumers face elevated interest rates, many of the biggest real estate investors have access to cheaper Wall Street financing, allowing them to buy up real estate with all-cash offers based on financing costs a working family could never get. As a result, institutional investors – including private equity and S&P 500 companies – are buying up formerly affordable manufactured housing communities and affordable single-family homes in far too many communities. Homeownership is the primary means for working-class and middle-class families to acquire wealth, and higher interest rates are making it harder for them to afford a mortgage to purchase a home, denying them the opportunity to build intergenerational wealth.

“Higher interest rates are hindering growth in the housing supply. High interest rates are also contributing to high housing costs by exacerbating our years-long housing shortage as they limit affordable housing providers’ ability to finance new construction at price points that workers can afford. As a result, housing production remains thousands of units behind each year in communities across the country, and renters are forced to pay high prices month after month. In 2022, a record half of renters were paying more than they could afford for housing, pushing their ability to save for a down payment further out of reach. If affordable housing providers remain unable to build new units that these workers can afford, housing costs will only continue to contribute to rising prices.

“Higher interest rates stall small business growth. Tightened credit conditions are making it difficult for small businesses to thrive. Keeping the policy rate higher for longer has driven up the cost of credit for small business loans. Today, a small business seeking to take out a loan will pay on average 9.3% in interest. For the small businesses who have already taken out loans, higher rates will increase their interest burden in 2024. Consequently, 9-out-of-10 small businesses think now is not a good time to expand their business. Small businesses employ half of America’s workers and higher rates are discouraging them from both hiring workers and increasing their employees’ wages to keep up with inflation.

“For working Americans and small businesses who already feel the crush of inflation, higher housing costs and reduced access to credit will only make it worse. Keeping interest rates high will be detrimental to American workers and their families and do little to bring down prices or promote moderate economic growth. While more must be done to address the fact that costs remain too high, it is becoming increasingly evident that restrictive monetary policy is no longer the right tool for combatting inflation, and I urge the Federal Reserve to ease monetary policy early this year.”

The wealth extraction machine on Wall Street does, however, benefit from higher interest rates. Because those rates drive more people into the need to borrow, the mega banks on Wall Street, which are also among the largest credit card providers, can charge higher interest rates on their credit cards to a growing number of desperate consumers.

Today, the Fed will make its announcement on interest rates at 2 p.m., followed by Fed Chair Powell’s press conference at 2:30 p.m. One thing you can expect to hear from Powell is how everything the Fed does is to help the American people. Powell came from the private equity wealth extraction firm, the Carlyle Group.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

Mr. Gensler, the U.S. Stock Market Structure Is an Institutionalized Wealth Transfer System

Ten Things You Can Do Now to Curb Wall Street’s Wealth Transfer System

Wall Street’s Wealth Transfer System Is Imperiling the U.S. Economy

As This Crypto Stock’s Price Collapsed, Goldman, JPMorgan and Citigroup Issued Buy Ratings