By Pam Martens and Russ Martens: August 17, 2022 ~

After crypto has blighted trust in the financial landscape of the United States and left tens of thousands of Americans as victims of theft, or locked out of access to their money, the Federal Reserve has finally found the courage to take on the loud-mouthed crypto hawkers and issue a warning.

After crypto has blighted trust in the financial landscape of the United States and left tens of thousands of Americans as victims of theft, or locked out of access to their money, the Federal Reserve has finally found the courage to take on the loud-mouthed crypto hawkers and issue a warning.

The Fed sent a letter yesterday to supervisory staff at its 12 regional Federal Reserve banks and to all Fed member banks. The letter started out with a curious sentence (potentially crafted to assuage the loud-mouthed crypto hawkers which include a significant number of right-wing members of Congress on the Senate Banking and House Financial Services Committees which oversee the Fed). The sentence read:

“The emerging crypto-asset sector presents potential opportunities to banking organizations, their customers, and the overall financial system…” (Italics added.)

The word “opportunities” typically suggests that something of a positive nature might transpire. But the letter from the Fed fails to mention so much as one positive development that might occur from banks engaging in crypto activities. Instead, it correctly outlines a multitude of nightmare scenarios that can – and have – occurred from engaging in crypto activities.

The Fed lists the following:

“novel risks such as those associated with cybersecurity and governance”;

“money laundering and illicit financing”;

“significant consumer risks such as those related to price volatility, misinformation, fraud, and theft or loss of assets”;

“uncertainty regarding the legal status of many crypto-assets; potential legal exposure arising from consumer losses, operational failures, and relationships with crypto-asset service providers”;

“limited legal precedent regarding how crypto-assets would be treated in varying contexts, including, for example, in the event of loss or bankruptcy”;

“risks to financial stability including potentially through destabilizing runs and disruptions in the payment systems.”

After more than making the case that crypto shouldn’t come within a ten-mile range of taxpayer-backstopped, federally-insured banks, the Fed then punts and simply requires banks to do the following before engaging in crypto activities:

“A supervised banking organization should notify its lead supervisory point of contact at the Federal Reserve prior to engaging in any crypto-asset-related activity. Any supervised banking organization that is already engaged in crypto-asset-related activities should notify its lead supervisory point of contact at the Federal Reserve promptly regarding the engagement in such activities, if it has not already done so. Federal Reserve supervisory staff will provide relevant supervisory feedback, as appropriate, in a timely manner.

“In all cases, a supervised banking organization should, prior to engaging in these activities, have in place adequate systems, risk management, and controls to conduct crypto-asset-related activities in a safe and sound manner and consistent with applicable laws, including applicable consumer protection statutes and regulations. This includes having adequate systems in place to identify, measure, monitor, and control the risks associated with such activities on an ongoing basis….”

The Fed certainly knows that the megabanks it supervises on Wall Street don’t have adequate systems in place to control even the risks associated with their ongoing activities. That’s why the Justice Department keeps handing out felony counts and deferred prosecution agreements to these banks. (Also see our recent report: Wall Street Megabanks’ Multi-Billion Dollar Blunders Suggest Money Controls as Good as George Bailey’s Uncle Billy.)

It’s simply stupid and illogical to think that these same banks could engage in crypto activities “in a safe and sound manner” when crypto and blockchain are themselves shams according to more than 1,600 of the smartest people in technology today, who sent a warning letter to Congress on June 1.

The letter was sent to key members of Congress and to the Chairs of the Senate Banking and House Financial Services Committees. It is signed by more than 1,600 computer scientists, software engineers and technologists from around the world. There are 45 signatories who work at Google; 19 who work at Microsoft; 11 employed at Apple. There are signatories that are Ph.Ds from the most prestigious universities in the world, including the University of Oxford and MIT. They wrote as follows:

“We strongly disagree with the narrative—peddled by those with a financial stake in the crypto-asset industry—that these technologies represent a positive financial innovation and are in any way suited to solving the financial problems facing ordinary Americans…

“As software engineers and technologists with deep expertise in our fields, we dispute the claims made in recent years about the novelty and potential of blockchain technology. Blockchain technology cannot, and will not, have transaction reversal or data privacy mechanisms because they are antithetical to its base design. Financial technologies that serve the public must always have mechanisms for fraud mitigation and allow a human-in-the-loop to reverse transactions; blockchain permits neither.”

The letter links to an article from Bruce Schneier, a Security Technologist who teaches at the Harvard Kennedy School. The article appeared at Wired on February 6, 2019 under the headline: “There’s No Good Reason to Trust Blockchain Technology.” The article makes the following salient points:

“What blockchain does is shift some of the trust in people and institutions to trust in technology. You need to trust the cryptography, the protocols, the software, the computers and the network. And you need to trust them absolutely, because they’re often single points of failure.

“When that trust turns out to be misplaced, there is no recourse. If your bitcoin exchange gets hacked, you lose all of your money. If your bitcoin wallet gets hacked, you lose all of your money. If you forget your login credentials, you lose all of your money. If there’s a bug in the code of your smart contract, you lose all of your money. If someone successfully hacks the blockchain security, you lose all of your money. In many ways, trusting technology is harder than trusting people. Would you rather trust a human legal system or the details of some computer code you don’t have the expertise to audit?”

Losing all your money currently appears to be a feature not a bug of crypto and blockchain. For how that is playing out with crypto investors being locked out of getting access to their money, crypto bankruptcy filings and the like, see this August 11 report from David Gerard and Amy Castor.

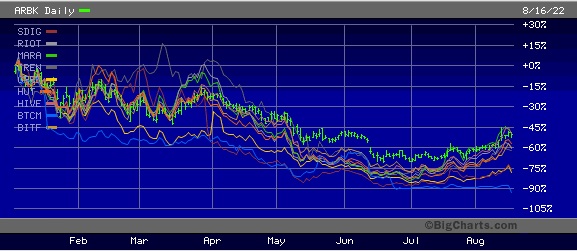

And it’s not just investors in crypto currencies that are in tears and shock. Investors in the publicly-traded shares of crypto exchanges and crypto mining companies are nursing serious losses as well. Coinbase, the publicly-traded crypto exchange that trades on Nasdaq, has lost more than 60 percent of its value year-to-date, while some crypto mining stocks have fared even worse.

The chart below shows the share price performance of ten crypto miners on a year-to-date basis through Tuesday, August 16, 2022: Argo Blockchain PLC (ARBK), Bitfarms Ltd. (BITF), BIT Mining Ltd. (BTCM), Hive Blockchain Technologies Ltd. (HIVE), Hut 8 Mining Corp. (HUT), Greenidge Generation Holdings (GREE), Iris Energy (IREN), Marathon Digital Holdings Inc. (MARA), Riot Blockchain Inc. (RIOT), and Stronghold Digital Mining (SDIG). The shares are down anywhere from 45 percent to more than 90 percent year-to-date.

Related Article: