By Pam Martens and Russ Martens: June 12, 2020 ~

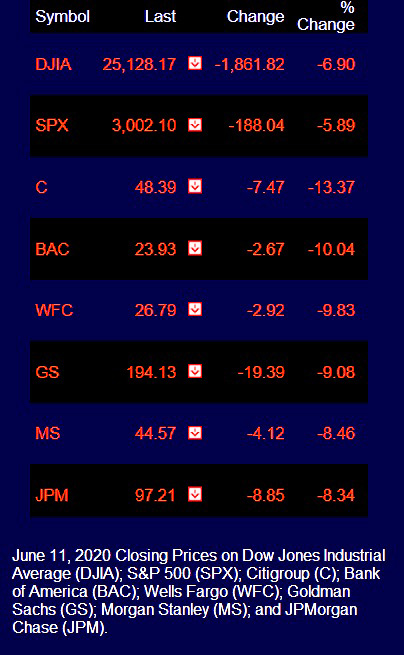

Every major Wall Street bank tanked yesterday. Citigroup fared the worst, losing 13.37 percent of its market value versus a broader market decline of 5.89 percent on the S&P 500 Index. Bank of America didn’t look like much of a source of strength either, losing 10.04 percent on the day. The largest bank in the country, JPMorgan Chase, whose CEO, Jamie Dimon, perpetually brags about its “fortress balance sheet,” lost 8.34 percent. For a close look at what’s hiding in the tall weeds behind that fortress, see here.

Just the afternoon before this bank carnage, this is what the Chairman of the Federal Reserve, Jerome Powell, had to say in his press conference about the U.S. banking system (which, of course, the Fed has been in charge of supervising in order to prevent another catastrophic blowup as occurred in 2008):

“You have a banking system that is so much better capitalized, so much stronger, better aware of its risks, better at managing its risks, more highly liquid. You have all of those things and they’ve been lending, they’ve been taking in deposits, they’ve been a source of strength in this situation.”

If these mega banks on Wall Street are in such good shape, why did the Fed have to jump in on September 17, 2019 – months before the first COVID-19 case appeared anywhere in the world – and start pumping hundreds of billions of dollars a week in loans to the trading units owned by these banks?

According to the Fed’s December 10-11 meeting minutes, its emergency repo loans amounted to “roughly $215 billion per day” flowing at super cheap interest rates to the trading houses on Wall Street. That amounted to approximately $6.23 trillion cumulatively in loans to these “highly liquid” banks. As of today, that figure stands in excess of $9 trillion in cumulative repo loans and the program is ongoing.

And then, of course, there’s that alphabet soup of emergency lending programs that the Fed has since rolled out to bail out Wall Street banks in a replay of the bailouts of 2007 to 2010.

Treasury Secretary Steve Mnuchin has stated that this financial crisis is nothing like the last one. But if that were true the Fed would not be using the identical emergency bailout programs that it used in 2007 to 2010. These are the names of the emergency funding facilities that the Fed used in the last crisis that it has recreated and given even the same names today: the Primary Dealer Credit Facility (PDCF); the Commercial Paper Funding Facility (CPFF); the Money Market Mutual Fund Liquidity Facility (MMMFLF); the Term Asset-Backed Securities Loan Facility (TALF) and the Foreign Central Bank Dollar Liquidity Swaps. The Fed has brand new bailout programs as well, such as the corporate bond buying programs, the Main Street Loan Facility (which does not sound like it will help actual Main Street businesses) and the Municipal Liquidity Facility to support lending to city, state and county governments. That last one is not yet operational.

The Fed is also flooding liquidity into Wall Street via quantitative easing programs (which it also used following the 2008 Wall Street crisis). This is where it buys up the excessive debt instruments that are clogging up the financial system. On September 18, 2019, one day after the Fed began its still unexplained emergency repo loan program, the Fed’s balance sheet stood at $3.89 trillion. On that date, it held $3.59 trillion in Treasury and Mortgage-Backed Securities that it had purchased and taken off the books of the banks. As of yesterday, the Fed’s balance sheet had ballooned to $7.2 trillion with $5.9 trillion in Treasury and Mortgage-Backed Securities. In order to keep the wheels from coming off the Wall Street banking bus, the Fed has had to purchase $2 trillion in debt from Wall Street in a period of just 9 months while flooding the system with $9 trillion cumulatively in repo loans. Since mid-March, the Fed has been making those repo loans at 1/10th of one percent interest — effectively free money going to Wall Street.

We’re simply not buying the idea that these six mega banks with $202 trillion notional (face amount) in opaque derivatives are going to provide the strength we need in this storm. It’s long past the time to break up these banks and restore the Glass-Steagall Act where the casino trading houses are separated from the federally-insured, deposit-holding banks.