By Pam Martens and Russ Martens: May 22, 2023 ~

Pretty much everything the average American has read about the banking crisis is wrong. And there is at least a prima facie case that could be made that Big Media is responsible for that misinformation.

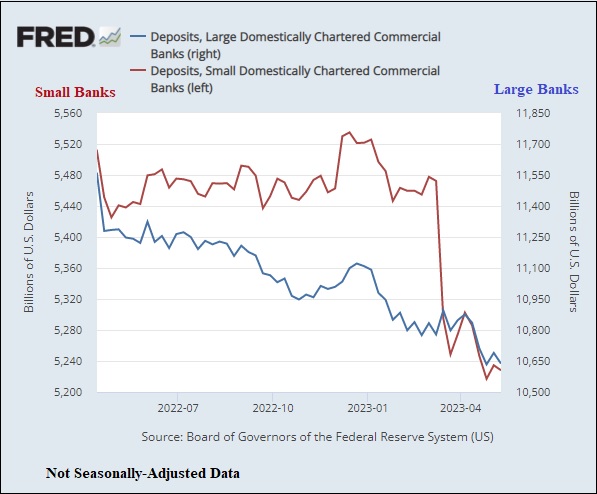

Let’s start with the dozens of mainstream media reports that small banks were bleeding deposits and these deposits were flooding into the biggest banks in the U.S. as a safe haven. Those reports gave the distinct impression that the mega banks on Wall Street are viewed by Americans as a safe place to stash money, never mind that they blew up the U.S. financial system in 2008 and still have more than $200 trillion in derivatives lurking in the shadows.

According to FRED data compiled by the St. Louis Fed (see chart above), bank deposits at the 25 largest U.S.-chartered commercial banks peaked at $11.556 trillion on April 13, 2022, then went into a persistent downtrend that erased $457 billion of deposits by December 12, 2022. Meanwhile, the more than 4,000 small U.S. banks, on the other hand, produced a $25 billion gain in deposits in the same time span.

It was not until all of those news articles appeared in March and April of this year, saying that small banks were losing deposits, that the small banks actually saw a sharp drop in their deposits.

On March 13 of this year, the Financial Times ran this headline: “Large US banks inundated with new depositors as smaller lenders face turmoil.” The subhead was even more questionable, reading: “Failure of Silicon Valley Bank prompts flight to likes of JPMorgan and Citi.” (JPMorgan Chase has been charged with an unprecedented five felony counts by the U.S. Department of Justice over the past nine years. See JPMorgan’s Board Made Jamie Dimon a Billionaire as the Bank Rigged Markets, Laundered Money, and Admitted to Five Felony Counts.) Citigroup’s stock has been a basket case since the financial collapse in 2008. Citi did a 1-for-10 reverse stock split in 2011 to window dress its stock price.

On April 28, the Bloomberg columnist, John Authers, wrote a column that was syndicated to the Washington Post. Authers included this misleading information about the four largest U.S. banks: JPMorgan Chase, Bank of America, Wells Fargo and Citigroup’s Citibank.

“This summary from the Canadian firm Palos Management explains neatly why the bigger banks are still OK:

“The first quarter’s performance of the big four was consistent with a broad consensus that the big banks have capitalized on massive depositor inflows, clearly related to the well-documented liquidity stresses facing their smaller, regionally based brethren. This should come as no surprise. The panic-fueled depositor exodus from the smaller banks to the larger ‘too big to fail’ banks is simply a rational decision. Protection of capital rules.”

As we reported on May 8, the actual reality is this: Deposits at JPMorgan Chase, Bank of America and Wells Fargo Shrank by $465 Billion Y-O-Y; More than Twice the Total of 4,000 Small Banks. In that article, we provided granular details as follows:

“The deposit losses at JPMorgan Chase, Bank of America and Wells Fargo are more than twice what the 4,000 small banks lost in total during the same period. Their combined loss in deposits was just $210 billion…

“Bank of America and Wells Fargo not only lost those large deposit sums on a year-over-year basis, but both banks saw deposits fall during the past five quarters, including the quarter ending March 31, 2023 when headlines were declaring that they were seeing big inflows of deposits as a result of the banking crisis. JPMorgan Chase lost deposits in each of the quarters in 2022 and then saw a small increase in deposits in the first quarter of this year – likely from all of those misleading headlines. (This information is easily obtained from the financial statements the firms file publicly with the SEC.)”

Over this past weekend, the Wall Street Journal ran a big article on how the banking crisis has “only made JPMorgan stronger.” (Paywall.) Reporter David Benoit writes as follows about JPMorgan Chase’s purchase of the collapsed bank, First Republic:

“Yet JPMorgan’s show of strength, for many, exposed a weakness in the U.S. financial system. The bank and its largest rivals have become so big, their reach so extensive, that the government would almost surely step in to prevent their failure. That implicit guarantee encourages people and businesses to move their money to them in times of stress creating a feedback loop that makes big banks bigger at the expense of their smaller peers.”

The only feedback loop we’re seeing is the echo chamber of the mainstream business press.

What is not in dispute about JPMorgan Chase’s grab of First Republic Bank is the following: JPMorgan Chase was first called First Republic’s “rescuer” by the media. Then JPMorgan Chase became First Republic’s “advisor” to find strategic options for its survival. Then JPMorgan Chase put at least 800 of its employees to work on doing due diligence in order to buy First Republic for itself and get a sweetheart deal from the FDIC. The sweetheart terms of the deal include the FDIC eating 80 percent of any losses on single-family residential mortgages for 7 years and 80 percent of any losses on commercial loans, including commercial real estate, for five years. The FDIC also, bizarrely, handed JPMorgan Chase a $50 billion, five-year fixed-rate loan at an undisclosed interest rate.

All of this raises the question, who got the bailout: uninsured depositors at First Republic Bank or JPMorgan Chase?