By Pam Martens and Russ Martens: April 25, 2023

For years Wall Street On Parade saluted the work of the Office of Financial Research (OFR) in sounding the alarms about the risks building up in the U.S. banking system – even when it was politically unpalatable for the OFR to do so. Then the Trump/Koch administration took over and gutted OFR and put a crony in charge.

It does not appear that the damage to staffing and talent under the former Trump/Koch administration has been adequately repaired under the Biden administration.

The OFR was created after the near collapse of the U.S. financial system in 2008. It derives its statutory role from the Dodd-Frank financial reform legislation of 2010. Its key job is to issue timely alerts and research reports to keep the Financial Stability Oversight Council (F-SOC) informed of emerging financial threats or weaknesses that have the potential to crater the U.S. financial system again.

Unfortunately, there was no loud warning issued (at least publicly) by OFR prior to three banks blowing up in the span of five days in March and rapidly spreading panic among uninsured bank depositors.

According to H.8 data from the Federal Reserve, as of the week ending March 1 there was $17.636 trillion in deposits at U.S. banks, not seasonally adjusted. There was just a negligible drop in deposits of $20 billion over the next week that ended March 8. (The H.8 is based on Wednesday to Wednesday data.)

Then the following occurred:

On Wednesday, March 8, Silvergate Capital Corporation, parent of Silvergate Bank, which had gotten in bed with crypto companies (including Sam Bankman-Fried’s house of frauds) announced it was winding down and would “voluntarily liquidate the Bank.” That sent depositors fleeing from other banks with crypto exposure and the share prices of those banks plunging.

On Friday, March 10, Silicon Valley Bank, headquartered in Santa Clara, California, was put into receivership by the Federal Deposit Insurance Corporation (FDIC).

On Sunday, March 12, the New York headquartered Signature Bank was also put into receivership by the FDIC.

Silicon Valley Bank and Signature Bank, respectively, were the second and third largest bank failures in U.S. history – a point not lost on depositors reading those facts in newspaper headlines. (The largest bank failure was Washington Mutual in 2008.)

After this series of events in a 5-day span, deposit flight got into gear. At the close of the week ending March 15, deposits were down to $17.486 trillion. By the close of the week ending March 22, deposits had plunged to $17.307 trillion.

From the week ending March 1 to the week ending March 22, deposits in U.S. commercial banks had declined by an astounding $328 billion dollars – in a span of just three weeks.

As of the most recent H.8 data for the week ending April 12, deposits stood at $17.380 trillion – still down $256 billion from the week ending March 1.

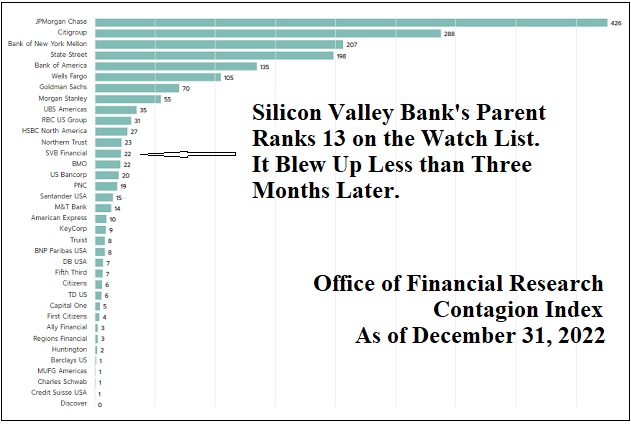

Only one of the banks that imploded was on the OFR’s Contagion Index list. Per the chart above, that was Silicon Valley Bank and it ranked 13 on the OFR’s watch list for the period ending December 31, 2022.

The other two banks which helped spread panic and contagion, Silvergate Bank and Signature Bank, were not on OFR’s Contagion Index at all. That’s very troubling because on August 1 of last year, we published an article headlined as follows: Brace Yourself for Federally-Insured Bank Failures Caused by Crypto. We specifically mentioned Silvergate Bank and Signature Bank in the article.

OFR explains its Contagion Index as follows:

“[It] measures the loss that could spill over to the rest of the financial system if a given bank were to default. It depends on the size of the bank, its leverage, and how connected it is to other financial institutions:

OFR Contagion Index = Connectivity X Net Worth X (Outside Leverage).

Connectivity is defined by OFR as “the share of the bank’s unsecured liabilities that are held by other financial institutions. It is the ratio of the bank’s liabilities within the financial system to the bank’s total liabilities. With higher connectivity, a bank’s failure has a potentially broader impact on the rest of the financial system.”

OFR defines a bank’s net worth as “the difference between a bank’s assets and its liabilities. A larger bank’s failure can have a broader impact on the financial system, other things being equal.”

Outside leverage is defined by OFR as “the vulnerability of the bank to shocks from the real side of the economy. It is the ratio of a bank’s claims on nonfinancial entities to its net worth.”

What OFR has not captured in its Contagion Index is panic spreading because of reputational damage to the banking system itself. Silvergate Bank was federally-insured but had been in the headlines as potentially facilitating the looting of customer funds at Sam Bankman-Fried’s crypto exchange, FTX. That reputational damage then spilled over to other federally-insured banks involved in any manner with crypto companies. That crypto had gained a foothold in taxpayer-backstopped, federally-insured banks drained confidence in the U.S. banking system.

In the case of Silicon Valley Bank, its regulators had also allowed it to set itself up for reputational damage by effectively becoming a Wall Street IPO pipeline in drag as a federally-insured bank. Also, a large percentage of its deposits were uninsured, meaning they were larger than the $250,000 cap per depositor, per bank set by the FDIC. When the bank announced on March 8 that it had taken a loss of $1.8 billion on the sale of underwater securities and would be raising additional capital through a secondary stock offering of common as well as mandatory convertible preferred stock (which would dilute existing shareholders) that set those uninsured deposits into serious motion out of the bank.

Signature Bank had also become tainted by rubbing its elbows too close to crypto and had a large percentage of uninsured deposits. A bank run ensued there as well.

On March 29, the Vice Chair for Supervision at the Federal Reserve, Michael Barr, indicated during his testimony before the Senate Banking Committee that his office would be conducting a review of what went wrong at Silicon Valley Bank and releasing a report on May 1. The FDIC is conducting a similar review of the failure of Signature Bank and will also release a report on May 1.

The FDIC is also slated to release a report on May 1 regarding the deposit insurance system, options for consideration related to deposit insurance coverage levels, excess deposit insurance, and the adequacy of DIF, the Deposit Insurance Fund.