By Pam Martens and Russ Martens: April 20, 2023

The official that oversaw the secret funneling of trillions of dollars of bailout money from the New York Fed to the grossly mismanaged mega banks on Wall Street during the financial crisis of 2008 to 2010, had the temerity yesterday to pen an opinion piece at Bloomberg News pointing his finger at current Fed officials for today’s banking crisis – without once mentioning his role in getting us here.

The article was written by William (Bill) Dudley, who served as President of the New York Fed from January 27, 2009 to June 18, 2018. Prior to that Dudley was Executive Vice President of the Markets Group at the New York Fed, the group that runs its own trading floors in New York and Chicago and trades with the Wall Street mega banks it is also supposed to be supervising.

The New York Fed has become the official money spigot for Wall Street bailouts while being, literally, owned by some of the biggest banks on Wall Street. (See These Are the Banks that Own the New York Fed and Its Money Button.) Prior to joining the New York Fed in 2007, Dudley worked for two decades at – wait for it – Goldman Sachs, becoming a partner, managing director and chief economist.

Dudley’s broader agenda became clear in the opening sentence of his opinion piece yesterday. He writes that this is the “first banking crisis since 2008,” which dovetails nicely with the Wall Street lobbyists’ propaganda that there is nothing significantly wrong with the U.S. banking system so Congress shouldn’t start thinking about separating the Wall Street trading casinos from the federally-insured commercial banks by restoring the Glass-Steagall Act – which prevented systemic banking crises for 66 years until its repeal in 1999.

In fact, this is the third major banking crisis since 2008 and all three have occurred in the span of less than four years – a clear indication that the structure of the U.S. banking system is in desperate need of a major overhaul.

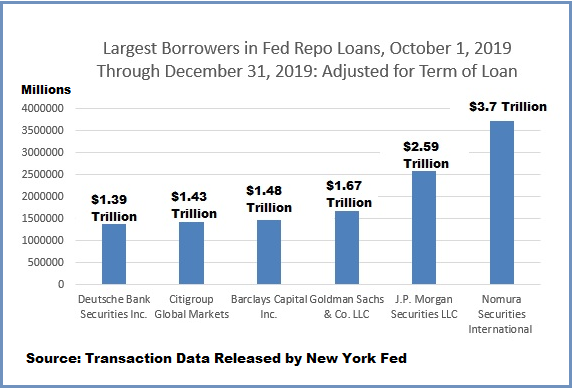

The first banking crisis since 2008 began on September 17, 2019 – for reasons the Fed has yet to explain with any credibility. In the last quarter of 2019, the New York Fed had to shovel emergency repo loans cumulatively totaling (on a term-adjusted basis) $19.87 trillion into Wall Street banks. As the chart below indicates, just six trading units of the mega banks on Wall Street received 62 percent of that amount. (Unadjusted for the term of the loan, the cumulative total was $4.5 trillion.)

Under the Dodd-Frank financial reform legislation of 2010, the Fed had to release the names of the banks that received these bailouts, and the dollar amounts of each loan, two years after the program began. While mainstream media went to court to get this information in 2008, there was a total mainstream media blackout when the Fed released the data for the 2019 bailouts. (See There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders.)

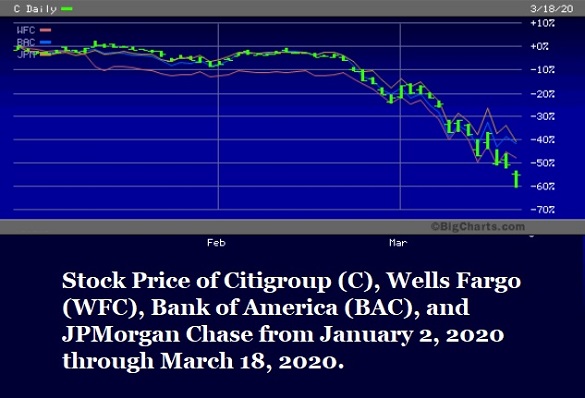

The next banking crisis occurred in March 2020 and was blamed on the pandemic. The share prices of the four largest banks (by deposits) collapsed by as much as 40 to 60 percent between January 2, 2020 and March 18, 2020. (See chart below.) The Fed rolled out the same alphabet soup of emergency lending programs that it had rolled out in 2008 – with the New York Fed once again in charge of the bulk of those programs.

Three years later, in March of 2023, the second and third largest bank failures in U.S. history occurred: Silicon Valley Bank and Signature Bank, respectively, were put into receivership by the Federal Deposit Insurance Corporation (FDIC). In addition, federal regulators had allowed Silvergate Bank, a federally-insured bank, to immerse itself with crypto outfits (including the crypto house of frauds owned by Sam Bankman-Fried) and it also experienced a bank run and was allowed to quietly wind down in March. It is far from clear that there will not be more bank failures before this latest crisis runs its course.

The good ole Fed is now doing something it has never done before in its 110-year history. It is accepting underwater bonds as collateral for emergency loans to teetering banks and paying 100-cents on the dollar on that collateral for loans of up to one year. (Historically, the Fed has imposed a haircut on collateral and made overnight loans through its Discount Window.) The Fed calls its new program the Bank Term Funding Program (BTFP).

Related Articles:

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

New Documents Show How Power Moved to Wall Street, Via the New York Fed

Intelligence Gathering Plays Key Role at New York Fed’s Trading Desk