By Pam Martens and Russ Martens: June 9, 2021 ~

The Federal Reserve will release the results of its stress tests of the mega banks on Wall Street on June 24. That exercise is nothing more than a shell game to mislead Congress and the public into believing that actual due diligence is being done by the Fed on these massive federally insured banks with their inhouse trading casinos. (See Three Federal Studies Show Fed’s Stress Tests of Big Banks Are Just a Placebo.) In reality, the Fed is a completely captured appendage of Wall Street.

The Federal Reserve will release the results of its stress tests of the mega banks on Wall Street on June 24. That exercise is nothing more than a shell game to mislead Congress and the public into believing that actual due diligence is being done by the Fed on these massive federally insured banks with their inhouse trading casinos. (See Three Federal Studies Show Fed’s Stress Tests of Big Banks Are Just a Placebo.) In reality, the Fed is a completely captured appendage of Wall Street.

The Fed has outsourced the nitty-gritty supervision of Wall Street banks to the New York Fed, which is, literally, owned by the same banks. (See These Are the Banks that Own the New York Fed and Its Money Button.)

That the Fed is still allowed by Congress to have anything to do with supervising these banks shows just how far down the rabbit hole Wall Street’s money and influence in Washington has taken the country.

There is only one institution in America that has less credibility than the mega banks on Wall Street. That’s the Federal Reserve. Despite not having one elected official among its ranks, the Fed has unilaterally altered the U.S. financial system into a grotesque version of itself.

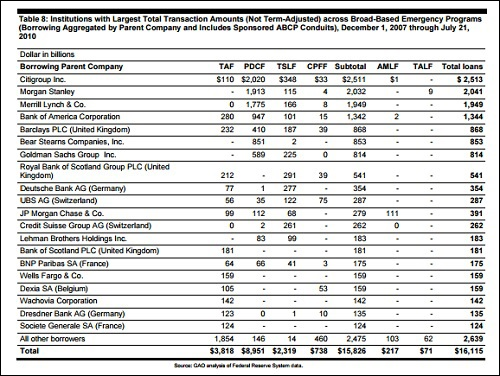

Let’s start with what the Fed did beginning in December of 2007 without any approval from Congress. The Fed created a sprawling octopus of bailout programs for the mega banks and their foreign derivative counterparties. The Fed then battled in court for years to keep Congress and the public from learning the astronomical sums the Fed had spent to prop up failed banks across Wall Street. When the government finally released an audit of the Fed’s bailout programs on July 21, 2011, the tally came to a cumulative $16 trillion. (See chart below.) But when the Levy Economics Institute added in other Fed bailout programs that the government audit had bypassed, the actual tally came to $29 trillion.

In what kind of democracy does an institution lacking even one elected official get to unilaterally prop up insolvent banking behemoths after those same banks cratered the U.S. economy through the creation of fraudulent mortgage products?

When the government audit was released, the office of Senator Bernie Sanders of Vermont released a statement, which read in part:

“The Fed outsourced virtually all of the operations of their emergency lending programs to private contractors like JP Morgan Chase, Morgan Stanley, and Wells Fargo. The same firms also received trillions of dollars in Fed loans at near-zero interest rates. Altogether some two-thirds of the contracts that the Fed awarded to manage its emergency lending programs were no-bid contracts. Morgan Stanley was given the largest no-bid contract worth $108.4 million to help manage the Fed bailout of AIG.”

Sanders stated at the time, “The Federal Reserve must be reformed to serve the needs of working families, not just CEOs on Wall Street.”

That statement from Sanders came almost a decade ago in July 2011. Not only has the Fed not been reformed but it has unilaterally given itself new powers to replace the free market’s setting of interest rates for its own regime of Fed administered rates.

How is the Fed administering rates? It has ballooned its balance sheet to $7.9 trillion (yes, trillion) by gobbling up Treasury securities and mortgage-backed bonds from the surpluses on Wall Street and parking them on its own balance sheet. It’s been engaged in this sleight-of-hand, which it quaintly calls “quantitative easing” since the financial crisis of 2008.

On December 12, 2007, the Fed’s balance sheet stood at $881.75 billion. It has exploded to nine times that amount in the span of 13-1/2 years.

Even Fed insiders have spoken out against these artificially low interest rates administered by the Fed. Eric Rosengren, President of the Boston Fed, noted the following in a speech he delivered to the Marquette University Economics Department on October 8, 2020:

“…the extended low interest rate environment after the Great Recession helps explain why the leverage ratio rose over the past 10 years. Corporations increased their leverage as the prevailing low interest rate environment provided more capacity to take on debt.

“However, in an economic downturn, greater leverage – with its principal and interest repayment demands – may prove problematic for firms, or by extension the economy. This can result in firms being forced into bankruptcy, which hurts a wide range of stakeholders in addition to lenders and investors, including customers, suppliers, and employees.”

Rosengren added later in the speech:

“Clearly a deadly pandemic was bound to badly impact the economy. However, I am sorry to say that the slow build-up of risk in the low-interest-rate environment that preceded the current recession likely will make the economic recovery from the pandemic more difficult.”

The mega banks on Wall Street that are supposed to be supervised by the Fed are among those corporations that have gorged on debt. According to a June 2020 article at Bloomberg News, four of those banking behemoths have also been paying out more than they earned for years. The article revealed the following about the dividends and stock buybacks at Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo:

“From the start of 2017 through March, the four banks cumulatively returned about $1.26 to shareholders for every $1 they reported in net income, according to data compiled by Bloomberg. Citigroup returned almost twice as much money to its stockholders as it earned, according to the data, which includes dividends on preferred shares. The banks declined to comment.”

Citigroup was the largest of the bank basket cases during the crash of 2008. It received a secret $2.5 trillion in cumulative loans from the Fed. (See chart below.) The Fed was not permitted by law to make loans to an insolvent institution. But it decided, on its own, to make loans to this highly questionable institution.

Just how little Congress has done to rein in the Fed is clear from the multi-trillions of dollars the Fed showered on Wall Street trading houses during the repo loan crisis that began on September 17, 2019 – months before there was any COVID cases reported anywhere in the world. (See Fed Repos Have Plowed $6.6 Trillion to Wall Street in Four Months; That’s 34% of Its Feeding Tube During Epic Financial Crash.)

The Fed is not just administering interest rates. It is also administering the stock market. On March 12 of last year, the Dow was down 1900 points intraday and looking like it was about to plunge further. The Fed directed the New York Fed to make the announcement that it would be offering an unprecedented $1.7 trillion in repo loans to its primary dealers (trading houses on Wall Street) over that day and the next. The Dow immediately shaved 500 points from its losses.

As we reported on that date:

“To prop up the stock market further, the Fed announcement indicated that the $500 billion in 3-month loans and $500 billion in one-month loans will be offered weekly ‘for the remainder of the monthly schedule.’ That means $1 trillion a week will be available at below-market interest rates. That will be on top of the $175 billion the Fed is offering daily in one-day loans and the $45 billion it is offering each Tuesday and Thursday in 14-day loans. This is a dramatic expansion of the Fed’s balance sheet to support Wall Street — all without one vote, or debate, or hearing occurring in Congress.”

Related Articles:

In the Midst of a Liquidity Crisis, the Fed Rolls Back Liquidity Requirements at Banks

Fed’s Latest Plan for Bailing Out Wall Street Banks: Let Them Overdraft their Accounts at the Fed