By Pam Martens and Russ Martens: June 16, 2021 ~

Corporate media outlets like Bloomberg News, the CBS news program 60 Minutes, and CNBC have been seduced into obsequious behavior when it comes to Jamie Dimon, the Chairman and CEO of JPMorgan Chase, despite the fact that Dimon has presided over the most unparalleled crime spree in the history of U.S. banking. Between 2014 and September of last year, JPMorgan Chase has been charged with five criminal felony counts by the U.S. Department of Justice. The bank admitted to all five counts. (See the bank’s detailed rap sheet here.)

Despite this crime spree and endless probation periods followed by more crime, Dimon has further seduced federal bank regulators into allowing his unrepentant behemoth to become the most systemically risky bank in America. That assessment is not our opinion. It is the assessment of the federal government based on hard data.

The National Information Center is a repository of bank data collected by the Federal Reserve. It is part of the Federal Financial Institutions Examination Council (FFIEC), which was created by federal legislation to create uniformity in the examination of U.S. financial institutions by the various banking regulators.

Each year the National Information Center creates a graphic profile of banks measured by 12 systemic risk indicators. The data used to create these graphics come from the “Systemic Risk Report” or form FR Y-15 that banks are required to file with the Federal Reserve. To measure the systemic risk that a particular bank poses to the stability of the U.S. financial system, the data is broken down into five categories of system risk: size, interconnectedness, substitutability, complexity, and cross-jurisdictional activity. Those measurements consist of 12 pieces of financial information that banks have to provide on their Y-15 forms.

The most recent data for the period ending December 31, 2019 indicates that in 8 out of 12 measurements – or two-thirds of all systemic risk measurements – JPMorgan Chase ranks at the top for having the riskiest footprint among its peer banks.

To put it another way, the largest bank in the United States with an apparent insatiable appetite to commit felonies is also the riskiest bank based on other key metrics.

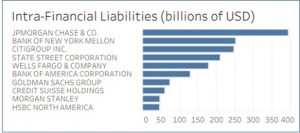

One of the 12 financial metrics is based on the Intra-Financial System Liabilities of each bank. This shows how much money a particular bank has at risk at other banks by using inputs such as how much of its funds it has on deposit with, or has lent to, other financial institutions; the unused portion of any credit lines it has committed to other financial institutions; and its holdings of debt, equity, commercial paper, etc. of other financial institutions. The idea, obviously, is to understand the interconnectivity of systemically-risky banks and whether one could cause a daisy-chain of contagion with other banks. (Think Lehman Brothers and Citigroup in 2008.)

JPMorgan Chase looks particularly dicey in terms of its Intra-Financial System Liabilities. The 2019 data indicate that JPMorgan Chase has $394.86 billion exposure in that category, which is $143 billion more than the next riskiest bank in that category, the Bank of New York Mellon.

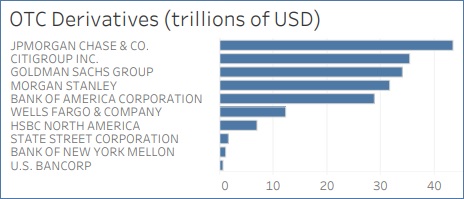

Equally unnerving, JPMorgan Chase ranks number one in the instruments that assisted mightily in blowing up Wall Street in 2008 – OTC (Over-the-Counter) derivatives. These are private contracts between two parties and lack the transparency or protections of being traded on an exchange. This means if the counterparty defaults and the exposure is large enough, it could put a federally-insured bank at risk. This is not a hypothetical outcome. The giant insurer, AIG, blew itself up in 2008 because it was holding tens of billions of dollars in OTC derivative contracts for the biggest banks on Wall Street that it could not pay its obligations on. The U.S. government was forced to nationalize AIG and paid more than $90 billion to the banks for their AIG derivative contracts and securities lending obligations that AIG could not make good on.

Among the biggest banks on Wall Street, JPMorgan Chase has the largest exposure to OTC derivatives, with $43.5 trillion exposure, according to the National Information Center data.

As you might recall, the Dodd-Frank financial reform legislation of 2010 was supposed to end the hubris of OTC derivatives and force these vehicles into the sunlight of exchanges and central clearinghouses. But that hasn’t happened. Corporate business media is simply declining to report on it. According to the Office of the Comptroller of the Currency, the federal regulator of national banks, as of December 31, 2020, only “35 percent of banks’ derivative holdings were centrally cleared.” That’s more than a decade after the “reform” legislation was signed into law.

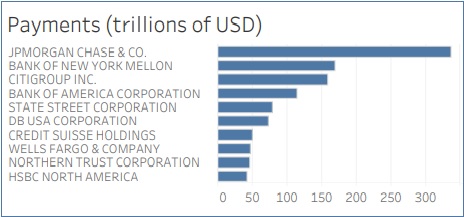

What you don’t want a high-risk institution to be is a pivotal cog in the U.S. payments system. But according to the Center’s data, that’s exactly how JPMorgan Chase has maneuvered itself. The bank was responsible for $337.49 trillion of the U.S. payments system in 2019. That’s more than the next two largest banks in that category combined: Bank of New York Mellon at $169 trillion; and Citigroup at $158 trillion.

Outside of Wall Street On Parade, there are only two trial lawyers who seem to comprehensively understand what is really going on at JPMorgan Chase. In 2016 Helen Davis Chaitman and Lance Gotthoffer, wrote a book, JPMadoff: The Unholy Alliance Between America’s Biggest Bank and America’s Biggest Crook, comparing the bank to the Gambino crime family. The lawyers wrote:

“In Chapter 4, we compared JPMC to the Gambino crime family to demonstrate the many areas in which these two organizations had the same goals and strategies. In fact, the most significant difference between JPMC and the Gambino Crime Family is the way the government treats them. While Congress made it a national priority to eradicate organized crime, there is an appalling lack of appetite in Washington to decriminalize Wall Street. Congress and the executive branch of the government seem determined to protect Wall Street criminals, which simply assures their proliferation.”

Chaitman and Gotthoffer write further in their book:

“If Jamie Dimon is running a criminal institution, he should be prosecuted for it. And law enforcement has the perfect tool for such a prosecution: the Racketeer Influenced and Corrupt Organizations ACT (RICO).

“Congress enacted RICO in 1970 in order to give law enforcement the statutory tools it needed to prosecute the people who committed crimes upon orders from mob leaders and the mob leaders themselves. RICO targets organizations called ‘racketeering enterprises’ that engage in a ‘pattern’ of criminal activity, as well as the individuals who derive profits from such enterprises. For example, under RICO, a mob leader who passed down an order for an underling to commit a serious crime could be held liable for being part of a racketeering enterprise. He would be subject to imprisonment for up to twenty years per racketeering count and to disgorgement of the profits he realized from the enterprise and any interest he acquired in any business gained through a pattern of ‘racketeering activity.’ ”

On September 16, 2019 two current and one former trader at JPMorgan Chase were charged under the RICO statute for turning the precious metals desk of JPMorgan Chase into a racketeering enterprise. Dimon got a pay bump for his “performance” that year to $31.5 million.