By Pam Martens and Russ Martens: August 20, 2020 ~

We have a marketing suggestion for the U.S. Postal Service Board of Governors if it is nutty enough to accept JPMorgan Chase’s overture to place its ATM machines on the premises of U.S. post offices. The marketing idea goes like this: place a big red, white and blue sign over each JPMorgan Chase ATM machine that reads: “From the wonderful folks who were Bernie Madoff’s bankers.”

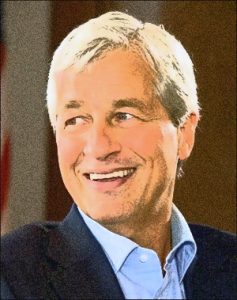

Business media was abuzz yesterday with the news that JPMorgan Chase has had conversations with the U.S. Postal Service regarding placing the bank’s ATM machines in post office branches. CNBC quoted Trish Wexler, a spokeswoman for JPMorgan Chase, confirming the talks and making the following statement:

“We had very preliminary conversations with the U.S. Postal Service several months ago about what it might look like to lease a small number of spaces to place ATMs to better serve some historically underserved communities.”

As we reported yesterday, the right wing Cato Institute, heavily funded by the foundations related to the fossil fuels billionaires Charles Koch and the late David Koch, has been pushing to privatize the U.S. Postal Service for decades. We note in the article that the effort has been stepped up by Cato’s Chris Edwards in the past two years. CNBC writes in its report that if the U.S. Postal Service were to be privatized, JPMorgan Chase “could be in line for exclusive rights to solicit postal customers, according to Washington D.C.-based newsletter Capitol Forum.”

Co-branding with JPMorgan Chase would be the dumbest move in the 245-year history of the U.S. Postal Service. According to Pew Research, the Postal Service “consistently tops the favorability list in Pew Research Center’s periodic surveys of public views of government agencies.” This year’s Pew Research poll shows 91 percent of both Republicans and Democrats “had a favorable view of the agency.”

That 91 percent favorability rating would be teaming up with a bank that has such a predatory reputation that two trial lawyers, Helen Davis Chaitman and Lance Gotthoffer, wrote a book in 2016, JPMadoff: The Unholy Alliance Between America’s Biggest Bank and America’s Biggest Crook, comparing the bank to the Gambino crime family. The lawyers wrote:

“In Chapter 4, we compared JPMC to the Gambino crime family to demonstrate the many areas in which these two organizations had the same goals and strategies. In fact, the most significant difference between JPMC and the Gambino Crime Family is the way the government treats them. While Congress made it a national priority to eradicate organized crime, there is an appalling lack of appetite in Washington to decriminalize Wall Street. Congress and the executive branch of the government seem determined to protect Wall Street criminals, which simply assures their proliferation.”

JPMorgan Chase has been under at least four criminal investigations by the U.S. Justice Department in the past seven years. One of the probes in 2013 investigated how the bank had used hundreds of billions of dollars of bank depositors’ money to gamble in exotic derivatives in London, losing $6.2 billion. That case was known as the London Whale and ended in the bank paying $900 million in fines but no criminal charges brought.

In 2014, JPMorgan Chase was charged with two criminal felony counts for how it mishandled the business account of Ponzi mastermind, Bernie Madoff. It looked the other way at glaring red flags of money laundering in the Madoff account for decades. At one point the bank told authorities in the U.K. that it thought Madoff might be running a Ponzi scheme. It filed no such concerns with U.S. regulators. The bank pleaded guilty to both felony counts.

In 2015, the Justice Department brought another criminal felony count against the bank, this time for engaging with other banks in rigging foreign exchange markets. The bank again pleaded guilty. In both the 2014 and 2015 cases, JPMorgan Chase was given a deferred prosecution agreement by the Justice Department.

On September 16 of last year, the Justice Department indicted two current and one former precious metal traders at JPMorgan Chase on criminal RICO charges. The traders were charged with running a racketeering enterprise out of the precious metals trading desk at JPMorgan Chase. The bank has indicated in an SEC filing that the bank itself remains under this criminal probe.

In a saner age in America, the U.S. government would suspend doing business with a corporation that was a recidivist criminal law breaker. But today, when it comes to Wall Street mega banks, that’s just quaint thinking.

The talks with the Postal Service by JPMorgan Chase come at a time when there are growing calls to allow the U.S. Postal Service to reenter the banking business in order to help low income populations that are currently unbanked. Last year, the nonprofit watchdog, Public Citizen, published a paper by Craig Sandler calling for that very thing. Sandler writes as follows:

“Nearly 28 percent of U.S. households (or 100 million people) do not have access to affordable financial services. As many as 8 million American households don’t have access to basic banking, like a checking account, and 1 in 5 Americans don’t have access to affordable accounts, debit cards, and credit.

“And when members of these communities cannot access traditional financial services, they have no recourse but to turn to alternatives. Millions of Americans—mostly the working poor, and disproportionately African-American or Latinx—rely on costly, predatory financial institutions including payday lenders and check-cashers who charge exorbitant interest rates and fees that trap unbanked and underbanked households in a debt cycle.

“No one policy can correct the injustice of so many Americans being unable to access retail banking and forced to utilize more financially dangerous services, but one way to broaden access to responsible financial services is to allow the U.S. Postal Service (USPS) to provide some basic banking services. ‘Postal banking’ could help ensure that all Americans have a safe, trusted source of low-cost, high-quality consumer-driven financial services in their communities. Affordable financial services provided by the USPS could help struggling families nationwide achieve financial stability – and strengthen the USPS mission to serve the public.”

According to the official history provided by the U.S. Postal Service on its website, this is how it got into banking services on January 1, 1911 and continued those services for more than half a century.

“An Act of Congress of June 25, 1910, established the Postal Savings System in designated Post Offices, effective January 1, 1911. The legislation aimed to get money out of hiding, attract the savings of immigrants accustomed to saving at Post Offices in their native countries, provide safe depositories for people who had lost confidence in banks, and furnish more convenient depositories for working people. The system paid two percent interest per year. Initially, the minimum deposit was $1, and the balance in an account could not exceed $500, excluding interest. Deposits were slow at first, but by 1929, $153 million was on deposit. Savings spurted to $1.2 billion during the 1930s and jumped again during World War II, peaking in 1947 at almost $3.4 billion. After the war, banks raised their interest rates and began offering the same governmental guarantee as the Postal Savings System. In addition, United States savings bonds gave higher interest rates. Deposits in the Postal Savings System declined, dropping to $416 million by 1964. On April 27, 1966, the Post Office Department stopped accepting deposits to existing accounts, refused to open new accounts, and cut off interest payments as the annual anniversary date of existing accounts came up.”

The system ended officially on July 1, 1967.

JPMorgan Chase’s overtures to the U.S. Postal Service come at a time when 20 state attorneys general are suing the Trump administration and the Postmaster General, Louis DeJoy, for taking multiple actions that they say were illegally conducted. DeJoy is a major Trump donor who just became Postmaster General in May of this year.

Internal documents have surfaced in the past week indicating that hundreds of high-speed sorting machines, which cost millions of dollars, were earmarked for removal, with reports that some have already been destroyed. Mail boxes were also being removed from streets and post offices and/or processing centers were being closed.

The state attorneys general say that this was illegal action because no permission was sought in advance from the Postal Regulatory Commission, as required by law, and there was no public comment period.

Democrats have advanced the theory, based on Trump’s own words in a phone interview with Maria Bartiromo on Fox Business on August 13, that Trump is out to sabotage mail-in voting for the November 3 presidential election. Trump said this to Bartiromo in that August 13 interview, referring to the stymied stimulus bill that has money allocated in it by Democrats for the Post Office: “If we don’t make a deal, that means they don’t get the money. That means they can’t have universal mail-in voting; they just can’t have it.”

The public will get to hear more about the matter tomorrow when the U.S. Senate’s Homeland Security and Governmental Affairs Committee holds a hearing, with DeJoy scheduled to testify and answer questions. Next Monday, the House Oversight and Reform Committee has also scheduled a hearing on the matter. The Committee will question DeJoy and Robert M. Duncan, the Chairman of the Board of Governors of the Postal Service.