By Pam Martens and Russ Martens: April 27, 2020 ~

Earlier this month President Trump advanced the view that during a national emergency the President has “total power.” The real power, however, is being exercised by the Federal Reserve Bank of New York (New York Fed) with not so much as one vote by any elected representatives of the citizens of the U.S.

The speed at which the New York Fed, owned by multinational banks, can create trillions of U.S. dollars by pushing an electronic button and bring financial relief to the 1 percent on Wall Street stands in sharp contrast to the millions of mom and pop small businesses across America who are still waiting to see a dime in relief from an elected Congress, forcing a growing number of small businesses to close permanently and thus further consolidating money and power in the United States.

On September 17, 2019, months before any case of coronavirus COVID-19 had been discovered anywhere in the world, the New York Fed began pumping out hundreds of billions of dollars a week in super cheap loans to the trading houses of Wall Street, a group of 24 firms it calls its “primary dealers.” This action in the repo loan market was the first by the New York Fed since the financial crisis of 2008. By January 27, 2020, before one death had been announced in the United States from the virus, the New York Fed had pumped $6.6 trillion cumulatively in revolving loans to the trading houses of Wall Street. By March 14, the loan tally was more than $9 trillion and climbing.

In addition to those repo loans, the New York Fed is running an alphabet soup of emergency relief programs for the mega banks and trading houses on Wall Street in addition to the billions the Fed is loaning through its Discount Window at 1/4 of one percent interest. U.S. Treasury Secretary Steve Mnuchin has made a grand gesture to the 1 percent on Wall Street by authorizing $454 billion of taxpayer money to be used to absorb losses on these emergency facilities for Wall Street.

In the past 90 years there have been three financial crises on Wall Street that required emergency operations by the Federal Reserve. Two of those three crises occurred in the past 12 years. That should send a very clear signal to every American and to Congress that Wall Street is bleeding the system dry.

According to a history provided by David Fettig, a Senior Advisor to the Federal Reserve Bank of Minneapolis, emergency lending by the Fed following the financial crash of 1929 “was used sparingly, and just 123 loans were made” from 1932 to 1936. The loans totaled $1.5 million or approximately $27.3 million in today’s dollars.

The 1936 loans were the last time the Fed invoked its emergency lending powers until 2007. During the 2007-2010 financial crisis, the Fed made more than 21,000 loans aggregating more than $19 trillion. (If you add in the dollar swap lines to foreign central banks the tally comes to $29 trillion.) The vast majority of the emergency funds during the 2007-2010 crisis came out of the New York Fed, just as they are again today.

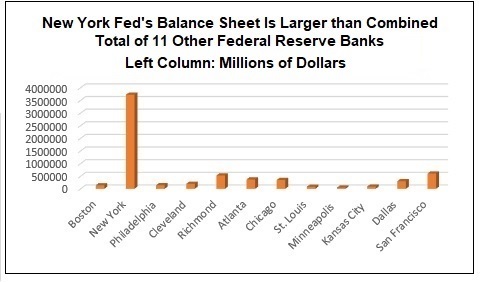

The New York Fed is unique among the 12 regional Federal Reserve banks. The President of the New York Fed makes a larger salary than the President of the United States — $486,600 (as of December 2018) versus $400,000 for the President of the United States. All 12 of the Federal Reserve banks’ balance sheets total $6.6 trillion. The New York Fed’s balance sheet of $3.7 trillion is bigger than the combined total of the other 11 Federal Reserve banks. That includes the Boston Fed, Philadelphia Fed, Cleveland Fed, Richmond Fed, Atlanta Fed, Chicago Fed, St. Louis Fed, Minneapolis Fed, Kansas City Fed, Dallas Fed, and San Francisco Fed.

The Dallas Fed, which represents a region of the country undergoing a catastrophic collapse in oil prices, has a balance sheet of just $300 billion to deal with the crisis versus the Wall Street-cozy New York Fed’s balance sheet of $3.7 trillion. The San Francisco Fed, which represents a region that is the fifth largest economy in the world, has an emergency balance sheet of just $606 billion according to the latest H.4.1 release from the Federal Reserve.

The New York Fed is unique from the other Fed Banks in other notable ways. It is the only one of the 12 regional Federal Reserve Banks to have a Wall Street-style trading floor with Bloomberg terminals and speed dials to the biggest firms on Wall Street. Since 1935, all open market operations of the entire Federal Reserve system have been carried out by the New York Fed.

The New York Fed’s website explains that it is “responsible for intervening in foreign exchange markets to achieve dollar exchange rate policy objectives.” The New York Fed stores “monetary gold for foreign central banks, government and international agencies.” Despite being the regulator in charge of the largest Wall Street bank holding companies at the time that their obscene levels of leverage and corruption collapsed the economy of the United States in 2008, the New York Fed continues to be in charge of placing bank examiners in these firms and functioning as their regulator as well as their financial bailout agent.

If Congress ever decides to get serious about reforming the U.S. financial system before the country has been bankrupted, there is no better place to start than the New York Fed.