By Pam Martens and Russ Martens: March 18, 2020 ~

Actress Louise Linton and Husband, U.S. Treasury Secretary Steve Mnuchin Show Off Newly-Minted Currency with His Signature

The Federal Reserve Board of Governors announced at 6 P.M. last evening that it is following the direction of Steve Mnuchin, the former foreclosure king who now serves as U.S. Treasury Secretary, and authorizing the reinstatement of a hideously operated, multi-trillion dollar bailout program for Wall Street’s trading houses known as the Primary Dealer Credit Facility (PDCF). Veterans on Wall Street think of it as the cash-for-trash facility, where Wall Street’s toxic waste from a decade of irresponsible trading and lending, will be purged from the balance sheets of the Wall Street firms and handed over to the balance sheet of the Federal Reserve – just as it was during the last financial crisis on Wall Street.

The Fed fought for years in court to keep the details of the PDCF and its sibling Wall Street bailout programs a secret from the American people. Thanks to an amendment attached to the Dodd-Frank financial reform legislation of 2010 by Senator Bernie Sanders, the Government Accountability Office (GAO) was instructed to conduct an audit of the PDCF and the rest of the alphabet soup of programs the Fed set up to secretly funnel $29 trillion to the denizens of Wall Street, the foreign banks that were counterparties to their failing derivative trades, central banks, and even a hedge fund that was shorting the Wall Street banks’ own stocks.

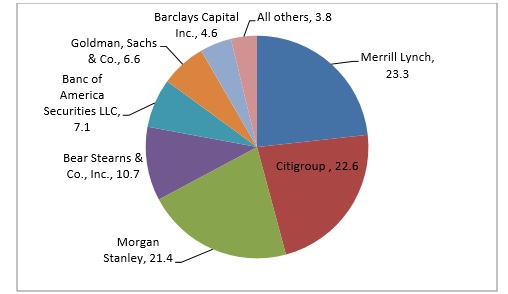

We learned from the GAO audit that the Primary Dealer Credit Facility was the largest Wall Street bailout program during the financial crisis. It issued 1,376 loans that cumulatively totaled $8.95 trillion. Just as is happening this time around, the Fed spun the story that the program would help American workers and businesses. It did no such thing. It went to bail out the trading and derivative operations of sinking ships on Wall Street as those same firms paid out millions of dollars in bonuses to their derelict executives and traders. Of the $8.95 trillion in loans issued by the PDCF, $5.7 trillion, or 64 percent, went to Citigroup, Morgan Stanley and Merrill Lynch according to the GAO audit. (The Levy Economics Institute, per chart above, found that percentage to be 67.3 percent.)

Yesterday, CNBC spun the news about the program this way: “The Federal Reserve is adding another weapon in its effort to make sure households and businesses get the funding they need as the economy deals with the coronavirus crisis.” CNBC added that Treasury Secretary Mnuchin said the program would “help facilitate the availability of credit to American workers and businesses.”

Only in some alternative universe from hell that exists in the likes of the brains of Lloyd Blankfein (the former CEO of Goldman Sachs who famously said he thought he was doing “God’s work”) could funneling $5.7 trillion to Citigroup, Morgan Stanley and Merrill Lynch be construed as helping American workers and businesses. During the financial crisis Citigroup was foreclosing on families using an alias and illegally holding homes off the market; Merrill Lynch, a retail brokerage firm and investment bank, was such a basket case that it had to be taken over by Bank of America; and Morgan Stanley was leveraged 40 to 1 “meaning for every $40 in assets, there was only $1 in capital to cover losses. Less than a 3% drop in asset values could wipe out a firm,” according to the Financial Crisis Inquiry Commission report that investigated the crash for Congress.

Even worse, as Morgan Stanley was collecting $2.04 trillion in bailout funds from the various Fed programs, Morgan Stanley’s own hedge fund, FrontPoint Partners, was shorting (making bets against) subprime residential mortgages as well as making short bets on the biggest banks on Wall Street. (See our in-depth report: Steve Eisman and FrontPoint Were Shorting Wall Street Banks While the Dumb Fed Was Giving FrontPoint Emergency Loans – and that’s not the Worst Part of this Story.)

The derelict manager of this hubris during the 2007-2010 financial crisis was the New York Fed. Yesterday, the Federal Reserve Board of Governors announced that the New York Fed will be put in charge again this time around.

While the Wall Street banks continue to charge American families 17 percent on their credit cards, the New York Fed will be making loans to them from the PDCF at the preposterous interest rate of 0.25 percent – the new interest rate at the Discount Window which was conveniently dropped by an unprecedented full point and a half just this past Sunday evening by the Federal Reserve.

And just as the PDCF did the last time around, the Fed said it will accept stocks as collateral for these loans – an unthinkable asset class for any prudent lender at a time when the stock market is plunging by as much as 3,000 points in one day. The Fed also announced that it will accept other highly dubious collateral, including: commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLOs), and collateralized debt obligations (CDOs). The strategy here is to apparently allow these instruments to turn into junk-rated securities on the books of the New York Fed rather than on the books of the mega Wall Street banks which trade publicly, unlike the New York Fed.

The Fed said the new PDCF will make 90-day loans and be in place for at least six months, with the ability to extend the program. The old PDCF lasted for two and a half years.

To quiet the outrage and the pitchforks, Mnuchin is hoping to buy off the American public’s curiosity about the sprawling, multi-trillion-dollar money spigot to Wall Street with a proposed $1,000 check to Americans which he wants to go out within two weeks. Wall Street’s $9 trillion repo loan program has already been in operation for six months and the new, multi-trillion PDCF program will be in operation for at least another six months, while the checks-to-Americans program appears to be a one-shot deal.

How the Federal Reserve has become the toxic waste dumpster for the trading houses on Wall Street involves Rodge Cohen, one of Wall Street’s go-to lawyers at Sullivan & Cromwell. Cohen played a significant role in how the Fed’s emergency lending authority under Section 13(3) of the Federal Reserve Act would be interpreted following the 1987 stock market crash.

The Federal Reserve was created in 1913 through Congressional legislation. Throughout the Fed’s history until the 2007-2010 financial crisis, its role was seen as lender-of-last-resort to the commercial banks of the United States, not high-risk securities firms on Wall Street. According to a history provided by David Fettig, a Senior Advisor to the Federal Reserve Bank of Minneapolis, Section 13(3) “was used sparingly, and just 123 loans were made” from 1932 to 1936 during the prior great crash on Wall Street. The loans totaled $1.5 million or approximately $27.3 million in today’s dollars. The 1936 loans were the last time 13(3) was invoked until 2007.

In a preliminary draft report issued by the Financial Crisis Inquiry Commission, it exposes the role of Rodge Cohen in a Section 13(3) amendment as follows: (The reference to Cohen was removed in the final report from the FCIC.)

“In 1991, Goldman Sachs and other large securities firms sought legislation that would give them greater access to the Fed’s emergency lending facility under Section 13(3) of the Federal Reserve Act. Goldman and the other firms were concerned about ‘the absence of a safety net beneath Wall Street firms’ in light of (i) the reluctance of some commercial banks to provide credit to securities broker-dealers during the 1987 stock market crash, and (ii) the failure of Drexel in 1990. At the suggestion of H. Rodgin Cohen, a banking lawyer with Sullivan & Cromwell in New York City, the securities firms urged Congress to include an amendment to Section 13(3) in FDICIA.

“The enacted 1991 amendment to Section 13(3) authorized the Fed to make emergency loans to nonbanking firms as long as those loans are ‘secured to the satisfaction of the [Fed],’ and the amendment also gave the Fed broad discretion to accept almost any type of collateral from the borrowing firms.”