-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: JPMorgan

72 Hours Before JPMorgan Offered $290 Million to Make Epstein Claims Go Away, a Lawyer Disclosed that the Bank Had Withheld 1500 Documents

By Pam Martens and Russ Martens: June 15, 2023 ~ Sigrid McCawley is a Managing Partner at law firm, Boies Schiller Flexner, which has been representing the sexually assaulted and/or sex-trafficked victims of Jeffrey Epstein for years, including Virginia Roberts Giuffre, who settled claims against Prince Andrew last year for an undisclosed sum of money. Giuffre alleged in her lawsuit that Epstein had trafficked her and forced her to have sex with Prince Andrew when she was just 17. McCawley is also a key lawyer on the case styled as Jane Doe 1 v JPMorgan Chase in the U.S. District Court for the Southern District of New York. That lawsuit alleges that JPMorgan Chase was for years aware that Epstein was a sexual predator of underage girls, kept him as a client nonetheless, and functioned as a cash conduit for his crimes while ignoring anti-money laundering laws. The JPMorgan internal emails … Continue reading

As JPMorgan Settles Epstein Victims’ Claims for $290 Million, Bombshell Documents Are Filed in the Other Epstein Case Against the Bank

By Pam Martens and Russ Martens: June 13, 2023 ~ Yesterday, at 9:33 a.m. ET, JPMorgan Chase and the law firm Boies Schiller Flexner, issued a terse joint statement indicating that they had informed Judge Jed Rakoff’s federal court in Manhattan that claims against the bank for aiding and abetting Jeffrey Epstein’s sex-trafficking of underage girls had been settled by the two sides. The settlement will require court approval. Law partner David Boies later confirmed to the press that the dollar figure for that settlement was an astonishing $290 million, despite the fact that the lawsuit was brought by just one women, Jane Doe 1. After Jamie Dimon, the Chairman and CEO of JPMorgan Chase, had argued for months that the bank was not responsible for Epstein’s sex crimes and trafficking of young girls, why would the bank flip on a dime on June 12 and decide to effectively admit its … Continue reading

“Relationship Managers” Handled Collapsed Silvergate and Signature Banks’ Crypto Accounts; Citibank’s Dictator Accounts; and JPMorgan’s Jeffrey Epstein Accounts

By Pam Martens and Russ Martens: June 12, 2023 ~ A dangerous malignancy has been growing on the U.S. banking system for at least two dozen years: It’s the job function benignly called the “Relationship Manager.” In October 2013, Carmen Segarra, a lawyer and former Bank Examiner at the Federal Reserve Bank of New York, filed a federal lawsuit alleging that Relationship Managers there, who were assigned to delicately manage relationships between the New York Fed and the powerful Wall Street banks, had obstructed and interfered with her investigation of Goldman Sachs and tried to bully her into changing her negative findings. When Segarra refused to change her examination, she was fired, according to a federal lawsuit she filed. In 2018, Segarra provided a more detailed accounting of how these corrupted relationships play out in her book, Noncompliant: A Lone Whistleblower Exposes the Giants of Wall Street. Given the influence that … Continue reading

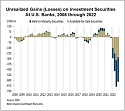

JPMorgan and Citigroup Are Using the Same Accounting Maneuver as Silicon Valley Bank on Hundreds of Billions of Underwater Debt Securities

By Pam Martens and Russ Martens: June 6, 2023 ~ As we reported yesterday, Silicon Valley Bank was not even on the “Problem Bank List” maintained by the Federal Deposit Insurance Corporation (FDIC) when it imploded in a span of 48 hours in March. According to testimony by the Federal Reserve’s Vice Chairman for Supervision, Michael Barr, on March 28 before the Senate Banking Committee, depositors had yanked $42 billion of their deposits from the bank on March 9 and had queued up to grab another $100 billion on March 10 when it was abruptly put into FDIC receivership. Had the FDIC not stepped in, Silicon Valley Bank would have lost 85 percent of its deposits in a two-day stretch. Two of the key internal problems at Silicon Valley Bank were its large amount of uninsured deposits (which pose a flight risk in times of banking turmoil) and Silicon Valley Bank’s … Continue reading

JPMorgan Chase Transferred $347 Billion in Debt Securities Over the Last 3 Years to Inflate Its Capital Using a Controversial Maneuver

By Pam Martens and Russ Martens: May 30, 2023 ~ Wall Street mega banks, as well as others, are moving vast amounts of their debt securities from one accounting category to another accounting category in order to stretch out unrealized losses over the life of the instrument. As the FDIC chart above indicates, as of December 31, 2022 unrealized losses on investment securities at U.S. banks stood at more than $600 billion. According to JPMorgan Chase’s 10-K (Annual Report) filings with the Securities and Exchange Commission, over the past three years it has moved a total of $347 billion (yes, “billion” with a “b”) of investment securities from the accounting category called “Available-for-Sale” (AFS) to the accounting category called “Held-to-Maturity” (HTM). JPMorgan Chase’s 2022 10-K advises as follows: “During 2022 and 2021, the Firm transferred $78.3 billion and $104.5 billion of investment securities, respectively, from AFS to HTM for capital management purposes.” JPMorgan … Continue reading

JPMorgan Chase and Jeffrey Epstein Were Both Involved in a Strange Offshore Company Called Liquid Funding

By Pam Martens and Russ Martens: May 24, 2023 ~ This Friday and Saturday, JPMorgan Chase’s Chairman and CEO, Jamie Dimon, is scheduled to sit for some very uncomfortable questioning in a deposition concerning what role he played in allowing his bank to serve as a vast cash conduit for Jeffrey Epstein, which enabled Epstein to perpetuate his sex trafficking of underage girls. The Attorney General’s office of the U.S. Virgin Islands (USVI) has filed a federal lawsuit against JPMorgan Chase that makes devastating charges against the largest bank in the United States. It alleges that JPMorgan Chase sat on a mountain of evidence that Jeffrey Epstein was running a child sex trafficking ring as it continued to keep him as a client; accept his lucrative referrals of wealthy clients; and provided him with large sums of cash and wire transfers to pay off victims – one of whom was a “14-year old … Continue reading

FDIC Seizure of Foreign Deposits at SVB Opens Pandora’s Box at JPMorgan Chase and Citi – Which Hold a Combined $1 Trillion in Foreign Deposits with No FDIC Insurance

By Pam Martens and Russ Martens: May 15, 2023 ~ If you have been following the banking crisis, you have likely read at least a dozen times that on March 12 federal banking regulators, with the consent of the U.S. Treasury Secretary Janet Yellen, invoked the “systemic risk exception” in order to protect both insured and uninsured depositors at the two banks that failed in March – Silicon Valley Bank and Signature Bank. That’s why there were gasps of shock on Saturday evening at around 5:30 p.m. when the Wall Street Journal (paywall) published the stunning news that depositors in the Cayman Islands’ branch of Silicon Valley Bank had their deposits seized by the Federal Deposit Insurance Corporation (FDIC), which they are unlikely to ever see again. As Wall Street On Parade has previously reported, under statute, the FDIC cannot insure deposits held on foreign soil by U.S. banks. What it … Continue reading

At Year End, 4,127 U.S. Banks Held $7.7 Trillion in Uninsured Deposits; JPMorgan Chase, BofA, Wells Fargo and Citi Accounted for 43 Percent of That

By Pam Martens and Russ Martens: May 11, 2023 ~ If the dark secrets about the U.S. banking system that federal regulators have been keeping since the financial crash of 2008 are allowed to be aired in public Congressional hearings as a result of the current banking crisis – and mainstream media will grow a backbone and cover those hearings – it could help the U.S. avoid a catastrophic financial reckoning down the road. For years, Wall Street On Parade has been reporting that just four banks in the U.S. control more than 85 percent of all the opaque derivatives in the banking system. We have also regularly reported how federal agencies have singled out these four banks for posing systemic risk to the financial stability of the United States. We’re talking about JPMorgan Chase, Bank of America, Wells Fargo and Citigroup’s Citibank. On March 30, we crunched the numbers from … Continue reading

Deposits at JPMorgan Chase, Bank of America and Wells Fargo Shrank by $465 Billion Y-O-Y; More than Twice the Total of 4,000 Small Banks

By Pam Martens and Russ Martens: May 8, 2023 ~ Since the banking crisis began making headlines at expensive media real estate, the narrative has been that deposits are fleeing the small commercial banks and flooding into the biggest banks that are perceived as too-big-to-fail and thus offer a safer venue for deposits. Because these mega banks are the same ones that the Fed has been bailing out since the financial crisis of 2008, that narrative requires believing that our fellow Americans are dumber than a stump. We decided to check out that narrative for ourselves. Not only is that scenario wrong, but it is so decidedly wrong, and it’s so easy to get the accurate figures, that from where we sit it looks like there might have been an agenda by someone to harm smaller banks. (Since it’s short sellers who have benefited to the tune of more than $7 … Continue reading

JPMorgan Chase, Officially the Riskiest Bank in the U.S., Is Allowed by Federal Regulators to Buy First Republic Bank

By Pam Martens and Russ Martens: May 1, 2023 ~ On Wall Street, the business model is you eat what you kill. Jamie Dimon and the bank he helms, JPMorgan Chase, just devoured First Republic Bank after Dimon had orchestrated the worst “rescue” of First Republic in the history of banking rescues. Given the outcome, one has to wonder if this rescue flop was a bug or a feature. (See Related Articles below.) After 7 weeks of Jamie Dimon’s “rescue,” First Republic and its preferred shares had been downgraded by credit rating agencies to junk; its common stock had lost 98 percent of its market value, closing at $3.51 on Friday and at $1.90 in pre-market trading early this morning; its long-term bonds were trading at 43 cents on the dollar; and depositors continued to flee the bank. And in order to pay out all those deposits that were taking flight, … Continue reading