-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: Jamie Dimon

Judge Orders Jury Trial for JPMorgan Whistleblower Who Claims Bank Fired Her for Reporting Suspicious Payments to Former U.K. Prime Minister Tony Blair

By Pam Martens and Russ Martens: August 3, 2022 ~ Playing out in a federal courtroom in Chicago have been JPMorgan traders telling a jury that it was standard operating procedure at the bank to rig precious metals markets in order to make huge profits for their trading desk. That case is U.S. v. Smith in the Northern District Court in Chicago. (Case number 1:19-cr-00669.) Now there may be more explosive revelations spilling out against JPMorgan Chase in the Southern District Court in Manhattan beginning this fall. That case is Shaquala Williams v JPMorgan Chase. (Case number 1:21-cv-0932.) Last week, Judge Jed Rakoff, who is overseeing the Williams case, ruled that JPMorgan’s motion for dismissal would not prevail on Williams’ claim for retaliatory dismissal and ruled that a jury trial would begin on November 7. (Judge Rakoff did dismiss the Williams’ claim that the bank’s actions had adversely affected a job offer.) … Continue reading

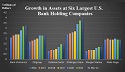

Federal Data Show JPMorgan Chase Is, By Far, the Riskiest Bank in the U.S.

By Pam Martens and Russ Martens: July 26, 2022 ~ The long-tenured Chairman and CEO of JPMorgan Chase, Jamie Dimon, likes to use the phrase “fortress balance sheet,” when talking about his bank to Congress or shareholders. But the data stored at its federal regulators show that the bank is, by far, the most systemically dangerous bank in the United States. And, despite its high risk profile, neither Congress nor federal regulators have restricted its growth. Its assets have soared by 65 percent since the end of 2016 and stood at $3.95 trillion as of March 31, making it the largest bank in the United States. Making this situation even more dangerous, the bank has admitted to five criminal felony counts over the past eight years and a multitude of civil crimes and multi-billion dollar fines — all during the tenure of Dimon. Neither Congress nor federal regulators nor the Justice Department … Continue reading

There Are Three Separate Cases in Federal Court Accusing JPMorgan Chase of a Culture of Fraud

By Pam Martens and Russ Martens: July 19, 2022 ~ JPMorgan Chase is the largest federally-insured bank in the United States. It is also one of the largest trading houses on Wall Street. That’s the Faustian bargain the Clinton administration entered into with Wall Street when it repealed the Glass-Steagall Act in 1999. According to data from the FDIC, as of June 30 of last year, JPMorgan Chase Bank N.A. had 4,925 branches in 44 U.S. states holding $2.01 trillion in deposits. Many of those deposits belong to mom and pop savers who have no idea that the bank has admitted to five criminal felony counts since 2014 and has a rap sheet that is the envy of the Gambino crime family. (Apparently, a federal judge in New York overseeing a current JPMorgan case is just as naïve about the bank’s criminal history. More on that shortly.) The bulk of Americans … Continue reading

Here Are the Orwellian Details of the U.S. Patent JPMorgan Got Approved for Its Sprawling System of Spying on Employees

By Pam Martens and Russ Martens: July 8, 2022 ~ In 2018, Bloomberg reporters Peter Waldman, Lizette Chapman, and Jordan Robertson published a stunning expose on how JPMorgan Chase was spying on its employees, including after hours, using as many as 120 engineers from the data mining company Palantir Technologies Inc. According to the Bloomberg report, “It all ended when the bank’s senior executives learned that they, too, were being watched, and what began as a promising marriage of masters of big data and global finance descended into a spying scandal.” But the surveillance program did not end. The bank simply developed its own proprietary spying system instead. Business Insider reporter, Reed Alexander, has reignited the scandal with the news that the internal surveillance program at JPMorgan Chase is now called “Workforce Activity Data Utility” or WADU. According to Business Insider, the surveillance is fostering paranoia inside the bank with … Continue reading

Report: JPMorgan Chase and Citibank Hold 90 Percent of All Gold and Other Precious Metals Derivatives Held by All U.S. Banks

By Pam Martens and Russ Martens: June 29, 2022 ~ Last Tuesday, the Office of the Comptroller of the Currency (OCC) released its quarterly report on derivatives held at the megabanks on Wall Street. As we browsed through the standard graphs that are included in the quarterly report, one graph jumped out at us. It showed a measured growth in precious metals derivatives at insured U.S. commercial banks and savings associations over the past two decades and then an explosion in growth between the last quarter of 2021 and the end of the first quarter of this year. In just one quarter, precious metals derivatives had soared from $79.28 billion to $491.87 billion. That’s a 520 percent increase in a span of three months. (See Figure 18 at this link. The last ten years of the graph is shown above.) Having studied these quarterly reports since the 2008 financial crash, we … Continue reading

As This Crypto Stock’s Price Collapsed, Goldman, JPMorgan and Citigroup Issued Buy Ratings

By Pam Martens and Russ Martens: June 27, 2022 ~ When the cryptocurrency exchange, Coinbase, first offered its stock to the public on April 14, 2021, its S-1 Registration Statement that was filed with the SEC indicated that Goldman Sachs, JPMorgan and Citigroup were its financial advisors, along with Allen & Company. Most Americans would assume that if one is the financial advisor to a company going public for the first time, the financial advisor would know a considerable amount about that company’s business and future prospects. But as we reported last Wednesday, horror stories in the thousands about how Coinbase runs its exchange have been piling up in the publicly accessible database of the federal regulator, the Consumer Financial Protection Bureau. Three business days after we published that information, Goldman Sachs finally put out a sell rating on the stock of Coinbase. The news came from Goldman Sachs before the … Continue reading

Senator Sherrod Brown Goes After 0-Count Felon Wells Fargo; Ignores 5-Count Felon JPMorgan Chase

By Pam Martens and Russ Martens: June 1, 2022 ~ Wall Street On Parade was previously a big fan of Senator Sherrod Brown, the Chair of the Senate Banking Committee. Not so much anymore. Brown supported the nutty nomination of Saule Omarova to head the Office of the Comptroller of the Currency (OCC), the regulator of national banks, while attempting to spin the naysayers as part of a smear campaign. So far this year, the Senate Banking Committee has held hearings on tangential areas while ignoring the biggest threats to financial stability in the U.S.: the $200.18 trillion in notional derivatives (face amount) concentrated at just five Wall Street megabanks (JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America). There have been no subpoenas flying from the Senate Banking Committee as the Fed continues to cover up the largest trading scandal in its history and refusing to release to … Continue reading

JPMorgan Whistleblower Names Former U.K. Prime Minister Tony Blair in Court Documents as Receiving “Emergency” Payments from Bank

By Pam Martens and Russ Martens: May 25, 2022 ~ An attorney turned whistleblower who worked in compliance at JPMorgan Chase, Shaquala Williams, has named former U.K. Prime Minister Tony Blair as one of the parties receiving improperly processed “emergency payments” from the bank. Williams is suing the bank for retaliating against her protected whistleblowing activities by terminating her employment after she raised concerns about these payments to Blair and other serious compliance issues. (The case is Shaquala Williams v JPMorgan Chase, Case Number 1:21-cv-09326, which was filed last November in the Federal District Court for the Southern District of New York.) The new revelation naming Tony Blair was contained in a transcript of Williams’ deposition that was filed with the court last week. Prior to that, Blair had been referred to simply as “a high risk JPMorgan third-party intermediary for Jamie Dimon…” in the Williams’ complaint. The fact that Williams … Continue reading

Warren Buffett Is Taking a Flyer on $3 Billion of Citigroup’s Stock — After It Loses 40 Percent in a Year

By Pam Martens and Russ Martens: May 17, 2022 ~ Tongues are wagging this morning about the 13F filing by Warren Buffett’s Berkshire Hathaway. The filing shows that in the first quarter of this year, Berkshire Hathaway bought 55,155,797 shares of Citigroup stock for its portfolio, which came to the tidy sum of $2.9 billion as of March 31, 2022. The tongue-wagging stems from the fact that over the past 52 weeks, Citigroup’s stock has lost 40 percent of its value, with no sign that the bleeding will stop anytime soon. Citigroup closed at $53.40 a share on March 31. It closed yesterday at $47.46. That means that Buffett’s wager on Citigroup is down 11 percent or a loss of $327.6 million so far. Knowing Citigroup’s history, things are highly likely to go from bad to worse from here. As Wall Street On Parade reported just last Friday, Citigroup’s Stock Price … Continue reading

While JPMorgan Chase Was Getting Trillions of Dollars in Loans at Almost Zero Percent Interest from the Fed, It Was Charging Americans Hit by the Pandemic 17 Percent on their Credit Cards

By Pam Martens and Russ Martens: April 21, 2022

Under just three of the emergency bailout programs offered by the Fed to Wall Street, units of the megabank JPMorgan Chase tapped over $6 trillion in cumulative (term-adjusted) loans from September 17, 2019 through the first quarter of 2020. That figure will definitely go higher as the Fed is releasing the names of the banks and the amounts they borrowed on a quarterly basis for its repo loan program.

Thus far, the numbers stack up as follows: a trading unit of JPMorgan Chase borrowed $6.19 trillion from the Fed’s repo loan program from September 17, 2019 through March 31, 2020. (Those are cumulative, term-adjusted figures.) A significant chunk of that money was borrowed at interest rates as low as 0.10 percent. The loans were collateralized with mostly treasury securities and agency mortgage-backed securities (MBS).

A trading unit of JPMorgan Chase also borrowed $400 billion in cumulative, term-adjusted loans from the Fed’s Primary Dealer Credit Facility (PDCF) during 2020. All of those loans were made at a fixed rate of 0.25 percent even though the Fed accepted lower-grade collateral, such as asset-backed securities, for some of the loans.

JPMorgan Chase’s money market funds also needed to borrow a cumulative $24.8 billion from the Fed’s Money Market Mutual Fund Liquidity Facility (MMLF) to bail themselves out during March and April of 2020. Some of those loans didn’t mature until 2021. JPMorgan borrowed from the Fed’s MMLF at rates between 0.50 and 1.25 percent.

While JPMorgan Chase, which has admitted to five criminal felony counts since 2014, was getting these sweetheart deals from the Fed, it was charging Americans who were struggling from the impact of the COVID-19 pandemic as much as 17 percent on their credit cards. You can read one of its credit card customer’s complaints about that 17 percent interest at this link at the Consumer Financial Protection Bureau’s (CFPB) complaint database.

Another JPMorgan Chase customer wrote to the CFPB that their employer filed for bankruptcy during the pandemic, leaving them unemployed. The customer said that when they asked JPMorgan for assistance in reducing the monthly amount they had to pay on their credit card, they were offered the following options: convert to a 60-month repayment plan with interest rates starting at 12 percent; no payment for 90 days but interest would continue to accrue at 14.24 percent; negotiate a payoff of the total principal balance of $14,000 with a 10 percent discount. (Where exactly would an unemployed person get $12,600 when they can’t meet their monthly credit card payment.) You can read the text of that complaint here.

We asked the CFPB database to show us just complaints against JPMorgan Chase since it started receiving those cozy low-interest repo loans from the Fed on September 17, 2019 – months before any COVID-19 cases had been reported anywhere in the world. The database turned up 28,974 complaints. You can browse through them here.

If you want to gauge the compassion that JPMorgan Chase has for its own low-wage tellers, you can read our report here. Despite the five felony counts and a rap sheet that would make the Gambino crime family blush under the leadership of Chairman and CEO Jamie Dimon, JPMorgan Chase’s Board has turned Dimon into a billionaire – on the backs of its low-wage tellers and customers paying double-digit interest rates on credit cards during a pandemic and declared national emergency.