-

Recent Posts

- Trump’s “Big Beautiful Bill” Is a Grotesque Giveaway to Fossil Fuel Billionaires While Adding $3.3 Trillion to Nation’s Debt

- Senator Chris Murphy Charges that Trump “Has Opened a Channel for Bribery”

- Congressman Casten: Trump’s Assault on the Rule of Law Is Causing Capital Flight Out of U.S. by Foreign Investors

- Trump’s Approval Rating Drops to 80-Year Low; IMF Says U.S. Tariffs Now Exceed the Highs During the Great Depression

- Nasdaq Has Lost More than 3,000 Points Since Trump’s First Full Day in Office in 2025; the Pain Has Barely Begun

- The Bond Crisis Last Week Was a Global No-Confidence Vote in U. S. President Donald Trump

- Trump’s Tariff Plan Guts $5 Trillion in Stock Value in Two Days; Senator Warren Calls for Emergency Action Before Markets Open on Monday

- Trump’s Attacks on Big Law, Universities, and the Media Have a Common Goal: Silence Dissent Against Authoritarian Rule

- Trump Administration Gives All Clear to Laundering Money through Shell Companies and Bribing Foreign Officials

- Four Megabanks on Wall Street Hold $3.2 Trillion in Uninsured Deposits – Which May Explain Senator Schumer’s Pivot to the GOP to Stop a Government Shutdown

- Here’s What Came Crashing Down Yesterday for Trump’s “Genius” Guy, Elon Musk: Tesla Stock, Access to Twitter (X), His Years of Secret Calls with Putin

- After Banning the Associated Press, Trump Is Now Targeting Specific Journalists That He Wants to See Fired

- Closely Watched Atlanta Fed Model Predicts Negative U.S. Growth in First Quarter

- Trump’s Gangster Diplomacy Makes Front Page Headlines Around the Globe

- Who Benefits Alongside Elon Musk If He Succeeds in Killing the CFPB: the Megabanks on Wall Street that Underwrite His Tesla Stock Offerings

- In Trump 1.0, the State Department Used Taxpayer Money to Publish a Book Elevating Elon Musk to a Superhero; It Was Funded by USAID, the Agency Musk Wants to Quickly Shut Down

- News Host Joy Reid Raises Threat of Trump Selling U.S. to Putin; Ten Days Later Her Show Is Cancelled

- Elon Musk’s DOGE Appears to Be Violating a Court Order; It Has Taken Down Hundreds of YouTube Videos that Educate Americans on How to Avoid Being Swindled

- Barron’s Releases Audio of Jamie Dimon Cursing Out His Workers at a Town Hall, as Dimon Plans to Dump Another One Million JPM Shares

- There’s One Federal Investigative Agency that Neither Trump nor Elon Musk Can Touch: It Just Opened an Investigation into DOGE

- Elon Musk’s Companies Were Under Investigation by Five Inspectors General When the Trump Administration Fired Them and Made Musk the Investigator

- Donald Trump Gives the Greenlight to Goldman Sachs and JPMorgan Chase to Return to Bribing Foreign Officials

- After Tech Geeks Built a Back Door to Loot Billions from FTX, Republicans Refuse to Investigate What Elon Musk’s Tech-Squad Did Inside the U.S. Treasury’s Payment System

- Former Prosecutor, Now U.S. Senator, Informs Tesla That CEO Musk May Be Violating Federal Law and to “Preserve All Records”

- Trump’s Hedge Fund Guy Is Now Overseeing the U.S. Treasury, IRS, OCC, U.S. Mint, FinCEN, F-SOC, and the Consumer Financial Protection Bureau

- As Elon Musk Begins Shutting Down Payments to Federal Contractors, a Strange Money Trail Emerges to His Operatives Inside the U.S. Treasury’s Payment System

- JPMorgan Chase Charged by Yet Another Internal Whistleblower with Cooking the Books

- We Asked Google’s AI Search Model, Gemini, Questions About the Fed and Wall Street Megabanks: It Got the Answers Dead Wrong

- With Trump and Melania’s Crypto Coins Likely to Raise Legal Challenges, Why Didn’t Trump Fire the SEC’s Inspector General in His Purge of IGs?

- Fossil Fuel Industry Could End Up Paying Tens of Billions for LA Wildfires and Deceiving the Public on Climate Change for Decades

- It’s Being Called the Biggest Grift by a President in U.S. History: Trump and First Lady Launch their Own Crypto Coins

- Trump Plans to Install a Fracking CEO to Head the Energy Department and Declare a National Emergency on Energy to Gain Vast Powers

- Fossil Fuel Money Played a Role in the Los Angeles Fires and the Push to Install Pete Hegseth as Secretary of Defense

- When It Comes to Wealth Retention in Retirement, Concrete May Be the New Gold

- Wall Street Watchdog Warns “Clock Is Ticking on a Coming Catastrophic Financial Crash”

- Wall Street Is Sending the Same Message to Americans on Fossil Fuel Financing that It Sent on Cigarettes: Drop Dead

- In a Six-Week Span, this Dark Pool with a Curious Past Traded 3.7 Billion Shares

- Wall Street’s Lobby Firm Hired Eugene Scalia of Gibson Dunn to Sue the Fed for Jamie Dimon

- Postmaster General Louis DeJoy Made $561,051 in Compensation in 2024, as Mail Costs Spiked and Delivery Deteriorated

- Fed Chair Jay Powell Sends a Bold Message to Trump and Tanks the Dow by 1123 Points

- The Head of Fixed Income at T. Rowe Price Makes the Scary Case for the 10-Year Treasury to Spike to 6 Percent

- $663 Billion in Cash Assets Have Gone Poof at the Largest U.S. Banks

- Donald Trump to Ring Bell at New York Stock Exchange Today as Hit List Posters Appear in Manhattan Targeting Wall Street CEOs

- Trump Has a Slush Fund to Prop Up the Dollar – Will He Use It to Prop Up Bitcoin Instead?

- A CEO Assassination; a Billionaire Heiress/NYPD Commissioner; a Secret Wall Street Spy Center – Here’s How They’re Connected

- Despite More than 1600 Tech Scientists Signing a Letter Calling Crypto a Sham, Trump Names a Crypto Cheerleader for SEC Chair

- The Fed Rings a Warning Bell: Hedge Funds and Life Insurers Are Reporting Historic Leverage

- Trump’s Nominee for FBI Director, Kash Patel, Has Businesses Financially Intertwined with Trump

- Donald Trump Is at Risk of Getting Named in a Fossil Fuels Conspiracy Lawsuit

- Trump Is Having Difficulty Getting a Lawyer to Accept the Nomination for SEC Chair: Here’s Why

Search Results for: stress test

After Passing Stress Tests, Wall Street Banks to Spend Like a Drunken Sailor – on their Own Stock Buybacks

By Pam Martens and Russ Martens: June 29, 2017 Yesterday, the Federal Reserve announced the second leg of its 2017 stress tests for the nation’s most systemic financial institutions. Known as the Comprehensive Capital Analysis and Review (CCAR), the Fed said it “did not object to the capital plans of all 34 bank holding companies” although Capital One Financial will be required to “submit a new capital plan within six months that addresses identified weaknesses in its capital planning process.” That all clear from the Fed unleashed what JPMorgan Chase CEO Jamie Dimon fondly refers to as “animal spirits” on Wall Street. The Fed had barely made its announcement when three of the biggest Wall Street banks announced they were earmarking about $47 billion to gorging on their own share buybacks. JPMorgan Chase led the pack with a potential buyback of $19.4 billion over the next 12 months, according to … Continue reading

Three Federal Studies Show Fed’s Stress Tests of Big Banks Are Just a Placebo

By Pam Martens and Russ Martens: November 16, 2016 The only thing standing between the American people and another apocalyptic financial collapse among by the biggest banks on Wall Street is the Federal Reserve’s stress tests and capital requirements. After Wall Street laid waste to the U.S. housing market and economy from 2008 through 2010, while propping itself back up with a feeding tube from the taxpayers’ pocketbook, the Obama administration passed the Dodd-Frank financial reform legislation in 2010. It wasn’t so much legislation as it was an illusory 2300 pages of rules that might someday get implemented in a meaningful way if President Obama appointed tough cops to his financial regulatory bodies – which he decidedly did not do. One of the promises in Dodd-Frank was that the Federal Reserve would annually assess whether the biggest and most dangerous banks have adequate capital to withstand a severe recession and … Continue reading

Big Banks May Get a Jolt When Fed Releases Final Results of Stress Tests Today

By Pam Martens and Russ Martens: June 29, 2016 Today, at 4:30 p.m., the Federal Reserve is scheduled to release the second leg of its annual stress tests of 33 banks holding $50 billion or more in total consolidated assets. The first leg of the tests was released last Thursday with all 33 banks getting a passing grade in terms of meeting the minimum capital cushion required. Today’s final round, called the Comprehensive Capital Analysis and Review (CCAR), will determine whether the banks are allowed to continue or increase dividend payments, conduct share buybacks or issue secondary stock offerings. This is the sixth annual round of stress tests conducted by the Fed since the financial crash in 2008. In addition to the regular stress tests, eight large banks with significant trading and/or clearing operations are required to show losses if a major counterparty defaulted. Those banks are: Bank of America, … Continue reading

The Market Just Held a Stress Test: Morgan Stanley, Met Life and Citigroup Flunk

By Pam Martens and Russ Martens: June 27, 2016 Wall Street On Parade has reported on multiple occasions that the Federal Reserve has no idea what it’s doing with its stress testing of the largest banks on Wall Street. Last Friday’s market action, following the Brexit vote in the U.K. to leave the European Union, proved just how feeble the Fed is when it comes to assessing systemic risk and capital vaporization at the deeply interconnected Wall Street mega banks. While the Dow Jones Industrial Average dropped 3.39 percent at the close on Friday, Morgan Stanley lost a stunning 10.15 percent of its market capital in a 6-1/2 hour trading session. At that speed, Morgan Stanley’s equity market capital could be wiped out in 10 trading sessions were this Brexit panic to continue. Citigroup, which became a basket case during the 2008 financial crisis, ending up as a penny stock … Continue reading

Buckle Up: Brexit Vote and Stress Test Results Arrive Tomorrow

By Pam Martens and Russ Martens: June 22, 2016 Talk about bad timing. Tomorrow, while the Brexit vote takes place in the U.K. and is guaranteed to whipsaw markets through the Friday morning open when the results of the vote are expected, the Federal Reserve plans to add to market jitters on Thursday by announcing the results of its stress tests on the biggest banks — while withholding the final leg of the results until the following Wednesday. The stress tests are an annual Fed exercise which are meant to reassure the public and Congress that the mega banks are holding adequate capital for even an extreme economic downturn; in other words, that another epic taxpayer bailout of insolvent banks won’t sneak up on the Fed like it did in 2008. Unfortunately, according to the Federal agency established under the Dodd-Frank financial reform legislation to provide ongoing research on potential … Continue reading

Treasury Drops a Bombshell: Fed’s Stress Tests Get It Wrong

By Pam Martens and Russ Martens: March 10, 2016 Four days after the Federal Reserve Board of Governors held an open meeting to propose a new rule to contain counterparty risk on Wall Street on a bank by bank basis, researchers at the U.S. Treasury’s Office of Financial Research (OFR) dropped a bombshell on the Fed. The researchers, Jill Cetina, Mark Paddrik, and Sriram Rajan, produced a study which shows, in their opinion, that the Fed’s stress test that measures counterparty risk on a bank by bank basis is all wet. The problem, say the researchers, is not what would happen if the largest counterparty to a specific bank failed but what would happen if that counterparty happened to be the counterparty to other systemically important Wall Street banks. The researchers note that the Fed’s stress test “looks exclusively at the direct loss concentration risk, and does not consider the … Continue reading

Bank Stress Test Results at 4:30 Today: Will the Fed Whistle Past the Graveyard?

By Pam Martens and Russ Martens: March 11, 2015 Results of the first leg of this year’s Federal Reserve stress tests, which measured capital adequacy of 31 of the most systemically important banks under a hypothetical market crash and deep recession, were released on March 5. Every institution passed that phase of the tests. At 4:30 p.m. today, the Federal Reserve will release its findings on the second leg of the tests: risk management capability, corporate governance and internal controls. Wall Street calls this element the “culture” test. For those who have been reading our columns since 2008, when the culture of Wall Street brought about the greatest U.S. economic collapse since the Great Depression of the 1930s, you might be thinking that the Fed’s concern over the culture on Wall Street is a day late and $14 trillion short. (The $14 trillion figure is the amount of secret loans … Continue reading

Charges of Lies Swirl Around Tim Geithner’s New Book, “Stress Test”

By Pam Martens: May 12, 2014 Tim Geithner, former head of the New York Fed during the lead up to the Wall Street melt down, then Secretary of the Treasury in President Obama’s first term, is undergoing his own version of a big bank stress test: does he have the capital to survive the storm he has stirred up with his new, revisionist history book, Stress Test: Reflections on Financial Crises. Geithner’s book has barely made it to the bookstore shelves (it’s slated for official release today) and already he’s been called a liar by R. Glenn Hubbard, Dean of the Columbia Business School; Geithner is effectively calling author Ron Suskind a liar in the book; and the book’s attack on Neil Barofsky, former Special Inspector General of the Troubled Asset Relief Program (TARP) has warranted a strong response from Barofsky where he says he doesn’t believe former Treasury Secretary … Continue reading

Citigroup Flunks Stress Test: Ghosts of Glass-Steagall Haunt the Fed

By Pam Martens: March 27, 2014 It only took three press releases over as many days but the Federal Reserve finally spit out the truth yesterday on its stress tests of the big banks: Citigroup, the largest bank bailout recipient of 2008, still doesn’t have its house in order more than five years later. How many more years of economic malaise will it take before the delusional Fed admits to the public that only the restoration of the Glass-Steagall Act, separating banks holding insured deposits from gambling casinos on Wall Street, will put our financial system back on sound footing? The Fed’s comments on Citigroup yesterday included the following: “While Citigroup has made considerable progress in improving its general risk-management and control practices over the past several years, its 2014 capital plan reflected a number of deficiencies in its capital planning practices, including in some areas that had been previously … Continue reading

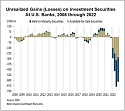

There Are Two Reasons that 75 Percent of U.S. Banks Didn’t Hedge Their Interest Rate Risk as the Fed Hiked Rates at the Fastest Pace in 40 Years

By Pam Martens and Russ Martens: October 10, 2023 ~ An academic study released in April found that during the fastest pace of Fed interest rate hikes in 40 years, the majority of U.S. banks failed to hedge their interest rate risk. The study on hedging is titled: Limited Hedging and Gambling for Resurrection by U.S. Banks During the 2022 Monetary Tightening? Its authors are Erica Jiang, Assistant Professor of Finance and Business Economics at USC Marshall School of Business; Gregor Matvos, Chair in Finance at the Kellogg School of Management, Northwestern University; Tomasz Piskorski, Professor of Real Estate in the Finance Division at Columbia Business School; and Amit Seru, Professor of Finance at Stanford Graduate School of Business. Among the key findings of the study are the following: “Over three quarters of all reporting banks report no material use of interest rate swaps.” “Only 6% of aggregate assets in the U.S. banking system … Continue reading