By Pam Martens and Russ Martens: October 10, 2023 ~

An academic study released in April found that during the fastest pace of Fed interest rate hikes in 40 years, the majority of U.S. banks failed to hedge their interest rate risk.

An academic study released in April found that during the fastest pace of Fed interest rate hikes in 40 years, the majority of U.S. banks failed to hedge their interest rate risk.

The study on hedging is titled: Limited Hedging and Gambling for Resurrection by U.S. Banks During the 2022 Monetary Tightening? Its authors are Erica Jiang, Assistant Professor of Finance and Business Economics at USC Marshall School of Business; Gregor Matvos, Chair in Finance at the Kellogg School of Management, Northwestern University; Tomasz Piskorski, Professor of Real Estate in the Finance Division at Columbia Business School; and Amit Seru, Professor of Finance at Stanford Graduate School of Business.

Among the key findings of the study are the following:

“Over three quarters of all reporting banks report no material use of interest rate swaps.”

“Only 6% of aggregate assets in the U.S. banking system are hedged by interest rate swaps.”

“Banks with the most fragile funding – i.e., those with highest uninsured leverage — sold or reduced their hedges during the monetary tightening. This allowed them to record accounting profits but exposed them to further rate increases. These actions are reminiscent of classic gambling for resurrection: if interest rates had decreased, equity would have reaped the profits, but if rates increased, then debtors and the FDIC would absorb the losses.”

One of the two key reasons for this lack of hedging was to window dress the bank’s earnings. The authors explain as follows:

“…we show that banks with more fragile funding decreased the amount of hedging activity during the period of monetary tightening. One might conjecture that banks more exposed to solvency runs would have larger incentives to avoid further asset value declines and thus avoid failure, so they might want to increase their hedging activities. Instead, we find that banks with higher uninsured leverage (higher share of uninsured deposit funding) sold or reduced their hedges during 2022. Because of reduced hedges, these banks went on to suffer larger losses when interest rates increased further. A case study of the recently failed Silicon Valley Bank (SVB) is illustrative. SVB hedged about 12% of all securities at the end of 2021. By the end of 2022, they hedged only 0.4% of all securities. During this period, the duration of their assets increased by almost two years. So, every additional percentage point increase in the policy rate led to a two-percentage point larger decrease in asset values than it would have in 2021. Reduction in hedges by the banks with more fragile funding is suggestive of gambling for resurrection. Selling profitable hedges allows weak banks to increase current accounting earnings. At the same time these banks have taken a large risk, which is profitable for bank shareholders on the upside, but the losses are borne by the FDIC on the downside.”

But the other key reason for the lack of hedging relates to a controversial accounting category called “Held-to-Maturity” or HTM. The authors explain:

“When banks report assets in their financial disclosures, two categories are relevant to hedging transactions: debt securities and derivatives. Debt securities can be classified at management’s discretion based on their intent with the securities as either available for sale (‘AFS’) or held to maturity (‘HTM’). AFS securities can be sold at banks’ discretion, and their value is marked to market (fair value) with unrealized gains and losses reported in ‘other comprehensive income.’ HTM assets are intended and designated to be held to maturity, with the bank planning to collect the cash flows of the duration of the asset. HTM assets are recorded and held at cost, with differences between cost and fair value disclosed (occasionally) in footnotes. Hedging HTM securities would require banks to record changes in the value of these assets (which are otherwise held at cost) and reflect them directly on their income statement, resulting in the loss of the securities’ HTM accounting status. This accounting treatment reduces banks’ incentives to hedge HTM securities if they perceive such fluctuations in reported earnings as costly and prefer to retain the HTM designation.”

CPA/CFA Sandy Peters posted the following at the CFA Institute website, which clarifies what the HTM category is all about at many of the banks using it:

“What that means is that the financial statement carrying value of those financial instruments held-to-maturity is reflected at amortized cost, or what management paid for the asset sometime in the past plus amortization of the discount or premium from the face value. The fair value is only disclosed on the face of the financial statement and in the footnotes. Any unrealized loss is ‘hidden in plain sight.’

“But management intent and business model do not change the value of financial instruments. The HTM classification only makes it harder for investors and depositors to see.”

Federally insured banks, backstopped by the U.S. taxpayer, are required to protect the safety and soundness of the institution. Neither of the reasons cited above for failing to hedge potentially catastrophic interest rate risk accomplishes that.

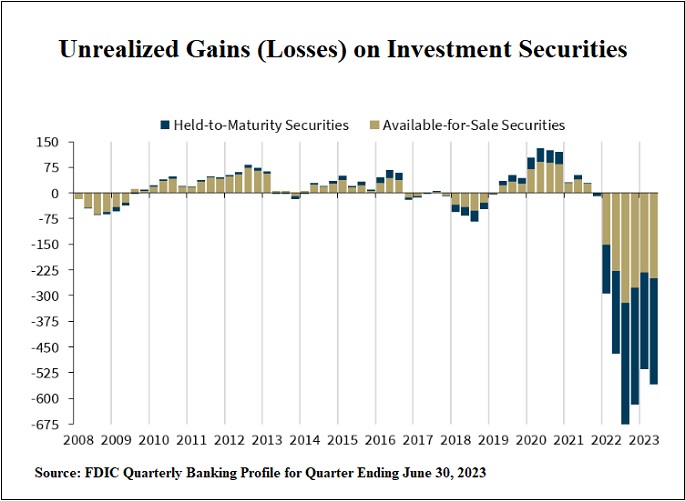

According to the FDIC’s quarterly report for the quarter ending June 30, “Unrealized losses on securities totaled $558.4 billion in the second quarter, up $42.9 billion (8.3 percent) from the prior quarter. Unrealized losses on held-to-maturity securities totaled $309.6 billion in the second quarter, while unrealized losses on available-for-sale securities totaled $248.9 billion.”

The chart below from the FDIC’s Quarterly Banking Profile shows just how dramatic the unrealized losses are this time around versus other periods of banking stress.

Related Articles: