By Pam Martens and Russ Martens: October 14, 2016

One would have had to have been in a coma for the past eight years not to realize there has been an ongoing Wall Street banking conspiracy in the United States. The Government Accountability Office (GAO) tallied it up and found it amounted to $16 trillion in secret loans from the Federal Reserve – an unfathomable bailout never approved by Congress. On May 20 of last year the U.S. Justice Department documented a vast conspiracy by global banks in the foreign currency markets with the banks admitting to the felony charges. The former heads of Federal regulatory agencies have written books about the conspiracy. Frontline and Sixty Minutes have produced documentaries on it. Banking whistleblowers have organized to fight it in an effort to save the country. A major motion picture, The Big Short, was released this year which put one aspect of the conspiracy into layman’s language and was based on a book by Wall Street veteran, Michael Lewis. Wall Street On Parade has chronicled the ongoing banking conspiracy for the past decade.

But yesterday, after Donald Trump made a reference to a banking conspiracy in his speech in West Palm Beach, Florida, a writer at the New York Times quickly pointed the anti-Semite finger at Trump, quoting Jonathan Greenblatt, CEO of the Anti-Defamation League and others. The Times wrote:

“The remarks drew criticism from some who said they resembled prejudicial language used by anti-Semites. ‘Whether intentionally or not, Donald Trump is evoking classic anti-Semitic themes that have historically been used against Jews and still reverberate today,’ Jonathan Greenblatt, the chief executive of the Anti-Defamation League, a group that fights discrimination, said in a statement.”

The full transcript of Trump’s speech was made available by Time Magazine. There is only one reference to the words “bank” or “banking.” Trump said the following:

“The Clinton machine is at the center of this power structure. We’ve seen this first hand in the WikiLeaks documents, in which Hillary Clinton meets in secret with international banks to plot the destruction of U.S. sovereignty in order to enrich these global financial powers, her special interest friends and her donors.”

Most Americans believe, for good reason, that global banks, including those on Wall Street, are actively engaged in a concerted wealth transfer system from the 99 percent to the 1 percent. That America now has the greatest wealth and income inequality since the 1920s further buttresses the wealth transfer reality.

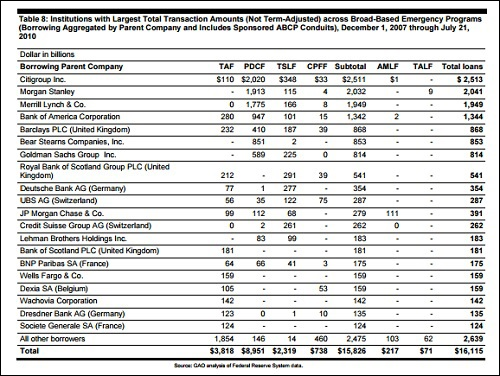

After the financial crash in 2008, the Federal Reserve fought for years in court to avoid providing details of the money it funneled to the global banks during the years of the crisis. When the Fed finally lost the court battle, the Government Accountability Office tallied up the secret Fed loans, all of which had been made at super low, below-market interest rates without any public disclosure. The final tally came to $16.1 trillion in cumulative loans. Yes, we said “trillion.” (See chart below from the GAO report.)

While Wall Street banks like Citigroup were receiving secret revolving loans from the Fed at less than 1 percent interest, the bank was driving its customers into foreclosure with exploding adjustable rate mortgage interest and credit card interest rates as high as 15 and 19 percent.

While banks were getting their secret $16 trillion bailout, families in jeopardy of being put out on the street were getting the shaft from their government. During the financial crisis, Neil Barofsky was the Special Inspector General of TARP, one of the key bank bailout programs. His official job was to monitor how the hundreds of billions of taxpayer dollars were spent. In 2012, Barofsky released his book, Bailout: How Washington Abandoned Main Street While Rescuing Wall Street. According to Barofsky’s book, the Home Affordable Modification Program (HAMP) did not have a goal of keeping struggling families and children in their homes. It’s real goal, according to U.S. Treasury Secretary Tim Geithner, was to “foam the runway” for the banks. Barofsky writes:

“For a good chunk of our allotted meeting time, Elizabeth Warren grilled Geithner about HAMP, barraging him with questions about how the program was going to start helping home owners. In defense of the program, Geithner finally blurted out, ‘We estimate that they can handle ten million foreclosures, over time,’ referring to the banks. ‘This program will help foam the runway for them.’

“A lightbulb went on for me. Elizabeth had been challenging Geithner on how the program was going to help home owners, and he had responded by citing how it would help the banks. Geithner apparently looked at HAMP as an aid to the banks, keeping the full flush of foreclosures from hitting the financial system all at the same time. Though they could handle up to ‘10 million foreclosures’ over time, any more than that, or if the foreclosures were too concentrated, and the losses that the banks might suffer on their first and second mortgages could push them into insolvency, requiring yet another round of TARP bailouts. So HAMP would ‘foam the runway’ by stretching out the foreclosures, giving the banks more time to absorb losses while the other parts of the bailouts juiced bank profits that could then fill the capital holes created by housing losses.”

As Wall Street On Parade reported just this past Tuesday, Citigroup was in the midst of receiving the largest financial bailout in U.S. history while one of its executives, Michael Froman, was simultaneously playing a major role in making key personnel decisions for the first Obama administration.

If the Clintons look like they’re part of this conspiracy, it’s from their long-term coziness with the serially charged Citigroup. Bill Clinton was responsible for repealing the Glass-Steagall Act which allowed the creation of “universal” banks like Citigroup, which peddle dangerous investments and derivatives around the globe while also holding insured deposits. According to the Center for Responsive Politics, Citigroup was the largest donor to Hillary’s first run for the Senate. (The employees or PACs of the firm make the donations, not the corporation itself.)

As we reported in July of 2014, after Hillary had made another fact-challenged statement to ABC’s Diane Sawyer that she and Bill Clinton were “dead broke” when they left the White House, Citigroup provided a $1.995 million mortgage which allowed the Clintons to buy their Washington, D.C. residence prior to their leaving the White House. Citigroup has also paid Bill Clinton hundreds of thousands of dollars in speaking fees and committed $5.5 million to the Clinton Global Initiative, a controversial charity run by the Clinton family.

Citigroup’s coziness to the Clintons and the Obama administration has allowed it to keep its executives in high offices in the Federal government. Three former Citigroup executives now sit as U.S. Treasury Secretary (Jack Lew), U.S. Trade Representative (Michael Froman) and Vice Chair of the Federal Reserve, Stanley Fischer.

Trump is far from alone in thinking big Wall Street banks have seized our democracy. Senator Bernie Sanders, a Jew from Brooklyn, fired up an entire nation with a presidential campaign calling for a political revolution against the banks and the establishment. He repeatedly, and correctly, stated that the business model of Wall Street had become fraud. Senator Elizabeth Warren also gets this. On March 13, 2014, when former Citigroup executive Stanley Fischer appeared before the Senate Banking Committee for his confirmation hearing to become Vice Chairman of the Federal Reserve, the following exchange occurred:

Senator Warren: “Now, I’m concerned that the mega banks not only have the capacity to tilt the financial system, but that they also have the capacity to tilt the political system. You know, we’ve learned that as big banks get bigger and bigger their lobbying power and influence in Washington also tend to grow. That means big banks can often delay, water down or even kill important regulations. So, size can have ripple effects everywhere and for that reason I think it’s a mistake to talk about size without considering how it affects the ability of government to enforce meaningful regulation.

“A century ago when Teddy Roosevelt and others worked to break up the giant trusts, this was a big concern – not just the economic impact of size but the political impact that came with size as well. So, Dr. Fischer, you have a great deal of experience as an observer and as a participant in the financial system, is this a point that you’ve thought about and do you think it’s possible for large Wall Street banks to amass too much political power?”

Fischer responded that he wasn’t convinced that banking supermarkets actually achieve any economies of scale.

Senator Warren continued: “Many big banks are well represented in Washington but the connection between Citigroup and Democratic administrations really sticks out. Three of the last four Democratic Treasury Secretaries have Citigroup ties; the fourth was offered but turned down the CEO position at Citigroup. Former Directors of the National Economic Council and the Office of Management and Budget at the White House and our current U.S. Trade Representative also have Citigroup ties. You once served as President of Citigroup International and are now in line to be number two at the Federal Reserve…”

Trump is, indeed, a deeply flawed messenger to be proffering the truth on the Clintons and the banks to the American people. But that doesn’t mean that he’s wrong on those two points. Attempting to tar Trump with the cudgel of anti-Semitism when legions of social justice Jews are writing books and papers about the banking cartel that’s killing America is pretty lame for a New York Times writer. It smacks of a heavy-handed attempt to socialize people to silence on the matter of the greatest bank heist in history.