By Pam Martens and Russ Martens: January 27, 2015

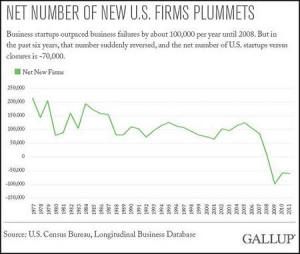

Earlier this month, Jim Clifton, Chairman and CEO of Gallup, published a stunning indictment of Wall Street as a job creating engine. Clifton reported that the U.S. now ranks 12th among developed nations in business startups with countries such as Hungary and Italy having higher startup rates. Of equal concern writes Clifton, “American business deaths now outnumber business births.”

Earlier this month, Jim Clifton, Chairman and CEO of Gallup, published a stunning indictment of Wall Street as a job creating engine. Clifton reported that the U.S. now ranks 12th among developed nations in business startups with countries such as Hungary and Italy having higher startup rates. Of equal concern writes Clifton, “American business deaths now outnumber business births.”

Clifton has a theory on why America’s crisis in creating new businesses is a well-kept secret. He writes:

“My hunch is that no one talks about the birth and death rates of American business because Wall Street and the White House, no matter which party occupies the latter, are two gigantic institutions of persuasion. The White House needs to keep you in the game because their political party needs your vote. Wall Street needs the stock market to boom, even if that boom is fueled by illusion.”

A key function of Wall Street is to bring promising new companies to market to ensure that the U.S. remains competitive in new industries and good jobs and innovation. This process is called Initial Public Offerings or IPOs. But the nation was put on notice as far back as 2001 that Wall Street was more snake oil salesman than the locomotive for new business launches. The largest investment banks were calling the startups they were peddling to the public on the Nasdaq stock market “dogs” and “crap” behind closed doors while lauding their virtues in publicly released “research” announcements.

Writing in the New York Times in 2001, Ron Chernow precisely analyzed how the Nasdaq stock market, Wall Street’s primary market for tech startups, had served the country. Chernow wrote:

“Concern has centered on the misery of small investors maimed in the tech wreckage. But what happened to all the money they squandered in the I.P.O.’s? Think of the stock market in recent years as a lunatic control tower that directed most incoming planes to a bustling, congested airport known as the New Economy while another, depressed airport, the Old Economy, stagnated with empty runways. The market has functioned as a vast, erratic mechanism for misallocating capital across America.”

At the time Chernow wrote those words, $4 trillion had been erased from the markets. At Nasdaq’s peak, set on March 10, 2000, it was at 5,048.62. Yesterday, the Nasdaq closed at 4,771.76. Our job creation engine has sputtered and backfired for a decade and a half without intervention from Congress or the White House. Wall Street investment banks are still allowed to write research reports on the same companies they are bringing to market despite the $4 trillion lesson that this is a flawed, corrupt system.

Just seven years after the Nasdaq crash, Wall Street collapsed the entire U.S. financial system and the nation’s economy. We are now entering the second leg of that economic collapse as deflation takes root in major industrialized nations around the globe, supply gluts proliferate on weak demand, and oil and industrial commodity prices collapse.

Wall Street brought us to the brink in 2008 through a corrupt system whose only function was to enrich its players at the nation’s expense. These are a few of the milestones in that journey:

- Wall Street had insider knowledge that subprime loans were going to take down the housing market because Wall Street incentivized their employees to approve loans to people who were lying about their income and could not afford the mortgage payment;

- After Wall Street created the bad mortgage loans, they sold loans they knew to be likely to default to Fannie Mae and Freddie Mac, having good reason to believe those firms would fail as a result;

- Wall Street created Collateralized Debt Obligations (CDOs) because it could bury its exorbitant fees inside their complexities and bundle up all of its bad loans and sell them off to unwary pension funds and institutional investors;

- The rating agencies entrusted with the critical role of providing honest ratings of these CDOs were corrupted by being paid for the ratings by the Wall Street firms. This pay to play system remains in place;

- Wall Street had insider knowledge that many of these CDOs were ticking time bombs. To profit from this knowledge, Wall Street firms bought Credit Default Swaps on the CDOs, a form of insurance that would pay off when the CDO defaulted or rise in value as the credit worthiness of the CDO declined. AIG sold this insurance through its AIG Financial Products division. When AIG failed, the U.S. government paid 100 cents on the dollar to Wall Street firms for the Credit Default Swaps they had purchased from AIG;

- Wall Street looked around for other suckers to fleece – public school districts, towns, counties, cities and states. It knew that it was only a matter of time before its massive issuance of mortgages to people who could not afford them would blow up the housing market and create a long-term downturn, bringing rates to record lows, so it sold tens of billions of dollars of interest rate swaps to these public entities. The public entities would receive a variable rate tied to Libor; Wall Street would receive a higher, fixed rate. Wall Street then proceeded to engage in a conspiracy to rig the Libor interest rate to its advantage. Typically, the public entity ended up receiving a fraction of one percent in interest, while contractually bound to pay Wall Street firms as much as 3 to 6 percent in a fixed rate for twenty years or longer. To get out of the deals, public entities have been forced to pay Wall Street tens of billions of dollars in termination fees, further fleecing the public purse.

Wall Street’s overarching function today is that of an institutionalized wealth transfer mechanism, propped up by compromised regulators and a dysfunctional Congress. As the PBS program Frontline reported in 2013, if your work career spans 50 years and you receive the historic return of 7 percent on stocks in your 401(k) plan, the 2 percent typical fee charged by Wall Street mutual funds will gobble up almost two-thirds of your account.

The Frontline program was called “The Retirement Gamble.” Wall Street On Parade checked the math and found this was not a gamble but a certainty: “under a 2 percent 401(k) fee structure, almost two-thirds of your working life will go toward paying obscene compensation to Wall Street; a little over one-third will benefit your family – and that’s before paying taxes on withdrawals to Uncle Sam.”

All of these examples cited above are part and parcel of why the United States has the fourth most unequal income distribution in the developed world. That income inequality, according to the Organisation for Economic Co-Operation and Development (OECD) is dampening growth prospects. The OECD found in a study released in September of 2014 that “countries where income inequality is decreasing grow faster than those with rising inequality.” The study noted that in Italy, the U.K. and the United States, “the cumulative growth rate would have been six to nine percentage points higher had income disparities not widened.”

Related Article:

Glass-Steagall, the Four Horsemen, and the Crippled Job Market