By Pam Martens and Russ Martens: June 3, 2024 ~

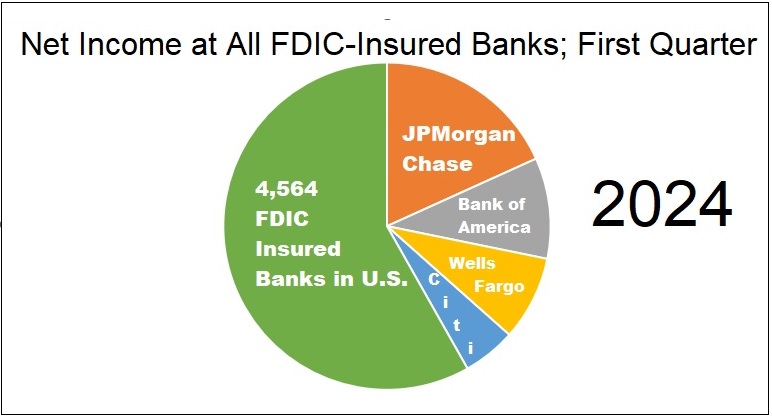

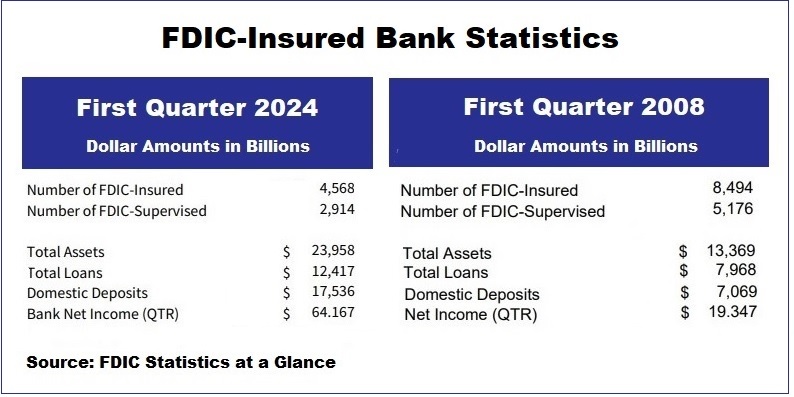

Last Wednesday, the Federal Deposit Insurance Corporation (FDIC) released its quarterly banking profile for the quarter ending March 31, 2024. A key piece of data released at that time was the net income (net profits) for all 4,568 FDIC-insured banks in the United States. That tally came in at $64.2 billion.

We decided to see just how concentrated those profits have become at a handful of behemoth banks on Wall Street – which also dangerously operate as trading casinos. We had no problem knowing where to start. We picked the largest and riskiest bank in the United States, JPMorgan Chase.

The publicly-traded JPMorgan Chase & Co., which includes its sprawling trading operations around the globe as well as the FDIC-insured bank, had previously reported net income for the first quarter of $13.4 billion. A handy page at the FDIC, using the drop down box for “income and expenses,” shows the net income attributable to just the FDIC-insured bank, JPMorgan Chase Bank N.A., was $11.7 billion.

That $11.7 billion in net income at JPMorgan Chase Bank, N.A. represents 18 percent of all bank profits at all 4,568 FDIC-insured banks in the United States.

That would be a highly dangerous and systemic bank based on that fact alone. But when one throws in the nonstop sleaze (like banking Bernie Madoff and Jeffrey Epstein for decades) and five felony counts this bank has racked up during the tenure of its Chairman and CEO, Jamie Dimon, it becomes crystal clear that this bank poses unacceptable and unmanageable risk to the financial stability of the United States.

No other bank in the U.S. comes even close to the percentage share of net income as JPMorgan Chase Bank N.A. The second largest U.S. bank by assets, Bank of America N.A., reported $6.4 billion in net income in the first quarter; Wells Fargo Bank N.A. reported $5.36 billion; and Citigroup’s Citibank N.A. reported $3.37 billion. (These figures are for just the FDIC-insured bank – not the whole publicly-traded company, although none of the banks come close to JPMorgan Chase in total earnings either.)

The four FDIC-insured banks together gobbled up a total of $26.83 billion in net income, or a stunning 42 percent of the net income for the remaining 4,564 banks.

We decided it would be instructive to see JPMorgan Chase’s share of net income in the banking sector prior to the greatest financial collapse in the U.S. since the Great Depression. We’re talking about the financial collapse of 2008 which was triggered by incompetently supervised megabanks on Wall Street that had gorged on subprime debt and off-balance-sheet derivatives. (Despite collapsing the U.S. economy in 2008, federal regulators have allowed those derivatives to remain off-balance sheet today. See JPMorgan Chase Has $2.9 Trillion Exposure in Off-Balance Sheet Items Vs $2.3 Trillion on Its Balance Sheet.)

According to the FDIC, the net income attributable to JPMorgan Chase Bank N.A. for the quarter ending March 31, 2008 was $2.134 billion. At that time there were 8,494 FDIC-insured banks with a total net income of $19.347 billion. That means that prior to the financial collapse in 2008, JPMorgan Chase’s net income represented only 11 percent of all profits at FDIC-insured banks. (For the key reason that almost 4,000 banks have disappeared since the first quarter of 2008, you can thank federal regulators rubber-stamping bank mergers.)

So what happened in 2008? As chaos and panic reigned, federal regulators allowed Jamie Dimon to buy up Bear Stearns when it collapsed as well as Washington Mutual and bring them under the umbrella of JPMorgan Chase. When Dimon bought Washington Mutual (WaMu) in September 2008, it was the largest savings and loan in the U.S. with $309 billion in assets.

Now, flash forward to the spring of 2023 when there was another bank panic – this time at non-conventional regional banks. Who did federal regulators sell the collapsed First Republic Bank to? They rubber-stamped the sale to JPMorgan Chase – despite it already being the riskiest and largest bank in the U.S.

For why the structure of the U.S. financial system is allowed to veer from one crisis to the next, see our report last week on the sick, revolving door culture between Washington and Wall Street that is tolerated by the U.S. Congress.

There is another giant red flag in the statistics on the chart below, which we captured from the FDIC’s quarterly statistics at a glance for the first quarter of 2024 versus the first quarter of 2008. While deposits have grown by 148 percent at FDIC-insured banks, the dollar amount of loans at the same banks has grown by a paltry 52 percent.

What are the giant casino banks doing with the tens of billions of dollars they could be using for loans to grow American businesses, foster innovation, create well-paying jobs, and keep the United States competitive on the world stage? They are using tens of billions of dollars to buy back their own stock and prop up its share price – which, in turn, delivers multi-million dollar “performance” stock bonuses to men in the corner offices of the banks — like Jamie Dimon. (See Jamie Dimon Has Spent $117 Billion Propping Up JPMorgan’s Share Price with Buybacks in 10 Years; He’s Counting on Trump’s MAGA Crowd to Rescue Him.)

In July of 2017, Thomas Hoenig, then Vice Chair of the FDIC, sent a letter to the U.S. Senate Banking Committee. He made these points in his letter:

“[If] the 10 largest U.S. Bank Holding Companies [BHCs] were to retain a greater share of their earnings earmarked for dividends and share buybacks in 2017 they would be able to increase loans by more than $1 trillion, which is greater than 5 percent of annual U.S. GDP.

“Four of the 10 BHCs will distribute more than 100 percent of their current year’s earnings, which alone could support approximately $537 billion in new loans to Main Street.

“If share buybacks of $83 billion, representing 72 percent of total payouts for these 10 BHCs in 2017, were instead retained, they could, under current capital rules, increase small business loans by three quarters of a trillion dollars or mortgage loans by almost one and a half trillion dollars.”

Congress failed to meaningfully reform the Wall Street megabanks after the crash of 2008. The U.S. economy has paid the price as banking regulators sleepwalk into the next crisis.