By Pam Martens and Russ Martens: December 12, 2023 ~

There is a battle raging between the Wall Street mega banks and their federal banking regulators. The regulators want the mega banks to hold more capital against their high risk trading positions to prevent a replay of the bailouts in 2008 and repo bailouts in the fall of 2019. The mega banks have launched a deceptive ad campaign and public relations battle to thwart that from happening.

The federal regulators’ efforts to raise capital are being undermined by Fed Chairman Jay Powell’s perpetual testimony to Congress that the U.S. banking system is safe and sound and adequately capitalized.

Thus far, no member of Congress has thought to question Fed Chair Powell during public hearings as to why the Fed needs a new permanent bailout facility of $500 billion, on top of its century-old Discount Window, if the banking system is adequately capitalized.

The half trillion dollar bailout facility has the benign-sounding name of Standing Repo Facility (SRF). (The Fed always gives a benign-sounding name to the unprecedented bailout facilities it has been perpetually creating since 2008.)

On July 28, 2021, when first disclosing the creation of the SRF, the Federal Reserve made the following unprecedented announcement:

“Under the SRF [Standing Repo Facility], the Federal Reserve will conduct daily overnight repo operations against Treasury securities, agency debt securities, and agency mortgage-backed securities, with a maximum operation size of $500 billion. The minimum bid rate for repos under the facility will be set initially at 25 basis points, somewhat above the general level of overnight interest rates. Counterparties for this facility will include primary dealers and will be expanded over time to include additional depository institutions.”

Primary dealers are decidedly not deposit-taking institutions. The word “dealer” gives this away. They are broker-dealers, meaning their business is the trading of securities, such as stocks, bonds, commodities, and futures. It was never the intent of Congress to make the Federal Reserve the lender of last resort to trading casinos on Wall Street.

Repos, short for Repurchase Agreements, are overnight loans that are typically made between financial institutions where safe collateral such as short-term Treasury securities are posted to ensure the repayment of the loan. When the Fed has to get involved in the Repo market, it means there is a liquidity crisis of some nature, such as mega banks backing away from lending to each other out of fear of default.

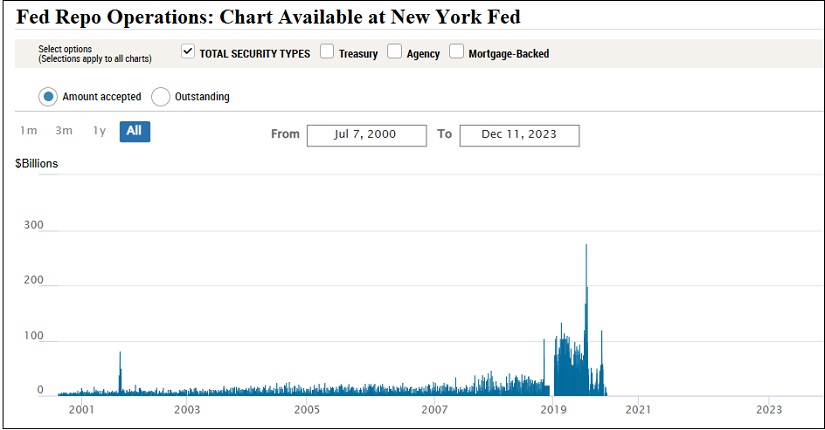

The chart above shows the increasing nature of the Fed’s involvement in the repo market as a bailout facility to the trading houses on Wall Street.

The controlling legislation for the Federal Reserve is the Federal Reserve Act. That legislation makes clear that the Fed is to be the lender of last resort to depository institutions – those taking deposits from individuals and businesses – by making short term loans through its Discount Window. (Depository institutions are worthy of central bank emergency loans because they, in turn, make loans to consumers and businesses to grow the U.S. economy.) In case of a dire emergency, the Fed is also allowed to make short-term loans under emergency lending facilities. The Fed’s establishment of a permanent lending facility to support securities trading on Wall Street shows just how distorted the Fed’s mission has become.

The Fed has also made it possible for the mega banks on Wall Street to now get two bites from the same apple. Each of the mega banks own a primary dealer (securities trading house) as well as a federally-insured bank. The Fed has now made both units eligible to borrow from its Standing Repo Facility.

For example, JPMorgan Chase’s broker-dealer, J.P. Morgan Securities LLP, is a primary dealer with the New York Fed and, thus, automatically eligible to borrow from the Standing Repo Facility. The Fed has also approved JPMorgan Chase Bank, the federally-insured banking unit of JPMorgan Chase, to borrow at its Standing Repo Facility. Two units of the same corporate parent will now be able to tap the daily maximum lending limit set by the Fed, giving the mega bank twice the borrowing capacity.

The chart above from the New York Fed shows that no lending has occurred from the Fed’s repo facility or Standing Repo Facility since the still unexplained mega bank crisis in the last quarter of 2019 through the COVID pandemic crisis of 2020. And yet, the New York Fed has this statement on its website:

“The New York Fed Trading Desk conducts overnight repo transactions under a Standing Repo Facility to support the effective implementation of monetary policy and smooth market functioning. In addition to primary dealers, participants in these transactions include Standing Repo Facility counterparties.”

For insight into whether the New York Fed has actually stopped making its bailout repo loans or just tucked them into a more opaque part of its own plumbing, see our report: Watchdog Report: Fed’s Billions in Emergency Repo Loans to Wall Street Didn’t Go Away in June; They Just Went Dark.

The New York Fed’s insatiable money spigot to the mega banks on Wall Street impacts the U.S. economy because it fuels wealth inequality by enriching the top 10 percent of Americans who own the vast majority of all stocks and bonds in the U.S. It impacts the economy further because it is ballooning the size of the Fed’s balance sheet (which now stands at $7.8 trillion) which the U.S. taxpayer is ultimately on the hook for. It impacts the U.S. economy because it is worsening the bubble that already exists in the stock market, thus making the inevitable bursting of the bubble worse. And it impacts the U.S. economy because these unprecedented bailouts of Wall Street by the Fed undermine the trust the American people have in their central bank and the U.S. banking system. (See here and here.)

The Federal Reserve has outsourced most of its bailout activity beginning in 2008 to just one of its 12 regional Fed banks, the New York Fed, which is privately owned by the mega Wall Street banks in its district.

The New York Fed is also the most inherently conflicted Frankenbank in the history of central banks. Not one member of its Board or management is elected by the American people and yet it can create trillions of dollars at the push of an electronic button and make that money flow to benefit the interests of the top ten percent of Americans. (It’s no wonder that New York City ranks number one among cities in the world for the largest number of billionaires, with 136 billionaires living there in 2022.)

Henry Steele Commager, an American historian, once wrote that “The generation that made the nation thought secrecy in government one of the instruments of old world tyranny and committed itself to the principle that a democracy cannot function unless people are permitted to know what their government is up to.”

Tragically, the U.S. government has outsourced its money-printing to an unaccountable, privately-owned facility in lower Manhattan that has no respect for the public’s right to know. The New York Fed has a long history of denying basic information to Wall Street On Parade in order to keep a very dark curtain around its interconnections to Wall Street’s trading houses.

In 2013, Wall Street On Parade attempted to obtain a simple photograph of the trading floor of the New York Fed, which interacts daily with the trading floors on Wall Street. No photograph was forthcoming. Instead, we had to spend weeks researching other sources until we located photographs from an educational video. The New York Fed has since that time quietly established yet another trading floor in Chicago, the center of the futures markets.

On April 6, 2015 William (Bill) Dudley, the President of the New York Fed at the time, stated in a speech that “the Federal Reserve already is very transparent and accountable to Congress and to the public.” Two days later, Wall Street On Parade attempted to get one piece of very basic information from the Fed. Again we were stonewalled. We wanted to know if JPMorgan Chase, a bank operating at the time under a deferred prosecution agreement for criminal acts and under a criminal investigation for potential currency rigging (it pleaded guilty to that count in May 2015) was still the custodian of $1.7 trillion of mortgage backed securities owned by the Federal Reserve, as we had reported on November 3, 2014.

In the fall of 2019 there was speculation on Wall Street at the time the Fed initiated its emergency repo loans, that JPMorgan Chase had played a role in triggering the lack of liquidity in the repo loan market by withdrawing large sums from its liquid reserves at the Fed. The $158 billion that JPMorgan Chase withdrew in 2019 from its liquid reserves at the Fed represented 57 percent of its total reserves at the U.S. central bank.

Wall Street On Parade attempted to learn more about this by filing two Freedom of Information Act (FOIA) requests, one with the Federal Reserve in Washington, D.C. and one with the New York Fed, which likes to say that it follows the Federal Reserve’s FOIA guidelines.

The Federal Reserve acknowledged to Wall Street On Parade on March 11, 2020 that it had 233 documents that might provide some transparency on why JPMorgan Chase was allowed to draw down $158 billion of its reserves. After taking four months to respond to what should have been a 20-business day turnaround on our Freedom of Information Act request, the Federal Reserve denied our FOIA in its entirety. (Our earlier request to the New York Fed resulted in the same kind of stonewalling. See The New York Fed Is Keeping JPMorgan’s Secrets Close to Its Chest.)

The Federal Reserve Board of Governors in Washington, D.C. has also been a party to protecting its interactions with Wall Street from public scrutiny. Ben Bernanke, the Fed Chairman during the financial crisis, stated that one of his priorities was to “make the Federal Reserve more transparent.” But in December of 2013, when we asked the communications office of the Fed for Bernanke’s 2007 and 2008 appointment calendar, we were told we would have to file a Freedom of Information Act (FOIA) request for it – an obvious stalling tactic for something so basic.

When we finally received the appointment calendar, there were redactions of 84 meetings that occurred between January 1, 2007 and the pivotal collapse of Bear Stearns on the weekend of March 15-16, 2008. Bernanke’s calendar for March 7, 2008 shows a full day of appointments redacted. The Fed might possibly justify this level of secrecy in the midst of a financial panic, but we received the deeply redacted materials six years after the crisis.

And for how Wall Street On Parade was stonewalled on our FOIAs for information on the worst trading scandal in Fed history, see our report: The Fed Pulls a Dark Curtain Around Former Dallas Fed President, Robert Kaplan, and His Trading in S&P 500 Futures.

If you believe a democracy requires transparency and accountability from those in positions of power, we urge you to call your U.S. Senators today and demand hearings, under oath, on the structure of the New York Fed and its crony ties to Wall Street.