By Pam Martens and Russ Martens: July 17, 2023 ~

Leslie Wexner (left); Jack Kessler (right). Both men were involved in the New Albany Company with Jeffrey Epstein and both served on the Board of a predecessor bank to JPMorgan Chase. Official photo from the New Albany Company Website.

In August 2007, Slate writer Emily Yoffe exploded a powder keg of parental anger when she shared her experience shopping with her 11-year-old daughter for back-to-school clothing in a store called Limited Too. The store, part of a large retail chain, marketed itself as an apparel haven for Tweens – girls ages 7 to 14.

What Yoffe found inside the store was deeply disturbing: “a line of padded, underwire push-up bras for girls with nothing of their own to pad or push up…scanty panties…pairs with rhinestone hearts or printed with cheeky sayings such as ‘Buy It Now! Tell Dad Later!’ ”

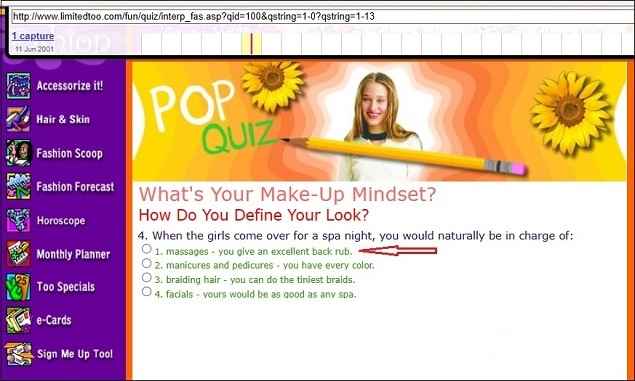

Limited Too is no longer in business but we did a check at the Internet Archives’ Wayback Machine to get a first-hand look at what Limited Too was peddling on its website in those early years. We found really sick stuff — like a survey of young girl customers that inquired if they were good at giving “massages.” (See screen shot above.) Sex trafficker Jeffrey Epstein, who had multiple ties to this store chain, was indicted in 2019 for sex trafficking and luring underage girls to his home for “massages,” which quickly became sexual assaults. (Epstein died in a Manhattan jail in 2019 while awaiting trial, taking a lot of dark secrets with him. His death was ruled a suicide by the Medical Examiner.)

One of Epstein’s victims, Virginia Roberts Giuffre, alleged in a lawsuit that Epstein’s (now convicted) accomplice, Ghislaine Maxwell, saw Giuffre reading a book about massage therapy at Donald Trump’s Mar-a-Lago resort in Palm Beach when Giuffre was working there as a spa attendant in 2000. Giuffre was under age at the time. Maxwell recruited Giuffre, on the pretext that she would be trained as a massage therapist, then Maxwell turned the position into what effectively became Giuffre serving as a sex slave to Epstein and his pals. In a BBC interview in 2022, Giuffre said she was “passed around like a platter of fruit” for sex with Epstein’s powerful friends.

We also found an inordinate amount of sexualized underwear for children at Limited Too’s website, including one black pair of children’s underwear that said “I Love Sleep Overs.” (In what alternate universe from hell should a child have comments about sleepovers imprinted on sexualized black underwear?)

We also found pervy surveys at Limited Too that pried deeply into girls’ personal lives. (How is that legal in the United States? Or is it one more example of the no-law zone drawn around everyone and everything tied to Jeffrey Epstein and his pervy pals in government, Wall Street and Big Tech?)

The title of Yoffe’s article about Limited Too was “Lolita’s Closet,” ironically providing a Freudian nexus to what would be revealed years later: Epstein’s private Boeing 727 jet which was dubbed the “Lolita Express,” a reference to its use to transport underage girls around the globe for sexual assault by himself and his wealthy friends.

Limited Too’s sick stuff is one more link in getting to the real truth in the relationship between retailing billionaire Leslie Wexner, Jeffrey Epstein and the Wall Street mega bank, JPMorgan Chase.

The bulk of Jeffrey Epstein’s wealth came from Wexner, the founder of The Limited retail chain as well as Limited Too. Wexner served as Chairman and CEO of a retailing conglomerate which, at various times, included a stable of other female apparel and beauty chains such as Abercrombie & Fitch, Victoria’s Secret, Lane Bryant, Bath & Body Works and others. (The conglomerate was previously known variously as The Limited or L Brands.)

Epstein functioned as a financial advisor to Wexner and held a power of attorney for Wexner’s financial interests from approximately 1986 to at least 2008. The Boeing 727 came from The Limited to Epstein. Epstein’s Upper East Side mansion in Manhattan came from Wexner. According to Epstein’s victims who have come forward, both the 727 and the Manhattan mansion were used to facilitate sexual assaults on underage girls. Prosecutors found a safe full of photos of naked girls, hundreds of which appeared to be underage, when the Manhattan mansion was raided by the FBI in 2019.

According to court filings, Epstein also posed for years as a recruiter for Victoria’s Secret models, telling models that he could get them work at the company. Multiple women have said that when they showed up for the modeling interview with Epstein, he sexually assaulted them. Limited Too had underage models and photo shoots and that would seem to be a matter long overdue for prosecutors to investigate — particularly given its inquiry about underage girls giving massages.

In addition to having an inordinate amount of power over Wexner’s finances connected to his retailing empire and his charities, Epstein also became a business partner of Wexner’s in Wexner’s multi-million-dollar home/business development project known as the New Albany Company in New Albany, Ohio.

And, here is where you need to pay close attention: the largest federally-insured bank in the United States, JPMorgan Chase, had members of its Board of Directors who were designated as “independent” but were co-business partners with Epstein and Wexner in the New Albany Company project as the JPMorgan Board looked the other way at Epstein’s account activity at the bank. (See our report: Lawsuit Bombshell: Sex Trafficker Jeffrey Epstein Was “a Business Partner” with Members of JPMorgan’s Board of Directors.)

Wexner’s wife, Abigail Wexner, and some of his friends sat on the L Brands Board of Directors (a publicly-traded company) and it had an inordinate amount of “Related Party” dealings, including noting on its 2019 proxy filing with the SEC that the company would have dealings with The New Albany Company, “a business beneficially owned by Mr. and Mrs. Wexner….”

In 2019, the Board of Directors of L Brands hired the law firm, Davis Polk & Wardwell, to investigate the ties between Epstein and Wexner after their close relationship became public following Epstein’s arrest on federal sex trafficking charges. Wexner’s wife had been a lawyer at Davis Polk prior to her marriage to Wexner and the law firm was the longstanding outside counsel to the company. After a shareholder sued the company over Davis Polk not having adequate impartiality in the matter, L Brands hired a second law firm, Wachtell, Lipton, Rosen & Katz, to conduct a second investigation. We could find no public release of the findings of either report.

Wexner did, however, announce in 2020 that he would be stepping down as Chairman and CEO of L Brands. In 2021, both Wexner and his wife announced they would not seek reelection to the Board of L Brands. In August of 2021, L Brands ceased to exist with the spinoff of Victoria’s Secret and Bath & Body Works as separate companies.

JPMorgan Chase was Epstein’s primary banker for 15 years – from 1998 to at least 2013 – long after he was known as a sexual assaulter of children and after he had to register as a sex offender. At the same time, JPMorgan was regularly involved in stock dealings for Wexner, credit facilities for his retail businesses and debt offerings.

In fact, the SEC filing for the spinoff of Limited Too (a/k/a Too, Inc.) from The Limited in 1999, to trade as a separate company on the New York Stock Exchange under the ticker “TOO,” states that “In deciding to pursue the spin-off, The Limited considered several things, including the financial advice of J.P. Morgan Securities Inc….” J.P. Morgan Securities Inc. is the broker-dealer/securities trading unit of JPMorgan Chase. The same filing mentions Epstein in the following manner:

“On June 23, 1999, Mr. Wexner contributed 10,000,000 shares of The Limited’s common stock to ASW Investments, a trust organized under the laws of Ohio. On that same date, ASW Investments contributed its 10,000,000 shares of The Limited’s common stock to ASW Holdings, Inc. (‘ASW Holdings’), a Delaware corporation, in consideration of the issuance to ASW Investments of all of the outstanding shares of capital stock of ASW Holdings. The sole trustee of ASW Investments is Abigail S. Wexner, Mr. Wexner’s wife. The directors and executive officers of ASW Holdings are Ms. Wexner and Jeffrey E. Epstein.”

JPMorgan Chase now has three lawsuits against it connected to Epstein playing out in federal court in Manhattan. All three lawsuits charge that JPMorgan Chase functioned as a cash conduit that facilitated Epstein’s sex trafficking. Discovery materials in the two lawsuits filed late last year show that the bank paid cold, hard cash to Epstein, totaling millions of dollars and sometimes reaching $40,000 to $80,000 a month. The lawsuits credibly allege that Epstein used that cash to pay off his victims and his recruiters.

Think about this for a moment. If you’ve ever been inside a Chase Bank, you’ll realize that their teller window for picking up cash is visible to everyone standing in line for a teller. How does one pick up giant bundles of cash totaling $40,000 to $80,000 a month without drawing attention. Clearly, the public is not getting the full story here. Did the bank have a concierge service for Epstein where suitcases of cash were hand-delivered to him? What the public has learned from the partial release of internal emails between Epstein and bank personnel is that there was a quid pro quo between Epstein and the bank where he delivered clients and business deals to the bank and it continued to provide cash and banking services to a registered sex offender who was under ongoing investigations for sex trafficking.

What the lawsuits also clarify in granular detail is that JPMorgan Chase, once again, failed to file Suspicious Activity Reports (SARs), as it is legally required to do with the Financial Crimes Enforcement Network (FinCEN), as Epstein pulled all these huge sums of cash from his multitude of accounts with the bank. The bank was previously criminally charged by the Justice Department in 2014, and admitted guilt, for failing to file Suspicious Activity Reports on the business account it held for decades for Ponzi mastermind Bernie Madoff. In total, the bank has admitted to five criminal felony counts since 2014 – an unprecedented number for any U.S. federally-insured bank. (See a more detailed Rap Sheet for the bank here.)

The pattern of illegality at JPMorgan Chase is so pervasive that on September 29, 2020 the nonprofit watchdog, Better Markets, released a special report, titled: “After 20 Years of Repeated Illegal Conduct, the DOJ Must Bring Criminal Charges Against JPMorgan Chase and Its Executives.” The report includes this analysis:

“…JPMorgan Chase has a 20-year long RAP sheet that includes at least 80 major legal actions that have resulted in over $39 billion in fines and settlements. That RAP sheet, detailed below, reveals wide-ranging, predatory, and recidivist lawbreaking – some admitted, some alleged — from 1998 through 2019. The bottom line is this: JPMorgan Chase has reportedly committed scores of illegal acts and preyed upon and ripped off countless Main Street Americans with a frequency and severity that is shocking in its depth and breadth.

“Any other business in America with that recidivist record would almost certainly have been shut down by prosecutors long ago; executives at any other business in America with that recidivist record would likely be serving long prison sentences. But not JPMorgan Chase. Instead, this gigantic, wealthy, powerful, politically connected and too-big-to-fail Wall Street bank repeatedly gets favorable treatment by the government and is repeatedly allowed to use shareholders’ money to pay fines and buy get-out-of-jail-free cards for its executives in sweetheart settlements.”

The connection between Limited Too’s sick sexualization of children’s undergarments to Jeffrey Epstein and his sex-trafficking ring has yet to receive the critical investigation that must happen before this nightmare era of U.S. mega bank financing of sex-trafficking is quietly sealed away in obscenely fat payouts to lawyers, non-disclosure agreements for victims and unconscionable court protective orders signed without a whimper by a federal court judge.

Related Articles:

Jeffrey Epstein’s Curiously Nimble Trading in LinkedIn Stock Raises Red Flags