By Pam Martens and Russ Martens: June 5, 2023 ~

The second, third, and fourth largest bank failures in U.S. history occurred this year. And yet, none of the banks that blew up were on the “Problem Bank List” that is prepared quarterly by the federal bank regulator that is supposed to be on top of these things – the Federal Deposit Insurance Corporation (FDIC).

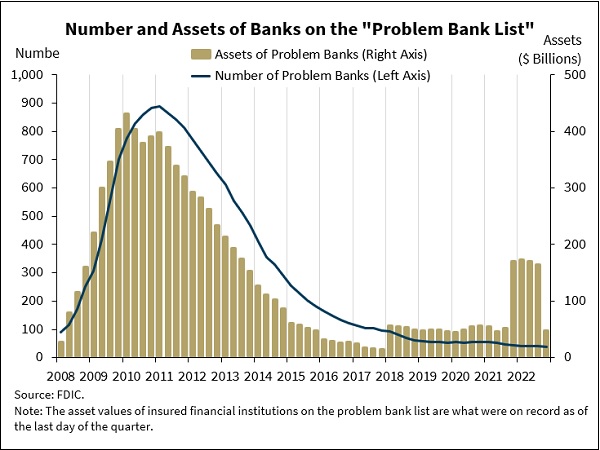

When the FDIC released its quarterly Problem Bank List for the quarter ending December 31, 2022, it showed just 39 banks were a problem with combined assets of a meager $47.5 billion.

Given that rosy picture, one can understand the shock to the American people when Silicon Valley Bank blew up on March 10 with $212 billion in assets and had to be put into FDIC receivership. Two days later, on March 12, Signature Bank failed and was put into FDIC receivership. As of December 31, 2022, Signature Bank had $110.4 billion in assets.

Then on May 1, First Republic Bank failed and was put into FDIC receivership with some assets and deposits being sold to JPMorgan Chase bank. According to the FDIC, as of April 23, 2023, First Republic Bank had $229.1 billion in total assets.

Together, those three banks had $551.5 billion in assets – more than half a trillion dollars – versus the FDIC’s estimate just a few months earlier that less than $47.5 billion in bank assets were housed at “Problem Banks.”

Putting out charts and projections that so spectacularly miss the mark does not instill confidence in Americans as to the safety and soundness of the U.S. banking system.

Given the seismic flop of the FDIC’s chart for December 31, 2022 (see chart above), one would have expected a more careful and thoughtful analysis when the FDIC released its Problem Bank List for the quarter ending March 31, 2023. Instead, the FDIC added just four banks to the Problem Bank List, bringing the number to 43, with combined assets of a still meager $58 billion.

That $58 billion stands in sharp contrast to the $1 trillion in assets at one of the four largest mega banks in the U.S. that a team of four highly-credentialed academics have raised alarms about.

The key takeaway from their study is this: “The U.S. banking system’s market value of assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.” (For more on this Held-to-Maturity accounting issue, see our report: JPMorgan Chase Transferred $347 Billion in Debt Securities Over the Last 3 Years to Inflate Its Capital Using a Controversial Maneuver.)

The academic study is titled: “Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?” Its authors are Erica Jiang, Assistant Professor of Finance and Business Economics at USC Marshall School of Business; Gregor Matvos, Chair in Finance at the Kellogg School of Management, Northwestern University, and Research Associate in the Corporate Finance group at the National Bureau of Economic Research (NBER); Tomasz Piskorski, Professor of Real Estate in the Finance Division at Columbia Business School and Research Associate at NBER; and Amit Seru, Professor of Finance at Stanford Graduate School of Business, a Senior Fellow at the Hoover Institution, and Research Associate at NBER.

The study looks at bank assets which have not been marked to market because they are placed in an accounting category called “Held-to-Maturity” or HTM. (One expert in the field calls this “Hide-Til-Maturity.”) The researchers then combine those findings with banks holding large quantities of uninsured deposits – sums exceeding the federal deposit insurance cap of $250,000 per depositor, per bank. The researchers conducted various scenarios to see how different categories of banks would perform. (Uninsured deposits have played a major role in the bank runs that have occurred this year.)

The study raised alarm bells regarding an unnamed bank with “assets above $1 trillion” potentially experiencing a bank run. (There are only four U.S. chartered banks that have assets above $1 trillion. According to the December 31, 2022 data from the Office of the Comptroller of the Currency, those are: JPMorgan Chase Bank N.A. with assets of $3.2 trillion; Bank of America N.A. with $2.4 trillion in assets; Citigroup’s Citibank N.A. with assets of $1.77 trillion; and Wells Fargo Bank N.A. with $1.71 trillion in assets.)

As of December 31, 2022, these same four banks held a combined $3.286 trillion in uninsured domestic deposits. JPMorgan Chase Bank N.A. held $2.015 trillion in deposits in domestic offices, of which $1.058 trillion were uninsured, or 52.5 percent; Bank of America held $1.9 trillion in deposits in domestic offices, of which $909.26 billion were uninsured, or 48 percent; Wells Fargo held $1.4 trillion in deposits in domestic offices, of which $721.1 billion were uninsured, or 51.5 percent; and Citibank N.A. (parent, Citigroup) held $777 billion in deposits in domestic offices, of which $598.2 billion were uninsured – a staggering 77 percent.

On May 1, the FDIC released its report on “Options for Deposit Insurance Reform.” Without mentioning that just four banks controlled $3.286 trillion of uninsured deposits at year end, the FDIC report did provide the figure of $7.7 trillion as the total of uninsured domestic deposits held by all banks at the end of 2022. That means that just these four banks held 43 percent of all uninsured deposits at 4,127 federally insured commercial banks in the U.S. as of year-end 2022.

The FDIC report shares this deeply disturbing detail:

“Following the 2008-2013 banking crisis, the reliance by the U.S. banking system on uninsured deposits grew dramatically, both in dollar volume and as a proportion of overall deposit funding. From year-end 2009 through year-end 2022, uninsured domestic deposits at FDIC-institutions increased at an annualized rate of 9.8 percent, from $2.3 trillion to $7.7 trillion.”

If ever there was a siren call to dramatically restructure federal oversight of the U.S. banking system, what has happened this year is it.

The final straw came on May 1 when federal regulators allowed the officially riskiest bank in the United States, JPMorgan Chase, to become even larger and riskier by buying the collapsed First Republic Bank.