By Pam Martens and Russ Martens: December 5, 2022 ~

If you have been following the Sam Bankman-Fried and FTX crypto exchange story since the company filed for bankruptcy on November 11, you have likely read the phrase “a valuation of $32 billion” dozens of times to describe the “valuation” of FTX as recently as February of this year. (We pulled up 47,600 results from a Google search.)

If you have been following the Sam Bankman-Fried and FTX crypto exchange story since the company filed for bankruptcy on November 11, you have likely read the phrase “a valuation of $32 billion” dozens of times to describe the “valuation” of FTX as recently as February of this year. (We pulled up 47,600 results from a Google search.)

But here’s the funny thing. No media outlet has bothered to explain how FTX came by that $32 billion valuation or precisely how Sam Bankman-Fried, the co-founder and CEO of FTX, became a billionaire overnight. FTX wasn’t publicly traded so its share price wasn’t determined by millions of investors buying and selling its stock on a public stock exchange five days a week.

And here’s another funny thing: mainstream media reported in late September that FTX was looking to raise $1 billion more from venture capitalists while keeping its valuation at $32 billion, the same value that it had in February. But between February 1 and September 30, Coinbase, a crypto exchange that actually did trade on a public exchange where millions of real people bought and sold its stock, had lost 67 percent of its value.

To understand how FTX came by that magical $32 billion valuation, let’s use the example of a chain of privately-owned lemonade stands. The owner says his lemonade is the best in the world because he uses only organic lemons. He puts together a slick pitch deck and shows it to a bunch of venture capitalists. He wants to keep 55 percent of his company so he is willing to sell investors 45 percent of the shares. To keep things simple, let’s say that there are 1,000 shares in total in the company. To get to a $32 billion valuation, each share must be valued at $32 million.

If the lemonade stand owner can get some well-known venture capital firms to pay that $32 million per share, then Wall Street and the business press is happy to say that the firm has a valuation of $32 billion – even though price discovery on a public stock exchange has never occurred and only a small amount of the shares are actually sold.

In the case of FTX, only $1.8 billion in shares were actually sold to outside investors. But the $32 billion valuation was thrown around as if market forces had genuinely determined what the company was worth. Likewise, Sam Bankman-Fried was said to be worth $16 billion based on the shares he retained in FTX and related companies.

It’s impossible to say that the outside investors in FTX did any real due diligence to determine what valuation to place on FTX. The company did not have a functioning Board of Directors or even a CFO. The related-party transactions were so outrageous that they made another huckster, WeWork’s Adam Neumann, look like a Boy Scout. FTX was using company funds to buy up to $300 million in real estate in the Bahamas, putting some of the properties in the names of executives and one $16.5 million “vacation home” property in the name of Sam Bankman-Fried’s parents.

FTX’s outside investors included some high-profile names on Wall Street: SoftBank (also a big investor in the WeWork fiasco); Sequoia Capital – which has written down its $214 million investment in FTX to zero; Third Point Ventures, Tiger Global, BlackRock, Thoma Bravo, and others.

Venture capital firms have a vested interest in grossly over-valuing a private firm that hopes to eventually go public on a stock exchange. The more over-valued the company is the more money the private investors make when they cash out their shares during or shortly after the IPO (Initial Public Offering). In the case of Coinbase, some of its private investors cashed out of their shares at more than $300 per share on its first day of trading on April 14, 2021. (Coinbase went public as a direct listing. In a traditional IPO, early private investors and company executives are not allowed to sell their shares for several months due to a so-called lockup period. There’s no such prohibition in a direct listing.) Coinbase closed last Friday at $47.67.

The big Wall Street mega banks that underwrite IPOs are also incentivized to keep their mouths shut about wildly inflated valuations, because they collect a fee based on the dollar amount of the offering. And Big Law firms that serve as legal counsel to the underwriters don’t want to rock the boat out of fear they’ll be cut out of future deals.

Just 14 years ago the United States experienced the greatest financial collapse since the Great Depression of the 1930s because of fast-talking hucksters on Wall Street pushing unregulated derivatives backed, in many cases, by little more than air. Millions of innocent Americans lost their jobs, their homes and their life savings in the crash.

Congress was supposed to write legislation that would make sure this kind of wholesale looting of the American people could never happen again. And yet, here we are today with millions of Americans’ life savings being looted by hucksters peddling cryptocurrencies backed by air – or stolen customers’ money in the case of FTX’s crypto token, FTT.

In his 1841 classic on market bubbles, Extraordinary Popular Delusions and the Madness of Crowds, the Scottish journalist Charles Mackay wrote this about the Dutch Tulip bubble in the 17th century: “The rage among the Dutch to possess them was so great that the ordinary industry of the country was neglected…”

The legitimate business of Wall Street is to allocate capital efficiently to solid companies that will grow the U.S. economy, create good-paying jobs, and keep America competitive on the world stage. But despite Wall Street’s willingness to bring crypto dogs public and venture capital’s willingness to fund crypto startups, there has been a preponderance of evidence that crypto has been a scam from the very beginning.

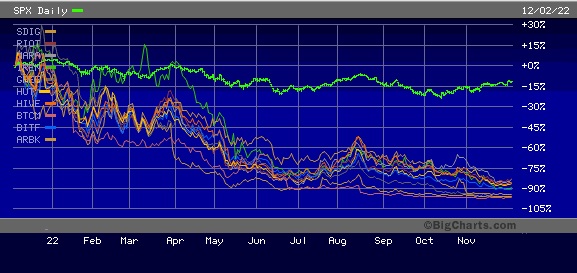

Investors who thought that investing in crypto mining companies that used massive amounts of energy to solve complex mathematical problems that served no socially-beneficial purpose whatsoever have seen their investment dollars evaporate this year. The chart below shows the share price performance of ten crypto miners over the past 12 months versus the S&P 500 Index (Ticker SPX): Argo Blockchain PLC (ARBK), Bitfarms Ltd. (BITF), BIT Mining Ltd. (BTCM), Hive Blockchain Technologies Ltd. (HIVE), Hut 8 Mining Corp. (HUT), Greenidge Generation Holdings (GREE), Iris Energy (IREN), Marathon Digital Holdings Inc. (MARA), Riot Blockchain Inc. (RIOT), and Stronghold Digital Mining (SDIG).

Tulips anyone?