By Pam Martens and Russ Martens: October 31, 2022 ~

Whether your mutual fund was one of the popular 60/40 funds (60 percent equities and 40 percent bonds) or was 100 percent in equities, you’ve been battered this year. The Fed’s relentless hiking of interest rates this year beat down the market value of existing bonds because they have lower fixed rates of interest, thus making them less valuable than the newly issued bonds with higher rates of interest. Growth stocks, which have dominated the investment scene for years, were particularly crushed because growth companies need to borrow money to grow and higher interest rates mean that their cost of capital will become more expensive, thus slowing growth and hurting their earnings outlook.

Another factor weighing on the negative performance of equities (stocks) is that higher interest rates pumped up the value of the U.S. dollar, hurting the earnings of U.S. companies that are big exporters. (Consumers in foreign countries hold foreign currency that has lost value to the U.S. dollar, thus making the cost of U.S. manufactured goods more expensive to them. That incentivizes those consumers to trim purchases of U.S. goods and/or switch to a less expensive foreign brand.)

The Financial Times reported on Saturday that the strong dollar is forecast to wipe $10 billion off U.S. corporate earnings in just the third quarter. Bloomberg News estimates that “The greenback’s strength is likely to reduce the profits of a third of the companies in the S&P 500 this quarter.”

To help our readers understand that the market pain is touching a wide swath of investors – not just your own 401(k) plan – we pulled up Kiplinger’s list of the 100 most widely-held mutual funds in 401(k) plans. Then we charted the share price performance for the past year through Friday, October 28, 2022. (Total return from any dividends or capital gains is not included.) Below are some of our findings:

JPMorgan’s idea of how to build seniors a “SmartRetirement” three years from now may need a serious overhaul. As the chart below indicates, that Fund has lost more than 25 percent of its share price over the past year through last Friday, October 28. Kiplinger categorizes the fund as a “Conservative Allocation” but what we observed on the JPMorgan Chase website calls that seriously into question. It states that as of September 30, 2022 its SmartRetirement 2025 Fund’s asset allocations included international equities, junk bonds (“high yield”), emerging market stocks and small caps along with other stock and bond exposures.

Making those big brains at JPMorgan look even worse, a passively-managed fund, the Vanguard 500 Index Fund lost about 10 percent less over the past year than JPMorgan’s SmartRetirement 2025 Fund.

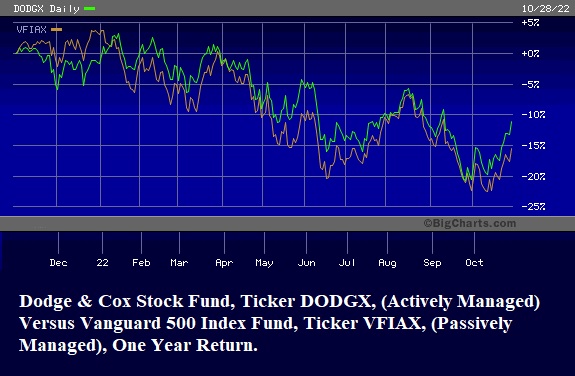

Another finding was that active management of a stock mutual fund can beat out a passive index fund in a challenging bear market if you select the right investment managers. The actively-managed Dodge & Cox Stock Fund, for example, has performed far better than the passively-managed Vanguard 500 Index Fund over the past year. (See chart below.) Dodge & Cox explains its investment strategy for this fund as follows:

“Select individual securities based on our analyses of various factors—including a company’s financial strength, economic condition, competitive advantage, quality of the business franchise, financially material environmental, social, and governance (ESG) issues, and the reputation, experience, and competence of its management—as weighed against valuation.”

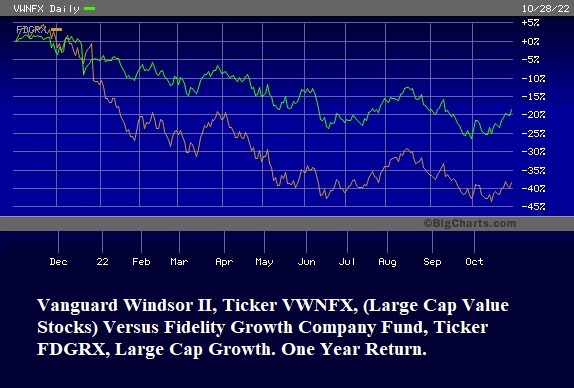

And, finally, investors need to fully grasp the difference between “growth” stocks and “value” stocks before the next bear market arrives. Investopedia includes the following characteristics for “growth” stocks:

“Growth stocks are those companies expected to grow sales and earnings at a faster rate than the market average.

“Growth stocks often look expensive, trading at a high P/E [price to earnings] ratio, but such valuations could actually be cheap if the company continues to grow rapidly which will drive the share price up.

“Since investors are paying a high price for a growth stock, based on expectation, if those expectations aren’t realized growth stocks can see dramatic declines.

“Growth stocks typically don’t pay dividends.

“Growth stocks are often put in contrast with value stocks.”

For an idea of what that reference to “dramatic declines” might look like, consider what happened to Facebook on February 3 of this year. In one trading session, the publicly-traded company that owns Facebook (Meta Platforms Inc.) lost 26.39 percent of its market value. Last Thursday, October 27, Facebook plunged another 24.5 percent – in one trading session. Its profit had plummeted 52 percent in the third quarter. On October 28, 2021 Facebook closed the trading day at $316.92. Last Friday, October 28, 2022, Facebook (Meta Platforms Inc.) closed the trading session at $99.20 – a decline of 69 percent in one year. Facebook pays no cash dividend and has never paid a cash dividend. There is nothing to buttress its fall (like investors receiving a quarterly cash dividend) when things go south.

Investopedia describes “value” stocks as follows:

“A value stock is trading at levels that are perceived to be below its fundamentals.

“Common characteristics of value stocks include high dividend yield, low P/B [price to book] ratio, and a low P/E [price to earnings] ratio.

“A value stock typically has a bargain-price as investors see the company as unfavorable in the marketplace.”

The chart below shows how a large cap value stock fund performed over the past year versus a large cap growth fund – which lost a gut-wrenching 40 percent of its share price.

Editor’s Note: Past performance is no guarantee of future performance for a mutual fund. Readers should not interpret this article as rendering investment advice. Always seek the advice of a qualified investment advisor and your accountant before investing or making changes to your investment portfolio.