By Pam Martens and Russ Martens: May 22, 2020 ~

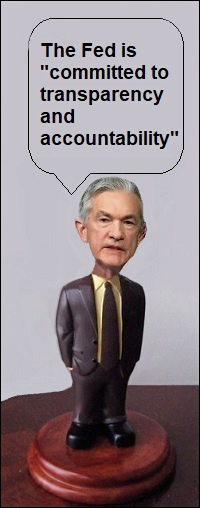

During his appearance before the Senate Banking Committee this past Tuesday, Federal Reserve Chairman Jerome Powell told Senator Jon Tester that the Fed “has committed to disclose all of the borrowers and the amounts in a timely way.” Powell was referring to the alphabet soup of emergency bailout programs for Wall Street that the Fed has established under Section 13(3) of the Federal Reserve Act.

During his appearance before the Senate Banking Committee this past Tuesday, Federal Reserve Chairman Jerome Powell told Senator Jon Tester that the Fed “has committed to disclose all of the borrowers and the amounts in a timely way.” Powell was referring to the alphabet soup of emergency bailout programs for Wall Street that the Fed has established under Section 13(3) of the Federal Reserve Act.

In a statement released by the Fed on April 23, it also said this on the subject of transparency:

“…the Board will report substantial amounts of information on a monthly basis for the liquidity and lending facilities using Coronavirus Aid, Relief, and Economic Security, or CARES, Act funding, including the: Names and details of participants in each facility; Amounts borrowed and interest rate charged…The Board will publish reports on its CARES Act 13(3) facilities on its website at least every 30 days and without redactions.”

The Fed has a website page that publishes its reports to the public and Congress every 30 days. If you click on the PDFs for the Primary Dealer Credit Facility, the Commercial Paper Funding Facility, and the Money Market Mutual Fund Liquidity Facility – three programs to benefit Wall Street – you will not find one iota of information on the names of borrowers or amounts they borrowed. (The Primary Dealer Credit Facility is not slated to use CARES Act money but it is established under the 13(3) emergency programs of the Fed.)

The Primary Dealer Credit Facility and Money Market Mutual Fund Liquidity Facility showed up on the Fed’s balance sheet on March 25 of this year, with balances of $27.7 billion and $30.6 billion, respectively. As of yesterday, the Fed showed the following balances for those two programs: $7.5 billion and $36.4 billion, respectively.

But when the Fed released its March 25 and April 24 reports on these two programs, there was not a scintilla of information on the names of borrowers or amounts borrowed.

The Commercial Paper Funding Facility showed up on the Fed’s balance sheet on April 15 with a balance of $974 million. It currently has a balance of $4.29 billion. But when the Fed filed its report to Congress on April 24, there was zero information on names of borrowers or amounts borrowed.

Many of the Fed’s other emergency programs have not yet gotten underway. Powell told the Senate Banking Committee on Tuesday that he hopes they will be operational within a few weeks.

But one program that has been operational for the past eight months is the Fed’s Repurchase Agreement (repo loan) facility. It had funneled $6 trillion in emergency, below-market rate, revolving loans to Wall Street’s trading houses before the first case of coronavirus had appeared anywhere in the United States. It is likely to remain behind the Fed’s dark curtain forever under the excuse that it’s part of the Fed’s open market operations. That program started on September 17, 2019 when the overnight lending rate on repo loans shot up from around 2 percent to 10 percent – signaling that Wall Street banks were backing away from lending to other financial institutions, the precise activity that heralded the financial crisis of 2007 to 2010.

The scenario that the Federal Reserve, which also functions as the supervisor of the largest Wall Street bank holding companies, had failed to detect systemic dangers at the mega banks for the second time in 12 years, was anathema to the Fed. That reality could bring on Congressional hearings and a potential stripping of Fed powers to be both a regulator and a bailout artist able to create trillions of dollars out of thin air at the push of an electronic button. So the Fed decided it would simply throw trillions of dollars in revolving loans at the problem and deny that there was anything wrong with the banks.

By March 14, the Fed had pumped out more than $9 trillion in revolving repo loans to the trading houses on Wall Street that are known as its primary dealers. (See list below.) Almost all of these trading units are attached to giant commercial banks that trade publicly. The Fed has yet to provide the names of borrowers or amounts they individually borrowed. Shareholders of a publicly traded company have a legal right to know if a bank is experiencing a liquidity crisis and needs to borrow from the Fed. The public has a right to know if the Fed has once again failed the American people in its oversight role of the behemoth Wall Street banks.

On May 8, the Fed released its “Supervision and Regulation Report.” It carried this statement: “The banking industry came into 2020 in a healthy financial position.”

But it is simply impossible for the following to be simultaneously true: the largest banks on Wall Street needed the Federal Reserve to be the lender-of-last resort to the tune of trillions of dollars in revolving loans before the first case of coronavirus had appeared in the U.S. while the big banks were also in a “healthy financial position.”

It could be true that some of the big banks were in a healthy financial position and simply backed away from lending to those banks they felt were not in a healthy financial position. But here’s the problem with that scenario.

We know from the Office of Financial Research (OFR), a Federal agency set up under the Dodd-Frank financial reform legislation of 2010 to alert federal regulators to growing risks in the financial system, that all of the major Wall Street banks are interconnected to one another as derivative counterparties. We also know that OFR warned in 2016 that the Fed’s stress tests were improperly structured to capture the true amount of risk in the U.S. financial system.

The OFR researchers who conducted the study, Jill Cetina, Mark Paddrik, and Sriram Rajan, found that the Fed’s stress tests were measuring counterparty risk for the trillions of dollars in derivatives on a bank by bank basis. The real problem, according to the researchers, was that contagion could spread rapidly if one big bank’s counterparty was also a key counterparty to other systemically important Wall Street banks. The researchers wrote:

“A BHC [bank holding company] may be able to manage the failure of its largest counterparty when other BHCs do not concurrently realize losses from the same counterparty’s failure. However, when a shared counterparty fails, banks may experience additional stress. The financial system is much more concentrated to (and firms’ risk management is less prepared for) the failure of the system’s largest counterparty. Thus, the impact of a material counterparty’s failure could affect the core banking system in a manner that CCAR [one of the Fed’s stress tests] may not fully capture.”

The March 2016 OFR study also found that just six banks make up the “core” of the U.S. financial system. That’s six banks out of a little over 5,000 commercial banks and savings associations in the U.S. Those six include: Bank of America Corp., Citigroup Inc., Goldman Sachs Group, Inc., JPMorgan Chase Co., Morgan Stanley, and Wells Fargo & Co. The researchers noted that while individual bank holding companies’ direct losses have declined under the Fed’s stress tests, “counterparty credit risks to the banking system collectively have risen and may suggest a greater systemic risk than is commonly understood.”

This counterparty concentration risk was also called out in the seminal report on the 2008 financial collapse by the Financial Crisis Inquiry Commission. The final report found this:

“Large derivatives positions, and the resulting counterparty credit and operational risks, were concentrated in a very few firms. Among U.S. bank holding companies, the following institutions held enormous OTC derivatives positions as of June 30, 2008: $94.5 trillion in notional amount for JP Morgan, $37.7 trillion for Bank of America, $35.8 trillion for Citigroup, $4.1trillion for Wachovia, and $3.9 trillion for HSBC. Goldman Sachs and Morgan Stanley, which began to report their holdings only after they became bank holding companies in 2008, held $45.9 and $37 trillion, respectively, in notional amount of OTC derivatives in the first quarter of 2009. In 2008, the current and potential exposure to derivatives at the top five U.S. bank holding companies was on average three times greater than the capital they had on hand to meet regulatory requirements. The risk was even higher at the investment banks. Goldman Sachs, just after it changed its charter, had derivatives exposure more than 10 times capital. These concentrations of positions in the hands of the largest bank holding companies and investment banks posed risks for the financial system because of their interconnections with other financial institutions.”

The federal regulator that reports on derivative risk is the Office of the Comptroller of the Currency (OCC). Yesterday it announced that its head, Joseph Otting, will be stepping down in eight days.

On March 30, the OCC released its latest quarterly report on derivatives held at the largest Wall Street banks as of December 31, 2019. JPMorgan Chase had notional (face amount) in derivatives of $46.88 trillion which netted to 153 percent total credit exposure to capital; Goldman Sachs Bank USA had $42.2 trillion notional in derivatives, which netted to 344 percent total credit exposure to capital; Citibank (which blew itself up in 2008 with derivatives and subprime debt) had $41 trillion in notional derivatives, which netted to 124 percent total credit exposure to capital. (See Table 4 in the Appendix at this link.)

The Fed hid its failures and those of its fellow regulators during the 2007 to 2010 financial crisis by secretly funneling $29 trillion cumulatively in revolving bailout loans to Wall Street, then waging a multi-year court battle with the media to keep the public from learning the names of the Wall Street bank borrowers and amounts borrowed.

What is strikingly missing today is any effort on the part of mainstream media to hold the Fed accountable by filing a Freedom of Information Act lawsuit to find out the true condition of the Wall Street behemoth banks and who the Fed has made all these loans to.