By Pam Martens and Russ Martens: April 30, 2020 ~

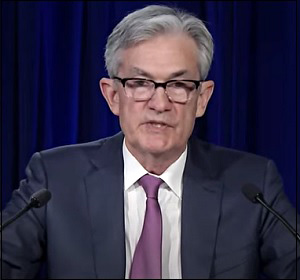

Fed Chairman Jerome Powell had one focus and one focus only at yesterday’s press conference. That was to come across as the epitome of prudence and law-abiding virtue. Unfortunately, the cold, hard facts on the ground keep getting in the way of that narrative.

Powell first read an opening statement which included this rather remarkable statement about the trillions of dollars in emergency funding facilities that the Fed has already rolled out, or plans to roll out, to bail out Wall Street’s excesses:

“Many of these programs rely on emergency lending powers that are available only in unusual circumstances such as those we find ourselves in today. We are deploying these lending powers to an unprecedented extent, enabled in large part by the financial backing and support from Congress and the Treasury…I would stress that these are lending powers and not spending powers. The Fed cannot grant money to particular beneficiaries. We can only make loans to solvent entities, with the expectation that the loans will be repaid.” (Italic emphasis added.)

The truth of the matter is that the Fed has adopted the mindset of Wall Street: it’s legal if you can get away with it. The Fed didn’t start its emergency programs as a result of the coronavirus COVID-19 pandemic as Powell suggests in the statement above. It started these programs on September 17, 2019 – three months before the first case of the virus had been announced anywhere in the world. That emergency action occurred when Wall Street banks refused to lend to each other in the repo loan market – just as they had in the financial panic of 2008.

The Fed didn’t officially invoke the emergency lending section of the Federal Reserve Act known as 13(3) for its repo loans, it simply made more than $9 trillion in super cheap loans to the trading houses of Wall Street over the next six months and refused to provide the names of the firms to whom the money went, leaving the public and shareholders in the dark as to what firm(s) was in trouble and getting a bailout.

Powell next told reporters yesterday that the Fed has only “lending powers and not spending powers.” Powell was attempting to appease academics, think tank scholars and media critics who believe it is violating the Federal Reserve Act and usurping the spending role of an elected Congress by buying up trillions of dollars in bonds.

It’s pretty silly for Powell to attempt to float the illusion that the Fed is adhering to its mandated role as just a lender-of-last-resort when its own balance sheet shows that, as of last Wednesday, it owns the following: $3.9 trillion in Treasury securities and $1.6 trillion in Mortgage-Backed Securities which it has purchased outright with money it creates out of thin air.

Securities owned outright by the Fed now make up 83 percent of its $6.6 trillion balance sheet. That doesn’t sound like a central bank that understands that it is just a lender-of-last-resort and has no spending powers.

In addition, since the Fed’s Commercial Paper Funding Facility (CPFF) was announced on March 23, it has purchased $2.7 billion of commercial paper, according to its latest balance sheet.

And really making waves are the Fed’s imminent plans to purchase outright upwards of $500 billion in corporate bonds, including junk bonds and junk bond ETFs (Exchange Traded Funds), under new facilities known as the Primary Market Corporate Credit Facility and the Secondary Market Corporate Credit Facility.

The sleight of hand that the Fed is using to pretend that it’s only lending money under its emergency 13(3) powers is its creation, via the New York Fed, of Special Purpose Vehicles (SPVs) as Limited Liability Corporations (LLCs). The New York Fed loans the money to the SPV it created and then that entity does the actual buying of the bonds or commercial paper.

Powell also inferred in his statement yesterday that the Fed’s massive Wall Street bailout programs had the “financial backing and support from Congress and the Treasury.” They may have the support of the former foreclosure king and Goldman Sachs banker Steve Mnuchin who failed up to become President Trump’s U.S. Treasury Secretary, but there is nothing in the CARES Act legislation to suggest that Congress has given the green light to the Fed becoming a junk bond market maker on Wall Street.

The Fed had been in existence for 95 years when the 2008 financial crisis struck. In all that time, the Fed had never engaged in buying up toxic assets from Wall Street. It understood that the Federal Reserve Act restricted its activity to a lender-of-last-resort. But this is how the government audit of the Federal Reserve by the Government Accountability Office in 2011 described the Fed’s “purchases” of toxic assets from Wall Street during the last financial crisis:

“Maiden Lane (Mar. 16, 2008) Special purpose vehicle created to purchase approximately $30 billion of Bear Stearns’s mortgage-related assets.”

“Maiden Lane II (Nov. 10, 2008) Special purpose vehicle created to purchase RMBS [Residential Mortgage Backed Securities] from securities lending portfolio of AIG subsidiaries.” Peak amount outstanding $20 billion.

“Maiden Lane III (Nov. 10, 2008) Special purpose vehicle created to purchase collateralized debt obligations on which AIG Financial Products had written credit default swaps.” Peak amount outstanding $24 billion.

“CPFF – Commercial Paper Funding Facility (Oct. 7, 2008–Feb. 1, 2010) Provided loans to a special purpose vehicle to finance purchases of new issues of asset-backed commercial paper and unsecured commercial paper from eligible issuers.” Peak amount outstanding $348 billion.

The Federal Reserve went rogue from December 2007 through at least the middle of 2010. But because the government audit of the Fed was not released until July 21, 2011 and the Dodd-Frank financial reform legislation was signed into law a year earlier, Congress failed to meaningfully rein in future abuses by the Fed.

Several reporters put Powell in the hot seat at yesterday’s press conference. Victoria Guida, reporter for Politico, reminded Powell that he had warned earlier this year that the federal debt was on an unsustainable path. Guida asked him if all of this new stimulus spending should be a concern.

Powell said that he’s been a long-time advocate for the U.S. to return to a sustainable path where the national debt is concerned. He remarked, as he has repeatedly in the past, that “the debt is growing faster than the economy.” But Powell cautioned that “This is not the time to act on those concerns,” adding that “The time will come, again, and reasonably soon I think, where we can think about a long-term way to get our fiscal house in order and we absolutely need to do that.”

Let that sink in for a moment. Before the 2008 financial crisis the Fed’s balance sheet stood at $929 billion as of December 26, 2007. After the crisis, the Fed’s balance sheet peaked at $4.5 trillion in 2015. The Fed promised to “normalize” its balance sheet. But instead of materially reducing its bond holdings, the Fed’s balance sheet has now skyrocketed to an unprecedented $6.6 trillion and is rapidly heading toward $10 trillion when all of its emergency programs are implemented. Can the Fed seriously lecture Congress about its out of control debt?

Scott Horsley of NPR also asked Powell a probing question, stating: “After the financial crisis banks were instructed to up their capital so they could weather an economic shock. What kind of steps do you think we need to take for the economy writ large to make it more resilient to this kind of shock?”

Powell kicked the can down the road, responding that “the time will come for a careful assessment to those questions; it’s early to be asking them; we’re still putting out the fire.” Powell did concede that the size of this shock will reveal weaknesses in the financial architecture “and we’ll have to go to work on those.”

The smoking gun question as to how the mega banks on Wall Street could have been well capitalized on September 17, 2019 — long before the COVID-19 outbreak — while needing the Fed to step in as the lender-of-last-resort to the tune of hundreds of billions of dollars a week, was never asked during the press conference.

In keeping with social distancing guidelines, the press conference was conducted with reporters asking questions from remote locations. A collage of reporters’ faces appeared on the Fed’s virtual live stream of the event, giving the press conference even more of an Alice in Wonderland quality.