By Pam Martens and Russ Martens: March 25, 2020 ~

Senate Majority Leader Mitch McConnell and New York State Senator and Minority Leader Chuck Schumer trotted out to the Senate floor after midnight last night to announce that they had reached a deal on the government stimulus package – the text of which the American public has not seen and only snippets of which have been seen by the members of Congress. Neither the Senate nor the House of Representatives have yet to vote on the bill.

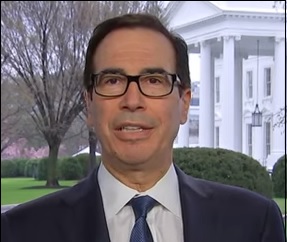

Americans got their first whiff that this was going to be another massive giveaway to Wall Street banks, just as happened from 2007 to 2010, when White House economic adviser Larry Kudlow appeared at the White House briefing yesterday evening. Kudlow revealed that the stimulus plan is actually a $6 trillion package — $2 trillion to struggling Americans and $4 trillion to dispense as Treasury Secretary Steve Mnuchin and the Federal Reserve see fit. Since the Federal Reserve has seen fit since September 17 of last year to flood the trading houses of Wall Street with $9 trillion cumulatively in revolving loans, one can reasonably expect that this is where the new $4 trillion will be going.

This is what Kudlow said at the press conference:

“I just wanna walk through a couple of key points. This legislation is urgently needed to bolster the economy, provide cash injections, liquidity and stabilize financial markets; to get us through a difficult period, a difficult and challenging period in the economy facing us right now. But also to position us for what I think can be an economic rebound later this year.

“We started the year very strong and then we got hit by the coronavirus, in ways that probably nobody imagined possible. We’re dealing with that as best we can. This package will be the single largest Main Street assistance program in the history of the United States…

“And finally, I want to mention the Treasury’s Exchange Stabilization Fund. That will be replenished. It’s important because that fund opens the door for Federal Reserve fire power to deal in a broad-based way through the economy for distressed industries, for small businesses, for financial turbulence. You’ve already seen the Fed take action. They intend to take more action. And in order to get this we have to replenish the Treasury’s emergency fund. It’s very, very important. Not everybody understands that. That fund, by the way, will be overseen by an oversight board and an Inspector General. It will be completely transparent. So, the total package here comes to roughly $6 trillion — $2 trillion direct assistance, roughly $4 trillion in Federal Reserve lending power.”

If you are an average American, you have no idea what Kudlow is talking about. How is the U.S. Treasury going to take $500 billion of taxpayers’ money that is dumped into its Exchange Stabilization Fund, hand part of that over to the Federal Reserve, and get $4 trillion in bailouts via the Fed?

It’s really quite easy. The first thing to understand is that we are the only “democracy” in the world that has turned the actual creation of unlimited amounts of our money over to a private entity owned by mega Wall Street banks. We’re talking about the New York Fed. (See related articles below.)

To understand what the Treasury and Fed now have in mind, you have to know what the Fed did the last time around. In order to bail out Bear Stearns and the giant insurer, AIG, the New York Fed set up opaque Special Purpose Vehicles (SPVs) called Maiden Lane I, Maiden Lane II and Maiden Lane III.

Maiden Lane I purchased approximately $30 billion of Bear Stearns’s toxic mortgage-related assets. Maiden Lane II purchased billions of dollars of residential mortgage-backed securities from the lending portfolio of AIG subsidiaries. Maiden Lane III purchased collateralized debt obligations on which AIG Financial Products had written credit default swaps. All three of these programs were actually bailouts of Wall Street’s mega banks. Over $93 billion of the money that went in the front door of AIG ended up going out AIG’s back door to pay off the Wall Street banks that would have had to report tens of billions of dollars in losses had the Fed not paid 100 cents on the dollar for AIG’s debts to the banks.

The Treasury has already committed to become a 10 percent equity holder in a new round of Special Purpose Vehicles being set up or planned by the New York Fed.

This is how the U.S. Treasury describes its Exchange Stabilization Fund (ESF) – pay close attention to the words we have italicized:

“The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury (‘the Secretary’).

“The Secretary is responsible for the formulation and implementation of U.S. international monetary and financial policy, including exchange market intervention policy. The ESF helps the Secretary to carry out these responsibilities. By law, the Secretary has considerable discretion in the use of ESF resources.

“The legal basis of the ESF is the Gold Reserve Act of 1934. As amended in the late 1970s, the Act provides in part that ‘the Department of the Treasury has a stabilization fund …Consistent with the obligations of the Government in the International Monetary Fund (IMF) on orderly exchange arrangements and an orderly system of exchange rates, the Secretary …, with the approval of the President, may deal in gold, foreign exchange, and other instruments of credit and securities.”

If this legislation passes as drafted, U.S. Treasury Secretary Steve Mnuchin will gain enormous powers. Is he someone whom the American people can trust?

This is what Senator Ron Wyden had to say during Mnuchin’s January 19, 2017 confirmation hearing:

“Mr. Mnuchin’s career began in trading the financial products that brought on the housing crash and the Great Recession. After nearly two decades at Goldman Sachs, he left in 2002 and joined a hedge fund. In 2004, he spun off a hedge fund of his own, Dune Capital. It was only a few lackluster years before Dune began to wind down its investments in 2008.

“In early 2009, Mr. Mnuchin led a group of investors that purchased a bank called IndyMac, renaming it OneWest. OneWest was truly unique. While Mr. Mnuchin was CEO, the bank proved it could put more vulnerable people on the street faster than just about anybody else around.

“While he was CEO, a OneWest vice president admitted in a court proceeding to ‘robo-signing’ upward of 750 foreclosure documents a week. She spent less than 30 seconds on each, and in fact, she had shortened her signature to speed the process along. Investigations found that the bank frequently mishandled documents and skipped over reviewing them. All it took to plunge families into the nightmare of potentially losing their homes was 30 seconds of sloppy paperwork and a few haphazard signatures.

“These kinds of tactics were in use between 2009 and 2014, a period during which the bank foreclosed on more than 35,000 homes. ‘Widow foreclosures’ on reverse mortgages – OneWest did more of those than anybody else. The bank defends its record on loan modifications, but it was found guilty of an illegal practice known as ‘dual tracking.’ One bank department tells homeowners to stop making payments so they can pursue modification, while another department presses on and hurtles them into foreclosure anyway.”

Before the confirmation hearing concluded, Senator Wyden added the following:

“Mr. Mnuchin, a month ago you signed documents and an affidavit that omitted the Cayman Island fund, almost $100 million of real estate, six shell companies and a hedge fund in Anguilla. This was not self-corrected. The only reason it came to light was my staff found it and told you it had to be corrected.”

Until Americans find their backbone, this is the “democracy” we are preparing to hand over to our children and grandchildren — a nation crippled by debt and living under the jackboot of corrupt politicians in service to their overlords on Wall Street.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

Federal Reserve Spokesman Explains How It Creates Money Out of Thin Air to Pump Out to Wall Street