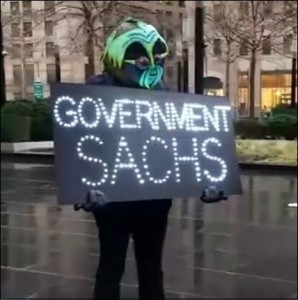

By Pam Martens and Russ Martens: January 23, 2020 ~

The head of the Federal Reserve Bank of Dallas (Robert S. Kaplan), the head of the Federal Reserve Bank of Minneapolis (Neel Kashkari), the Secretary of the U.S. Treasury (Steve Mnuchin), the President of the European Central Bank (Mario Draghi) and the head of the Bank of England (Mark Carney) all have two things in common: they sit atop vast amounts of money and they are all alums of Goldman Sachs. In addition, the immediate past President of the Federal Reserve Bank of New York, William Dudley, which secretly sluiced over $29 trillion to bail out Wall Street banks during the financial crisis and has now opened its money spigot for trillions of dollars more, worked at Goldman Sachs for more than two decades, rising to the rank of partner and U.S. Chief Economist.

Goldman Sachs has been variously depicted as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money,” by Matt Taibbi of Rolling Stone; or the amoral investment bank that bundled mortgages it knew would fail and sold them to their clients as good investments so that it could make millions betting against them (shorting); or the place where greed became so over-the-top that a vice president, Greg Smith, resigned on the OpEd page of the New York Times, writing that his colleagues callously talked “about ripping their clients off.” Smith’s bosses were implicated as well: “Over the last 12 months I have seen five different managing directors refer to their own clients as ‘muppets,’ ” wrote Smith.

Today, Goldman Sachs is under a criminal investigation by the U.S. Department of Justice and under a criminal indictment by Malaysia for its role in bribery and embezzlement of its sovereign wealth fund known as 1MDB.

Goldman Sachs’ notorious history has not stopped its alum from magically landing in government positions that control, create or funnel giant piles of money. Despite Donald Trump’s first run for President on a populist platform of cleaning the swamp in Washington, a full month before he even took his seat in the Oval Office, he had nominated or appointed the following individuals to his administration: Steve Mnuchin, a former 17-year veteran of Goldman Sachs and a foreclosure king during the financial crisis to be his Treasury Secretary; Steve Bannon, who had previously worked in Mergers and Acquisitions at Goldman, was to become Trump’s Senior Counselor and Chief White House Strategist.

Gary Cohn, the sitting President and Chief Operating Officer of Goldman, was picked by Trump to lead the National Economic Council and be his chief strategist in developing his economic policy. In the two years prior to the 2008 financial crash on Wall Street, Cohn was Co-President of Goldman. Cohn became a multi-millionaire from the business done in those years, earning $27.5 million in restricted stock and options just in the year 2006. As Greg Gordon of McClatchy Newspapers would report in 2009, a key part of Goldman’s business in the years before the crash operated like this: “In 2006 and 2007, Goldman Sachs Group peddled more than $40 billion in securities backed by at least 200,000 risky home mortgages, but never told the buyers it was secretly betting that a sharp drop in U.S. housing prices would send the value of those securities plummeting.”

Cohn and Bannon have since left the Trump administration. Mnuchin remains as U.S. Treasury Secretary.

Mnuchin is hardly the first Goldman Sachs alum to serve as U.S. Treasury Secretary. Robert Rubin was U.S. Treasury Secretary in the Bill Clinton presidency. Rubin was a long-tenured partner at Goldman Sachs who rose to the rank of Co-Chairman of the firm. Rubin was a key player in the repeal of the Glass-Steagall Act during the Clinton administration. Glass-Steagall had kept the U.S. financial system safe for 66 years by banning Wall Street’s trading houses from owning federally-insured, deposit-taking banks. Just nine years after the repeal, Wall Street would collapse again in a replay of 1929 – another period when Wall Street’s trading houses owned deposit-taking banks and used the funds to make fatal, speculative gambles.

Henry (Hank) Paulson served as U.S. Treasury Secretary in the George W. Bush administration and was on hand to make sure Wall Street got its massive bailout in 2008 during the worst financial crash since the Great Depression. Paulson received a massive windfall on his sale of his $480 million in Goldman Sachs’ stock when he left Goldman as CEO to become U.S. Treasury Secretary in 2006, getting out ahead of the details of Goldman’s role in the subprime debt crisis.

Sometimes the revolving door swings the other way at Goldman Sachs. E. Gerald Corrigan served as the President of the New York Fed from 1985 to 1993. One year later, Corrigan was on the payroll of Goldman Sachs as a Managing Director. He made partner two years later and worked there for the next 22 years.

After landing at Goldman, Corrigan co-chaired a secretive group that was made up of the chief risk officers of the Wall Street banks. It was called the Counterparty Risk Management Policy Group (CRMPG). The group’s plan was to periodically release erudite-sounding reports to regulators suggesting that Wall Street could police itself under a set of “Guiding Principles” in order to escape further scrutiny or regulation of its insane levels of derivatives.

Representatives from banks like Lehman Brothers, Citigroup, Bear Stearns and Merrill Lynch sat on key committees of the Group and helped to formulate the “Guiding Principles” for Wall Street. Lehman Brothers filed bankruptcy on September 15, 2008 – just five weeks after a report from the group on managing risk was released. One day before the Lehman collapse, Merrill Lynch had collapsed into the arms of Bank of America. In March of that year, Bear Stearns had flamed out spectacularly and was absorbed by JPMorgan with billions of dollars in help from the New York Fed. Also in 2008, Citigroup received the largest taxpayer bailout in U.S. history. It was later revealed by the Government Accountability Office that Citigroup had also secretly received over $2.5 trillion in cumulative, below-market, loans from the New York Fed – a significant part of which were made against collateral of junk bonds and stocks, which were in freefall at the time the New York Fed accepted them as collateral.

According to an email obtained by the Financial Crisis Inquiry Commission (FCIC) from Patrick M. Parkinson of the Federal Reserve to Steven Shafran (an official of the U.S. Treasury Department who had joined it in February 2008, also from Goldman Sachs to serve under Paulson), the Counterparty Risk Management Policy Group’s plan for dealing with a major defaulting counterparty was going to be relied upon. Shafran wrote as follows:

“Tim [Geithner, President of the New York Fed] will ask Corrigan to accelerate formation of the private-sector default management group (DMG) that was proposed by CRMPG III. Specifically, we will ask the group to advise us on: (1) the information that we would need to obtain from a troubled dealer to assess the potential impact of closeout of a dealer’s OTC derivatives books on its counterparties and on financial markets; and (2) the information that a potential acquirer of a troubled dealer’s OTC derivatives book (and possibly also related hedges) to assess the potential risks and returns from such an acquisition. The group’s advice (and what we learn in the course of inquiries at Lehman) would inform the next steps in the MIS project and ultimately what our expectations will be with respect to dealer MIS.”

The email was dated September 5, 2008 and marked “Highly Confidential.” Just 10 days later, Lehman Brothers filed bankruptcy, triggering a mass wave of panic and contagion among its derivative counterparties around the globe.

The insidious role of Wall Street banks in the takeover of key federal government posts, in the financing of federal candidates’ political campaigns, in behind-the-scenes enactment of legislation to further their disastrous money schemes, and in the effective takeover of the Presidential transition teams that pick the President’s cabinet, is a public corruption scandal of epic proportion that the front pages of U.S. newspapers have ignored for far too long. It’s up to engaged Americans to force the debate with letters to the editor and protests in front of newspaper offices across America.

Related Articles:

Goldman Sachs Top Lawyer Is Part of a Secret Banking Cabal as CEO Blankfein Denies One Exists

Goldman Sachs’ Rich Man’s Bank Backstopped by You and Me

Goldman Sachs Beats Another Fraud Rap: Can the Public Ever Get Justice in New York Courts?

Blowing the Whistle on the New York Fed and Goldman Sachs

Goldman Sachs Smears Greg Smith: Shades of Christian Curry

Barofsky Book: Goldman Sachs and Morgan Stanley Would Have Failed Next