By Pam Martens and Russ Martens: November 20, 2019 ~

The New York Fed has now pumped out upwards of $3 trillion in a period of 63 days to unnamed trading houses on Wall Street to ease a liquidity crisis that has yet to be credibly explained. In addition, it has launched a new asset purchase program, buying up $60 billion each month in U.S. Treasury bills. Based on the continuing escalation of its plans, it appears to be testing the limits of what the public will tolerate. We thought it was time to answer the question: who exactly owns the New York Fed and its magical money spigot that can pump trillions of dollars into Wall Street at the press of a button.

The largest shareowners of the New York Fed are the following five Wall Street banks: JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of New York Mellon. Those five banks represent two-thirds of the eight Global Systemically Important Banks (G-SIBs) in the United States. The other three G-SIBs are Bank of America, a shareowner in the Richmond Fed; Wells Fargo, a shareowner of the San Francisco Fed; and State Street, a shareowner in the Boston Fed.

G-SIBs have the ability to inflict systemic contagion on the entire global banking system (as happened in 2008) and thus must be monitored closely for financial stability. JPMorgan Chase, Citigroup, Goldman Sachs, and Morgan Stanley are also four of the five largest holders of high-risk derivatives. (Bank of America is the fifth.)

The five mega banks that are the major shareowners of the New York Fed are also supervised by the New York Fed, despite participating in the election of two-thirds of its Board of Directors. James Gorman, Chairman and CEO of Morgan Stanley, currently sits on the New York Fed Board. Jamie Dimon, Chairman and CEO of JPMorgan Chase, previously served two three-year terms on the Board.

These same Wall Street banks also participate in various advisory groups with the New York Fed where they hash out “best practices” for their industry. Those “best practices” were not sufficient to prevent JPMorgan Chase from becoming a three-count felon, Citigroup a one-count felon, and four of the banks (all but Bank of New York Mellon) from actively engaging in creating and selling subprime investments that blew up the U.S. financial system, the nation’s economy and a good swath of Wall Street in 2008.

There are 12 regional Federal Reserve banks of which the New York Fed is only one. But during the financial crisis, the New York Fed was given unprecedented powers by the Federal Reserve Board of Governors in Washington, D.C. to create over $29 trillion in electronically-engineered money to bail out Wall Street. A significant portion of the $29 trillion went to loans that were collateralized by stocks and junk bonds – an unprecedented action for the Federal Reserve. In some instances, the Fed threw its rule book under the bus and didn’t make loans at all, opting instead to buy up toxic assets outright through Special Purpose Vehicles it created. And despite its mandate to make properly collateralized loans to only solvent banks, it made over $2.5 trillion in loans to Citigroup, much of that after the bank was clearly insolvent.

The $29 trillion created electronically by the New York Fed from 2007 to the middle of 2010 is astronomical compared to the loans made by the Federal Reserve following the 1929 financial crash and early years of the Great Depression. Those Fed loans aggregated to only $1.5 million or approximately $25.5 million in today’s dollars.

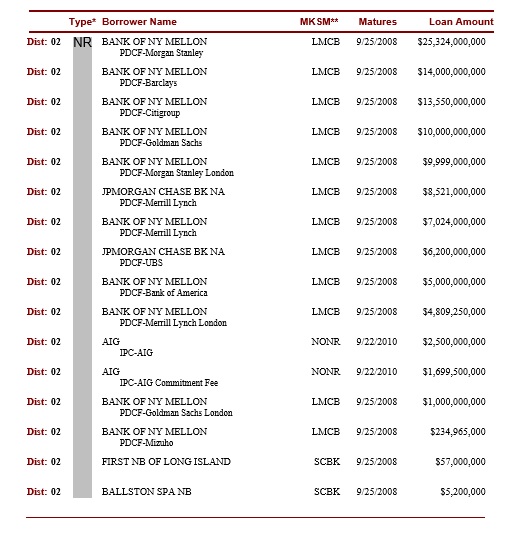

Consider that $25.5 million in today’s dollars that was distributed by the Fed from 1932 to 1936 to just one day in 2008. On September 24, 2008 the New York Fed pounded away on its money button to pump out $110 billion to the miscreants of Wall Street. (See chart below: where Bank of New York Mellon and JPMorgan Chase are listed in capitalized letters, they were acting as intermediaries for the New York Fed to disburse Primary Dealer Credit Facility (PDCF) money to the securities firms listed directly below each entry.) The $25.3 billion that Morgan Stanley received on just that one day is 1,000 times all the money the Fed disbursed during the 1930s.

The listing below came directly from the Federal Reserve when it was forced to hand over its Discount Window documents on March 31, 2011 after losing a multi-year court battle with the media to keep its money spigot secret.

A Sampling of Loans Made on Just One Day, September 24, 2008, by the New York Fed (Source: Federal Reserve Board of Governors)

The banks of New York and their foreign derivatives counterparties were the largest beneficiaries of the $29 trillion bailout and yet Congress has allowed the New York Fed to continue to supervise these Wall Street banking behemoths just as if the collapse in 2008 never occurred.

Unlike the Federal Reserve Board of Governors in Washington, D.C., which is considered an independent federal agency, the regional Federal Reserve banks are owned by their members banks. They are private institutions.

According to the December 31, 2018 financial statement for the New York Fed, the banks in its region owned 205,202,792 shares of stock in the New York Fed, which represented $10.26 billion of paid-in capital. This is how the New York Fed explains who its largest shareholders are:

“The Federal Reserve Act requires that each member bank subscribe to the capital stock of the Reserve Bank in an amount equal to 6 percent of the capital and surplus of the member bank. These shares are nonvoting, with a par value of $100, and may not be transferred or hypothecated. As a member bank’s capital and surplus changes, its holdings of Reserve Bank stock must be adjusted. Currently, only one-half of the subscription is paid in, and the remainder is subject to call. A member bank is liable for Reserve Bank liabilities up to twice the par value of stock subscribed by it.”

While the shares are non-voting in terms of quantity of shares held, the banks do get a vote in electing the Board of Directors of their regional Fed bank. Each regional Fed board has nine members. Six of the directors are elected by member banks. Three of the directors are appointed by the Federal Reserve Board of Governors in Washington, D.C.. From among these three, the Board of Governors selects a chairman and a deputy chairman of the given Bank’s board.

That might help to explain why Tim Geithner, when he was President of the New York Fed, was wining and dining Sandy Weill, the Chairman and CEO of Citigroup, who had sat on his Board, instead of reining in Citigroup’s wild gambles before it blew itself up. (Geithner failed up to become U.S. Treasury Secretary, where he continued to coddle the Wall Street banks.) Or it might help to explain why Jamie Dimon, the Chairman and CEO of JPMorgan Chase, hasn’t been booted out of the bank despite presiding over three criminal felony charges, to which the bank pleaded guilty, and the current, ongoing prosecutions of its traders for turning the JPMorgan Chase precious metals trading desk into a racketeering enterprise according to the U.S. Department of Justice. (While Dimon was defending his bank against losing $6.2 billion of its depositors’ money in derivative gambles in London in 2012, he was actually sitting as a member of the Board of Directors at the New York Fed, his regulator.)

It’s long past the time to remove the money button from the New York Fed along with its Wall Street cop badge. As it is currently structured, it’s more dangerous than the banks in its district.

Related Articles:

The Official Video from the Federal Reserve on How It Creates Electronic Money

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

New Documents Show How Power Moved to Wall Street, Via the New York Fed