By Pam Martens and Russ Martens: October 11, 2019 ~

It’s long past the time for the U.S. Congress to ask the overarching question: is the New York Fed’s massive loan program to Wall Street firms even legal? And was it legal from 2007 to 2010 during the financial collapse on Wall Street?

The Federal Reserve system was created in 1913 with a Discount Window that was to be the lender-of-last resort to deposit-taking banks to prevent panics and bank runs from bringing down the U.S. banking system. To this day, only deposit-taking institutions are allowed to borrow at the Fed’s Discount Window.

The core function of deposit-taking banks throughout U.S. history has been to use those deposits to lend to worthy businesses that can help grow the U.S. economy, keep America competitive, and bring good paying jobs to the American people.

Never in its history has the Federal Reserve, the U.S. central bank, been authorized to function as the lender of last resort to Wall Street stock trading firms. Those firms are supposed to be part of a free and efficient market system where those that take on undue risks trading stocks, bonds and derivatives are allowed to fail if their gambles go south. But during the financial crisis of 2007 and 2008, the Federal Reserve set up loan programs specifically designed to bail out the bad bets of securities firms on Wall Street. The Fed’s current loan program appears to be doing the exact same thing.

Below is a list of the 24 Wall Street firms (known as primary dealers) that are exclusively eligible to receive the hundreds of billions of dollars in overnight and longer term loans from the Fed via its regional bank known as the Federal Reserve Bank of New York (New York Fed). This loan program began abruptly on September 17 of this year.

Of the 24 firms, only one has the word “bank” in its name. That’s the U.S. branch of the Bank of Nova Scotia. Eleven of the firms have the word “Securities” in their name and are listed at Wall Street’s self-regulator, FINRA, as broker dealers – meaning their primary activity is selling securities (stocks, bonds, etc.) for their customers or their own account. The rest are investment banks that underwrite security offerings and have trading desks – again, not deposit taking banks. (Some, of course, are units of so-called universal banks, which thanks to the repeal of the Glass-Steagall Act in 1999, are allowed to own federally-insured commercial banks as well as all the high-risk stock trading businesses.)

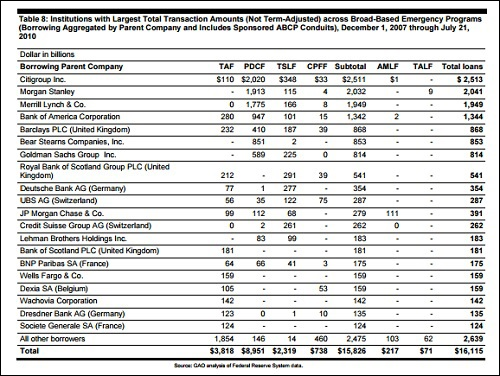

Among the list of 24 firms are Citigroup Global Markets and Morgan Stanley. Both of these are investment banks and ranked number 1 and number 2 on the New York Fed’s insidious bailout program during the financial crisis known as the Primary Dealer Credit Facility. (See chart below.) Citigroup Global Markets borrowed a mind-numbing $2.02 trillion in revolving loans from that program while Morgan Stanley borrowed $1.9 trillion of the total $8.95 trillion that was funneled to Wall Street securities firms. The PDCF loan facility lasted from March 16, 2008 to February 1, 2010 – a very long time for what the Fed characterized as an “emergency” action.

According to the Government Accountability Office’s audit of the Federal Reserve’s lending programs during the financial crisis, the PDCF worked like this:

“On March 16, 2008, the Federal Reserve Board announced the creation of PDCF to provide overnight collateralized cash loans to the primary dealers. FRBNY [Federal Reserve Bank of New York] quickly implemented PDCF by leveraging its existing legal and operational infrastructure for its existing repurchase agreement relationships with the primary dealers… Eligible PDCF collateral initially included collateral eligible for open-market operations as well as investment-grade corporate securities, municipal securities, and asset-backed securities, including mortgage-backed securities.”

But six months after PDCF began, Wall Street had run out of good collateral but still needed trillions of dollars in revolving loans. So the New York Fed started accepting dodgy collateral. The GAO report tells us this:

“On September 14, 2008, shortly before Lehman Brothers announced it would file for bankruptcy, the Federal Reserve Board announced changes to TSLF and PDCF to provide expanded liquidity support to primary dealers. Specifically, the Federal Reserve Board announced that TSLF-eligible collateral would be expanded to include all investment-grade debt securities and PDCF-eligible collateral would be expanded to include all securities eligible to be pledged in the tri-party repurchase agreements system, including noninvestment grade securities and equities.”

In other words, at a time when the stock market was in a state of freefall, the New York Fed was accepting “equities” (stocks) as collateral and “noninvestment grade securities,” a polite term for junk bonds: All being done to bail out Wall Street’s investment banks and stock-trading broker dealers – a job which has never been part of its mission.

One has to wonder just how long it will be before the New York Fed, openly or secretly again, starts to accept dodgy collateral from Wall Street for its loans.

It’s not a comforting thought that just one year ago we were reporting on the voices advocating for the Federal Reserve to be allowed to buy up stocks during the next Wall Street crisis of its own making. (See The Chorus Grows for the Fed to Buy Up Stocks in the Next Wall Street Crisis.)

Note: The GAO data excludes some Fed programs. For the full tally of $29 trillion, see this report from the Levy Economics Institute.