By Pam Martens and Russ Martens: October 2, 2019 ~

Two notable things happened on Monday, September 16, 2019. Rates started to spike in the overnight loan (repo) market, reaching a high of 10 percent the next day and forcing the Federal Reserve to step in as a lender of last resort for the first time since the financial crisis. The Fed has had to intervene every business day since then with overnight loans, funneling hundreds of billions of dollars to its primary dealers, while also providing $150 billion in 14-day term loans to unnamed banks.

The other notable thing to occur on September 16 was this: The largest bank in the United States, JPMorgan Chase, had its precious metals desk charged by the U.S. Department of Justice with being a criminal enterprise for approximately eight years as it rigged the prices of gold, silver and other precious metals. The head of that desk and two other precious metals traders were charged with racketeering under the RICO statute that is typically reserved for organized crime. The Justice Department said that the traders and their co-conspirators (others may be named at a later date) “conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.”

Wall Street veterans cannot remember any other time in history when the RICO statute (Racketeer Influenced and Corrupt Organizations Act) was used against a large bank in the United States. It was, however, used to indict members of the Gambino and Bonanno crime families in 2017.

JPMorgan Chase and its wily Chairman and CEO, Jamie Dimon, knew that the Justice Department was likely to be making serious charges about its precious metals desk. One of its traders on that desk, John Edmonds, had pleaded guilty to the Justice Department in October of last year and was cooperating in the probe.

In its February 2019 10-K filing with the Securities and Exchange Commission, JPMorgan Chase indicated that it knew more charges could be coming, writing that: “Various authorities, including the Department of Justice’s Criminal Division, are conducting investigations relating to trading practices in the precious metals markets and related conduct.”

Yesterday, Reuters’ David Henry reported the following:

“Analysts and bank rivals said big changes JPMorgan made in its balance sheet played a role in the spike in the repo market, which is an important adjunct to the Fed Funds market and used by the Fed to influence interest rates…

“Publicly-filed data shows JPMorgan reduced the cash it has on deposit at the Federal Reserve, from which it might have lent, by $158 billion in the year through June, a 57% decline.”

Reuters quotes an unnamed executive from another Wall Street bank calling JPMorgan’s cash move from the Fed “massive.” And, indeed, moving $158 billion within a 6-month period is not small change. The Reuters’ article notes further that JPMorgan’s draw down on its cash “accounted for about a third of the drop in all banking reserves at the Fed during the period.”

Jamie Dimon is always blathering on about his bank’s “fortress balance sheet.” So exactly why did he need to draw down $158 billion in cash from the bank’s deposits at the Federal Reserve. JPMorgan Chase has over 5,000 bank branches across the United States taking in deposits daily from average Americans.

Dimon had good reasons to be concerned about a trading desk at his bank being labeled a criminal enterprise under the RICO statute. That’s because, equally unprecedented, his bank already has admitted to three criminal felony counts within the past five years: two for its negligent handling of the business bank account for Bernie Madoff’s Ponzi scheme for decades and one for its role in the rigging of the foreign currency exchange market.

The latest RICO charges could put the bank in serious jeopardy. JPMorgan Chase is still under probation in its plea agreement for the role it played in rigging the foreign currency exchange market. It entered into that plea agreement on May 20, 2015 but a Federal District court did not approve the deal until 2017. This means that its three-year probation period does not end until January 2020.

JPMorgan Chase has acknowledged in a 10-K filing with the SEC that it remains on probation, writing as follows:

“The Firm previously reported settlements with certain government authorities relating to its foreign exchange (‘FX’) sales and trading activities and controls related to those activities. FX-related investigations and inquiries by government authorities, including competition authorities, are ongoing, and the Firm is cooperating with and working to resolve those matters. In May 2015, the Firm pleaded guilty to a single violation of federal antitrust law. In January 2017, the Firm was sentenced, with judgment entered thereafter and a term of probation ending in January 2020.”

As part of its plea agreement, JPMorgan Chase agreed to “not commit another crime in violation of the federal laws of the United States” during the term of probation.

There are two other unprecedented aspects about JPMorgan Chase. Despite three felony counts and now having one of its trading desks labeled a criminal enterprise under RICO, the man who has been at the helm of the bank throughout this crime spree, Jamie Dimon, remains as its Chairman and CEO. The bank’s Board has taken no action to oust Dimon as far as the public is aware, thus effectively condoning serial crime as an endorsed business model for a bank.

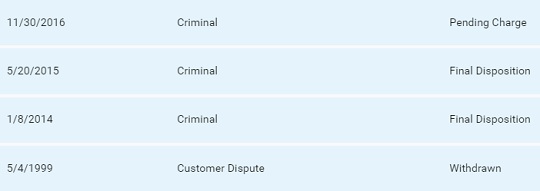

The other unprecedented aspect is that if a retail stockbroker had multiple criminal felony counts on his record – directly or indirectly – he would be unemployable on Wall Street. But if one goes to FINRA, Wall Street’s self-regulator, Dimon’s record shows up as follows on BrokerCheck.

Each criminal matter carries the following caveat: “Mr. Dimon is disclosing this matter because, in certain respects unrelated to the underlying conduct, he may be deemed to have exercised control over JPMC. There are no allegations or facts set forth in the information or plea agreement that refer to Mr. Dimon personally.”

Most corporate Boards believe that the culture and ethics of the company are set by the CEO and serial acts of criminality show a failure of leadership.

It is equally noteworthy that FINRA lists another “pending charge” relating to JPMorgan Chase that has yet to make headlines in the U.S. The pending charge reads: “Complicity in tax fraud under articles 1741, 1742 and 1750 of the French General Tax Code and articles 121-2, 121-6, 121-7 and 121-38 of the French Penal Code.”

The tax fraud case dates back to 2016 when the bank was indicted in France. French prosecutors accused it of helping the former CEO of Wendel SA, Jean-Bernard Lafonta, and other personnel at the company commit tax fraud. There has been no final disposition in that case.