By Pam Martens and Russ Martens: February 27, 2018

MarketWatch’s Tomi Kilgore reported on February 13, 2018 that JPMorgan analyst Stephen Tusa “became even more bearish” on General Electric (which has been a component of the Dow Jones Industrial Average since its creation in 1896). Kilgore reports further that the JPMorgan analyst had “slashed his stock price target to $14” from his previous target of $16. Only Deutsche Bank’s stock analyst, John Inch, says Kilgore, has a lower target, at $13.

JPMorgan, along with all of the other major Wall Street firms, is still allowed to issue research ratings on stocks despite the firms being charged by the Securities and Exchange Commission in 2003 in the epic research scandal on Wall Street.

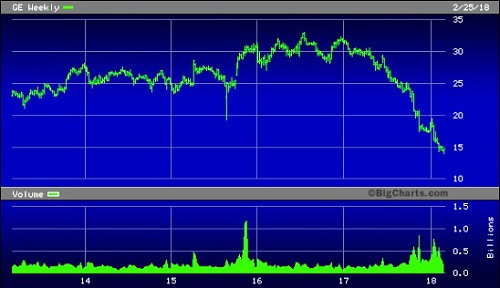

Yesterday morning, as the Dow was on its way to closing up a whopping 399 points, GE plunged to a nickel below the JPMorgan analyst’s prediction, touching an intraday low of $13.95.

JPMorgan knows a lot about GE because it was part of a syndicate of Wall Street banks that raised $8.7 billion for GE just last May in a Euro bond. Other Wall Street firms in the syndicate included Bank of America Merrill Lynch, Citigroup, Deutsche Bank and others.

In addition to being able to issue analyst stock ratings on GE and dozens of other companies and significantly benefit financially from debt underwritings that bury a company deeper and deeper under debt, these same Wall Street firms are permitted to trade shares of GE (and hundreds of other stocks) in their own internal Dark Pools – effectively unregulated stock exchanges inside the firms.

According to the slim amount of Dark Pool data that is released three weeks after the fact by Wall Street’s self regulator, FINRA, both JPMorgan and Deutsche Bank, the firms with the low-price targets on GE, have been actively trading GE stock in their Dark Pools.

We looked at the weekly FINRA data since December 25, 2017 up to the most recent data provided for the week of February 5, 2018. During that period, the most active week for Dark Pool trading in GE was the week of January 15, 2018. Dark Pools traded a total of 108.2 million shares of GE that week in 295,671 separate trades. JPMorgan has two Dark Pools – JPM-X and JPB-X, the latter created just last year. During the week of January 15, 2018, JPM-X traded 9.4 million shares of GE in 21,956 separate trades; JPB-X traded 701,809 shares of GE in 5,751 separate trades. Deutsche Bank’s Super-X (which ran afoul of regulators in 2016) traded 4.7 million shares of GE that week in 16,058 separate trades.

The two largest Dark Pools trading GE for the week of January 15, 2018 were those owned by UBS (UBS ATS) and Credit Suisse (Crossfinder). UBS settled charges with the SEC over its Dark Pool in 2015; Credit Suisse settled with the SEC over Crossfinder in 2016. For the week of January 15, 2018, UBS ATS traded 23.3 million GE shares in 71,318 separate trades while Credit Suisse’s Crossfinder traded 13.3 million shares in 41,107 separate trades.

But we don’t know if all of that volume at UBS and Credit Suisse actually originated at their own firms. According to the Rule 606 form filed by JPMorgan with the SEC for the fourth quarter of 2017 (the most recent data available), it is routing almost as much trading to itself as it is to UBS and Credit Suisse. The data shows that for New York Stock Exchange listed shares, it sent 9.44 percent of those shares to itself; 6.44 percent to UBS; and 5.74 percent to Credit Suisse. The New York Stock Exchange only received 4.61 percent of JPMorgan’s trades with the balance distributed to myriad other venues.

Did the shares of GE that were re-routed by JPMorgan to UBS and Credit Suisse end up in the Dark Pools of those firms? We can’t say. But we can ask one critical question: why would JPMorgan send trades to its two competitors instead of to the regulated New York Stock Exchange?