By Pam Martens and Russ Martens: June 28, 2017

Janet Yellen at London Conference on June 27, 2017 with Nicholas Stern, President of the British Academy

Yesterday the Chair of the U.S. Federal Reserve, Janet Yellen, was in London for a wide-ranging financial markets discussion with Nicholas Stern, the President of the British Academy. Making headlines from that discussion was Yellen’s stated belief that there will not be another financial crisis in our lifetimes. Yellen stated to Stern:

“Would I say there will never, ever be another financial crisis? You know probably that would be going too far, but I do think we are much safer, and I hope that it will not be in our lifetimes and I don’t believe it will be.”

While that remark has dominated the news, the more meaningful story is that Yellen (the top monetary authority in the United States; the head of the U.S. central bank; and the top dog at the Federal watchdog that regulates the largest bank holding companies on Wall Street) either intentionally misled the British Academy and global financial media yesterday or is unaware of the systemic risk in derivatives still on the books of the largest insured depository banks in the U.S.

In attempting to reassure global financial markets that the U.S. financial system is now much stronger and safer that at the time of the crisis in 2008, Yellen stated the following:

“We have been very focused on making sure that the core of our financial system has enough capital that we can provide assurance that our major banks would be able to go on lending and providing credit to the economy even after a very severe shock. We do what are called stress tests and the Fed just completed the first half of these stress tests last week and we hit the major banks that we subjected to these stress tests with enormous shocks: unemployment increasing to 10 percent; huge declines in house prices, commercial real estate prices, enormous shocks. And publicized exactly how these firms would fare and what losses they would take in every portfolio, what their capital position would be at the end of that.

“I think the public can see that the capital positions of the major banks are very much stronger at this point. This year all of the firms passed the quantitative part of the stress test….

On the matter of liquidity at the largest banks, Yellen had this to say:

“So suppose there were a scare and depositors decided ‘we want our money, we’re worried that there’s something wrong in your bank.’ Well, having enough liquidity that you would be able to meet deposit outflows that could occur, let’s say over a 30-day period even if they were severe, we’ve put in place for systemic banks – internationally-active banks, liquidity requirements they hold in order of magnitude more liquid assets.”

The problem with this concept is that the run on any of the major Wall Street banks would not be limited to depositors. Their derivative counterparties would attempt to grab capital ahead of the next guy, sending rumors flying and driving down the share price of the bank in the stock market, further intensifying the panic by wiping out billions of dollars of equity capital. Consider what we wrote about Citigroup’s rapid financial meltdown on November 24, 2008:

“Citigroup’s five-day death spiral last week was surreal. I know 20-something newlyweds who have better financial backup plans than this global banking giant. On Monday came the Town Hall meeting with employees to announce the sacking of 52,000 workers. (Aren’t Town Hall meetings supposed to instill confidence?) On Tuesday came the announcement of Citigroup losing 53 percent of an internal hedge fund’s money in a month and bringing $17 billion of assets that had been hiding out in the Cayman Islands back onto its balance sheet. Wednesday brought the cheery news that a law firm was alleging that Citigroup peddled something called the MAT Five Fund as ‘safe’ and ‘secure’ only to watch it lose 80 percent of its value. On Thursday, Saudi Prince Walid bin Talal, from that visionary country that won’t let women drive cars, stepped forward to reassure us that Citigroup is ‘undervalued’ and he was buying more shares. Not having any Princes of our own, we tend to associate them with fairytales. The next day the stock dropped another 20 percent with 1.02 billion shares changing hands. It closed at $3.77.

“Altogether, the stock lost 60 per cent last week and 87 percent this year. The company’s market value has now fallen from more than $250 billion in 2006 to $20.5 billion on Friday, November 21, 2008. That’s $4.5 billion less than Citigroup owes taxpayers from the U.S. Treasury’s bailout program.”

Yellen then attempted to downplay the risk from derivatives, making a seriously misleading statement that suggested the risk from derivatives at the major U.S. banks has been reined in. Yellen said:

“We’ve also changed the system in how derivatives work. Now, most standardized derivatives are centrally cleared….”

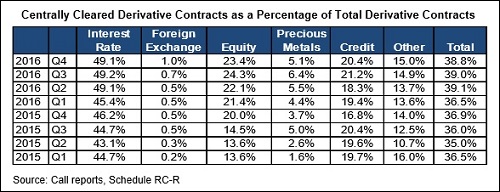

Yellen’s statement does not capture the enormous risk still prevalent in derivatives at the largest Wall Street banks. According to the U.S. Office of the Comptroller of the Currency’s (OCC) most recent “Quarterly Report on Bank Trading and Derivatives Activities” for the quarter ending December 31, 2016 only “38.8 percent of the derivative market was centrally cleared.”

The most dangerous part of the derivatives market, the credit default swaps, remain largely uncleared. The OCC wrote in its most recent report that only “22.5 percent of investment grade and 15.5 percent of non-investment-grade transactions were centrally cleared” in credit derivatives.

Yellen now follows firmly in the footsteps of former President Barack Obama in misleading the public on the derivative risks that remain at the mega Wall Street banks. As the OCC pointed out in its latest report, “A small group of large financial institutions continues to dominate derivative activity in the U.S. commercial banking system. During the fourth quarter of 2016, four large commercial banks represented 89.3 percent of the total banking industry notional amounts…” Those four banks are JPMorgan Chase with notional derivatives of $47.5 trillion; Citibank N.A. (the banking unit of Citigroup which received the largest taxpayer bailout in U.S. history in 2008) with notional derivatives of $43.9 trillion; Goldman Sachs Bank USA at $34.9 trillion; and Bank of America with $21.1 trillion.

Pretending that the U.S. has reined in the excesses of Wall Street and that the Federal regulators have a firm grasp of the situation is an illusion built on quicksand.

Related Articles:

Meet Your Newest Legislator: Citigroup

Wall Street Banks Are Trading as a Herd Because They are Highly Interconnected

Who is Morgan Stanley and Why Its $31 Trillion in Derivatives Should Concern You